Two unfolding geopolitical scenarios to keep on your radar in 2021

EY’s Mauricio Zelaya discusses two geopolitical trends that will affect the mining sector in 2021.

EY’s Mauricio Zelaya discusses two geopolitical trends that will affect the mining sector in 2021.

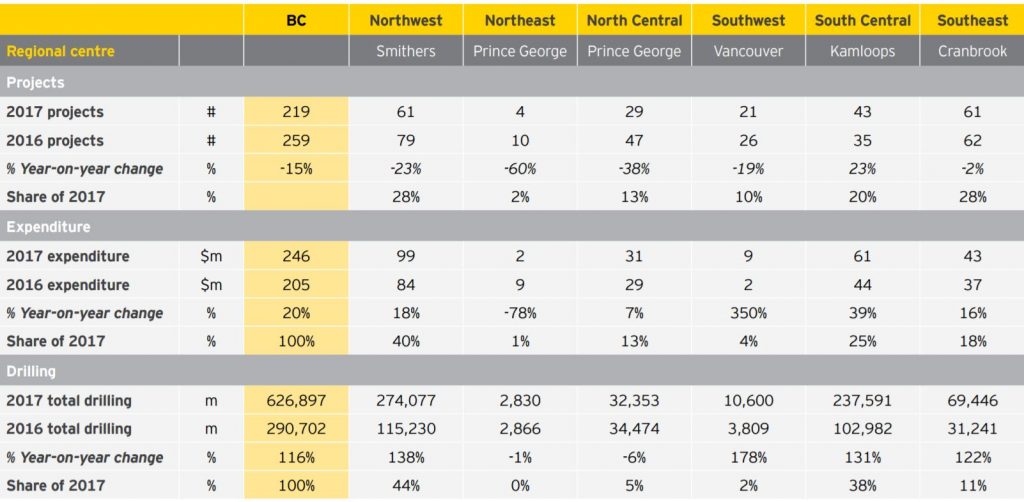

VANCOUVER – The mineral and coal exploration industry in British Columbia grew last year for the first time since 2012. This was […]