[caption id="attachment_1003742822" align="aligncenter" width="550"]

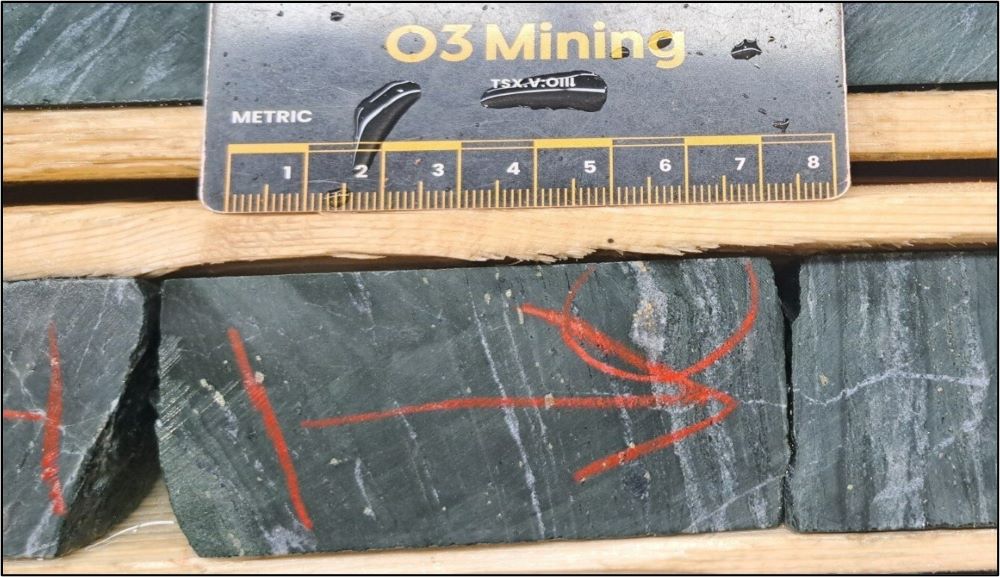

Bateman gold project Credit: Battle North Gold

Bateman gold project Credit: Battle North Gold[/caption]

A feasibility study on

Battle North Gold’s Bateman project in Ontario's Red Lake district has defined a 7-year, 1,315 t/d underground operation. This development features a 21-month construction and ramp-up period, which includes 14 months of gold production offsetting some of the expected capital expenditures.

During commercial operations, the mine would generate an average of 79,308 gold oz. annually, at all-in sustaining costs of US$865 per oz. The project funding requirement stands at $93.2 million, and includes $109.3 million in initial capital, offset by an expected $34.2 million from the sale of 47,829 pre-commercial gold oz., assuming a gold price of US$1,525 per oz. Life-of-mine sustaining capital outlays are pegged at $188.8 million.

The resulting development would bring in a net present value estimated at $305 million, based on a 5% discount rate and a US$1,525 per oz. gold price, with a 50.3% internal rate of return and 3.6-year payback.

“There are few standalone projects in the world that are as substantially de-risked, with significant infrastructure, with a short timeline to initial production, in a safe jurisdiction, as the Bateman gold project,” George Ogilvie, Battle North’s president and CEO, said in a release.

Ogilvie added that, subject to board approval, Battle North is looking to start construction at the site. The developer has also been planning out the development of the asset, with an assessment to mitigate ramp-up risks. This includes scheduling capital development nine months ahead of the mine plan, infilling the F2 deposit at 10-metre centres and establishing ramp access to increase shaft capacity.

“Most importantly, we have an operating team with extensive experience in building, operating and turning around underground mines; the collective operating experience of the Battle North team will be a significant factor in ultimately achieving a successful ramp-up to commercial production.”

In terms of capital and sustaining costs, the feasibility calls for a total of 36,657 metres of underground waste development over the life of the mine. An additional $34.1 million in upfront capital would be required for surface and mill upgrades, which includes an expansion of the existing tailings facility. There is a 1,800 t/d mill at the site, with potential to stage up to approximately 2,500 t/d.

On the mining side, Battle North is planning on a predominately bulk mining operation at Bateman; the project includes a 730-metre shaft and over 14,000 metres of underground workings.

The company currently has $55 million of cash on its balance sheet and is in advanced discussions with lenders about a potential debt facility to secure the remaining development capital.

Battle North, previously Rubicon Minerals, has approximately $704 million of tax loss pools available for deductions over the commercial production period. The base-case feasibility scenario above assumes no resulting income tax over the life of the project, with $407 million of pools remaining at the end of mine life. Looking at the scenario analysis provided in the release, the pools start to deplete at a gold price of US$1,900 per oz., and at Canadian to U.S. dollar exchange rates below 0.74. The press release notes that, in today’s gold price environment, the tax loss pools would be depleted over the life-of-mine.

The reserve statement from the feasibility study, including proven and probable categories, stands at 3.6 million tonnes, grading 5.54 g/t gold, for a total of 634,838 contained gold oz., derived using a 3.41 g/t cutoff grade. Additional measured and indicated resources total 1.5 million tonnes, at 7.24 g/t gold, with a further 1.3 million inferred tonnes, at 6.5 g/t gold.

The resources and reserves are within the F2 gold deposit, which remains open at depth and along strike. With excess mill capacity, Battle North sees potential to process additional incremental tonnes from potential extensions of F2, as well as from the McFinley and Pen zone targets. Resource estimates for McFinley and Pen are expected in the fourth quarter of this year and first quarter of 2021, respectively.

For more information, visit

www.BattleNorthGold.com.

Bateman gold project Credit: Battle North Gold[/caption]

A feasibility study on Battle North Gold’s Bateman project in Ontario's Red Lake district has defined a 7-year, 1,315 t/d underground operation. This development features a 21-month construction and ramp-up period, which includes 14 months of gold production offsetting some of the expected capital expenditures.

During commercial operations, the mine would generate an average of 79,308 gold oz. annually, at all-in sustaining costs of US$865 per oz. The project funding requirement stands at $93.2 million, and includes $109.3 million in initial capital, offset by an expected $34.2 million from the sale of 47,829 pre-commercial gold oz., assuming a gold price of US$1,525 per oz. Life-of-mine sustaining capital outlays are pegged at $188.8 million.

The resulting development would bring in a net present value estimated at $305 million, based on a 5% discount rate and a US$1,525 per oz. gold price, with a 50.3% internal rate of return and 3.6-year payback.

“There are few standalone projects in the world that are as substantially de-risked, with significant infrastructure, with a short timeline to initial production, in a safe jurisdiction, as the Bateman gold project,” George Ogilvie, Battle North’s president and CEO, said in a release.

Ogilvie added that, subject to board approval, Battle North is looking to start construction at the site. The developer has also been planning out the development of the asset, with an assessment to mitigate ramp-up risks. This includes scheduling capital development nine months ahead of the mine plan, infilling the F2 deposit at 10-metre centres and establishing ramp access to increase shaft capacity.

“Most importantly, we have an operating team with extensive experience in building, operating and turning around underground mines; the collective operating experience of the Battle North team will be a significant factor in ultimately achieving a successful ramp-up to commercial production.”

In terms of capital and sustaining costs, the feasibility calls for a total of 36,657 metres of underground waste development over the life of the mine. An additional $34.1 million in upfront capital would be required for surface and mill upgrades, which includes an expansion of the existing tailings facility. There is a 1,800 t/d mill at the site, with potential to stage up to approximately 2,500 t/d.

On the mining side, Battle North is planning on a predominately bulk mining operation at Bateman; the project includes a 730-metre shaft and over 14,000 metres of underground workings.

The company currently has $55 million of cash on its balance sheet and is in advanced discussions with lenders about a potential debt facility to secure the remaining development capital.

Battle North, previously Rubicon Minerals, has approximately $704 million of tax loss pools available for deductions over the commercial production period. The base-case feasibility scenario above assumes no resulting income tax over the life of the project, with $407 million of pools remaining at the end of mine life. Looking at the scenario analysis provided in the release, the pools start to deplete at a gold price of US$1,900 per oz., and at Canadian to U.S. dollar exchange rates below 0.74. The press release notes that, in today’s gold price environment, the tax loss pools would be depleted over the life-of-mine.

The reserve statement from the feasibility study, including proven and probable categories, stands at 3.6 million tonnes, grading 5.54 g/t gold, for a total of 634,838 contained gold oz., derived using a 3.41 g/t cutoff grade. Additional measured and indicated resources total 1.5 million tonnes, at 7.24 g/t gold, with a further 1.3 million inferred tonnes, at 6.5 g/t gold.

The resources and reserves are within the F2 gold deposit, which remains open at depth and along strike. With excess mill capacity, Battle North sees potential to process additional incremental tonnes from potential extensions of F2, as well as from the McFinley and Pen zone targets. Resource estimates for McFinley and Pen are expected in the fourth quarter of this year and first quarter of 2021, respectively.

For more information, visit

Bateman gold project Credit: Battle North Gold[/caption]

A feasibility study on Battle North Gold’s Bateman project in Ontario's Red Lake district has defined a 7-year, 1,315 t/d underground operation. This development features a 21-month construction and ramp-up period, which includes 14 months of gold production offsetting some of the expected capital expenditures.

During commercial operations, the mine would generate an average of 79,308 gold oz. annually, at all-in sustaining costs of US$865 per oz. The project funding requirement stands at $93.2 million, and includes $109.3 million in initial capital, offset by an expected $34.2 million from the sale of 47,829 pre-commercial gold oz., assuming a gold price of US$1,525 per oz. Life-of-mine sustaining capital outlays are pegged at $188.8 million.

The resulting development would bring in a net present value estimated at $305 million, based on a 5% discount rate and a US$1,525 per oz. gold price, with a 50.3% internal rate of return and 3.6-year payback.

“There are few standalone projects in the world that are as substantially de-risked, with significant infrastructure, with a short timeline to initial production, in a safe jurisdiction, as the Bateman gold project,” George Ogilvie, Battle North’s president and CEO, said in a release.

Ogilvie added that, subject to board approval, Battle North is looking to start construction at the site. The developer has also been planning out the development of the asset, with an assessment to mitigate ramp-up risks. This includes scheduling capital development nine months ahead of the mine plan, infilling the F2 deposit at 10-metre centres and establishing ramp access to increase shaft capacity.

“Most importantly, we have an operating team with extensive experience in building, operating and turning around underground mines; the collective operating experience of the Battle North team will be a significant factor in ultimately achieving a successful ramp-up to commercial production.”

In terms of capital and sustaining costs, the feasibility calls for a total of 36,657 metres of underground waste development over the life of the mine. An additional $34.1 million in upfront capital would be required for surface and mill upgrades, which includes an expansion of the existing tailings facility. There is a 1,800 t/d mill at the site, with potential to stage up to approximately 2,500 t/d.

On the mining side, Battle North is planning on a predominately bulk mining operation at Bateman; the project includes a 730-metre shaft and over 14,000 metres of underground workings.

The company currently has $55 million of cash on its balance sheet and is in advanced discussions with lenders about a potential debt facility to secure the remaining development capital.

Battle North, previously Rubicon Minerals, has approximately $704 million of tax loss pools available for deductions over the commercial production period. The base-case feasibility scenario above assumes no resulting income tax over the life of the project, with $407 million of pools remaining at the end of mine life. Looking at the scenario analysis provided in the release, the pools start to deplete at a gold price of US$1,900 per oz., and at Canadian to U.S. dollar exchange rates below 0.74. The press release notes that, in today’s gold price environment, the tax loss pools would be depleted over the life-of-mine.

The reserve statement from the feasibility study, including proven and probable categories, stands at 3.6 million tonnes, grading 5.54 g/t gold, for a total of 634,838 contained gold oz., derived using a 3.41 g/t cutoff grade. Additional measured and indicated resources total 1.5 million tonnes, at 7.24 g/t gold, with a further 1.3 million inferred tonnes, at 6.5 g/t gold.

The resources and reserves are within the F2 gold deposit, which remains open at depth and along strike. With excess mill capacity, Battle North sees potential to process additional incremental tonnes from potential extensions of F2, as well as from the McFinley and Pen zone targets. Resource estimates for McFinley and Pen are expected in the fourth quarter of this year and first quarter of 2021, respectively.

For more information, visit

Comments