Toronto's TAHERA DIAMOND CORP. is feeling the pinch of the strong Canadian dollar. Its Jericho diamond mine, Nunavut's first, is losing money - a lot of money. The company posted an operating loss of $45.5 million during the third quarter and a net loss of $143.1 million for the first nine months of 2007.

Chief among the reasons for the loss is the growing strength of the Canadian loonie, compared with the U.S. greenback. The Canadian dollar briefly traded above US$1.10 in Europe on Nov. 6, and it shows signs of returning to that level and staying there.

Rather than thinking of a "high" Canadian dollar, let's turn the problem around and look at the "low" U.S. dollar. Investors have so little faith in the U.S. economy that they are forcing that dollar down compared with all major currencies. One result of downward pressure on the U.S. dollar is the rise in the gold price, which is approaching US$850 per ounce. Another predictable outcome is a rising crude oil price, which is very close to US$100 per barrel. High fuel costs cut into the profitability of all mining operations in the far north.

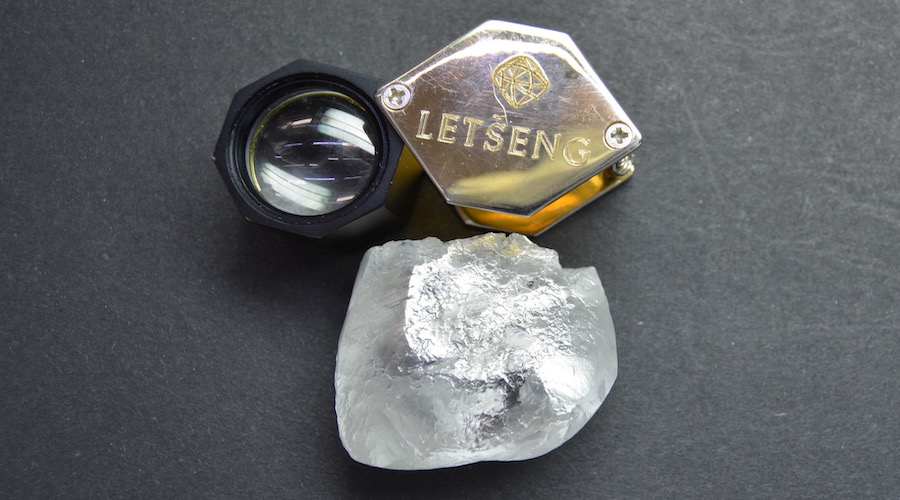

Diamonds are priced in U.S. dollars. The price has risen recently, but not enough to make up for the weakening American currency. Mines that sell their output in U.S. dollars, whether it is diamonds or base metals, are effectively receiving less value for their goods.

The dollar differential is not the only difficulty facing Tahera. The Jericho mine has been plagued with operating problems. Management began an operational review in March 2007, and it is continuing. The company says there have been improvements to plant throughput, carats recovered, grade and tonnages. There need to be more.

Tahera noted that the value of production for Q3 2007, was US$8.4 million or Cdn$8.6 million. Unfortunately, the company had total cash operating costs of Cdn$17.9 million. This news has forced the company's stock price down by roughly one-third to Cdn$0.20

Given the benefit of 20/20 hindsight, maybe Tahera would be profitable now, or at least not losing so much money, if it had attracted a senior partner before going into production, as the company seems to have wanted. Without a partner, the company had only limited finances and experience to build the project. The situation now appears that overly thrifty development is taking its toll.

The worst case scenario would be early closure of the Jericho diamond mine. Someone must be running projections to determine if the mine can become profitable before the ore runs out. We hope ingenuity and determination can turn the situation around soon.

Comments