Carbon and energy metrics hot commodities in evolving ESG space

Mark Fellows and Charles Cooper first had the idea to shift their mineral economics consultancy business, Skarn Associates, toward an energy and carbon focus in 2018.

But it turns out they were just a little too far ahead of the curve.

“We were both convinced that this (energy and carbon) was going to become a massive strategic issue for the industry. But back in 2018 when we first floated that idea to a few mining companies, nobody was very interested,” Fellows said.

It was only after teenage climate activist Greta Thunberg rose to global prominence the following year that that changed.

“In mid-2019, when Extinction Rebellion started happening and Greta Thunberg made a big splash, all of a sudden, everybody's attitudes started changing and we decided the time was right.”

Fellows and Cooper had cofounded U.K.-based Skarn Associates in late 2016 after long experience as “hardcore mineral economists” leading research units at S&P Global Market Intelligence, SNL Financial, GFMS Mine Economics and Brook Hunt (now Wood Mackenzie).

Looking to bring that same rigour and level of detail to the environmental, social and governance (ESG) space, Skarn Associates shifted its focus in early 2020 and officially relaunched in September. The entire team of eight also includes director of industry analysis Sophie Chung, who brings extensive experience in the economic analysis of base metals mines with Rio Tinto, Wood Mackenzie and others.

ESG is already a crowded space, with a number of voluntary frameworks in existence, including CDP Global (formerly the Carbon Disclosure Project). Companies are also coming under more pressure to follow reporting guidelines set out by the Task Force on Climate-Related Financial Disclosures.

And then there are the ESG ratings agencies, such as MSCI, Sustainalytics, KLD, S&P Global and others that provide ratings for individual companies. These ratings are often used by investors seeking to screen out companies with higher ESG risks.

“Many of big fund managers have been using proprietary ESG ratings from some of the ratings providers out there for quite a while,” Fellows says. “These ratings are probably better than nothing, but they are not a very transparent, easily comparable way of judging one company against another. The issue is that they're a composite rating produced under very different weightings and methodologies from one ratings provider to another.”

Fellows points to a study published in May 2020 by MIT's Sloan School of Management that found wide inconsistencies in the ESG ratings of companies by six prominent rating agencies.

The paper, titled “Aggregate Confusion: The Divergence of ESG Ratings” found an average correlation of only 0.54 between the agencies' ratings, with a range of between 0.38 to 0.71.

Not only does that make for “noisy” data for decision makers to rely on, but the authors found that one of the consequences of the divergence in ratings is that it actually “hampers the ambition of companies to improve their ESG performance” because of the mixed signals they receive from rating agencies about what is expected of them and what actions will be valued by the market.

The study also found divergence in how analysts at the same agency applied their own organization's methodology.

“The statistics seem to imply that within a given provider, individual analysts are not being consistent from one analyst to another in the way that they're applying the methodology, which implies the whole thing is subject to too much subjectivity,” Fellows says.

Given the growing interest in ESG and the increasing consideration of ESG factors in investment and financing decisions, Fellows argues that more detailed, reliable and objective information is needed.

“Right now, there's a danger of it being a victim of garbage in, garbage out. If you're basing this on corporate sustainability reporting primarily and the company is only providing you with the corporate level numbers it wishes to, you can't really form a view on what's driving that impact,” he says.

In contrast, Skarn Associates takes an asset-by-asset, technically driven approach that provides a third-party assessment of each asset's energy use and carbon emissions.

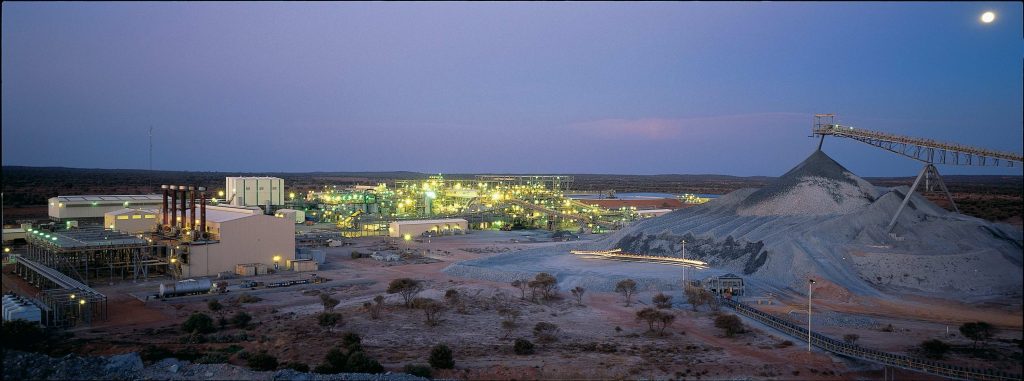

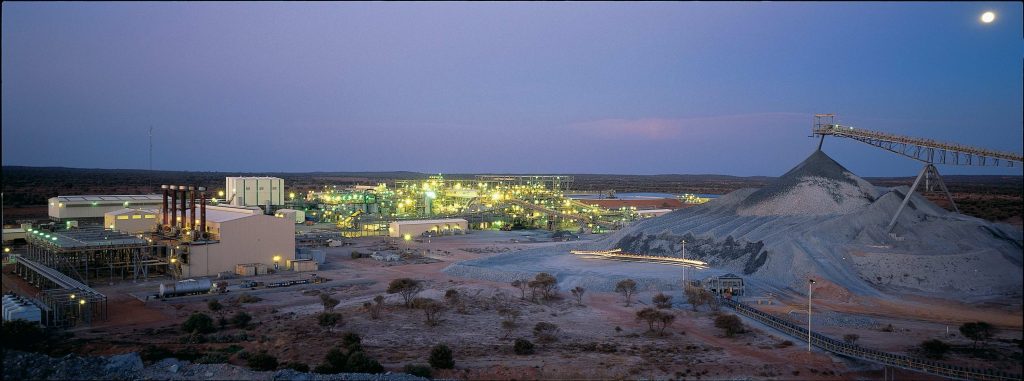

So far, Skarn offers carbon intensity curves for different commodities (including nickel, copper, gold, metallurgical coal, iron ore, and most recently, aluminum) that shows where each producing mine across the globe falls on the curve. The firm has built up extensive datasets that allow it to compare each asset in terms of energy inputs (fuel, electricity) and the carbon intensity of those inputs to calculate overall carbon intensity per unit of production.

The carbon intensity of producing nickel, for example, ranges from 2 tonnes CO2 per tonne of nickel produced (many operations in Canada at the low end of the range) to 100 tonnes CO2 per tonne of nickel in Indonesia and the Philippines.

On the mining side, companies want to know where their operations fall on the carbon intensity curve, and to be able to demonstrate progress to their stakeholders. Skarn was asked to provide carbon intensity curves for BHP Billiton's climate change briefing in September, during which the company outlined progress made toward its goal of achieving net zero emissions by 2050.

On the investment side, the carbon emissions curves provide the detailed information financial institutions are expecting.

“Many of the investment banks are being asked by their credit committees and stakeholders to account for the carbon footprint of the companies and assets that they are putting together deals in connection with,” Fellows says. EV battery manufacturers aiming to source the lowest carbon nickel to go into their batteries also need asset-level data.

Metal traders are also being asked similar questions – ultimately driven by consumer pressure – about the products they sell.

“An Apple or a Mercedes, BMW – all of these companies are now asking: 'Can you account for the carbon emissions associated with the raw materials input, how have you audited that, and can you assure me that this is ultimately sourced from a company or a mine which is on the low emissions end of the spectrum?'”

Both miners and investors are seeking more information about Scope 3 emissions. Scope 1 and 2 includes onsite mining and processing and transport of employees, but Scope 3 includes what happens to their product as it moves out of their control and into downstream processing and manufacturing facilities. That suggests that far from just facing pressure to act to reduce their own emissions, miners will also add to pressure downstream manufacturers face further down the value chain to adopt more environmentally friendly technologies for steelmaking, for example.

New field

As a new field, ESG reporting is still at the stage of figuring out what things should be measured and used to compare companies' performance.

“The next stage will be about much more detailed measurement of actual performance,” Fellows says, adding it will become more formalized in the way that financial reporting did.

Aside from energy consumption and carbon emissions, Skarn also offers water intensity metrics.

Ultimately, the goal is to progress to forecasting, Fellows says.

“The next priority is forecasting energy and carbon and matching that up against companies' commitments to decarbonize.”

For now, Skarn is looking to get feedback on what metrics investors and companies need through its recently launched free monthly Mining-ESG bulletin, featuring a mixture of recent ESG-related news and original analysis (www.skarnassociates.com).

The firm will also be looking at the economics of decarbonization.

For example, one of the likely candidates to substitute for diesel in haul trucks is hydrogen, Fellows says.

“What are the economics of hydrogen going to be in ten, fifteen years' time and what are the implications of that for capital spending in the industry?” he says, adding that it could shorten the mine life of many marginal operations where spending on a fleet upgrade can't be justified.

“It's going to give rise to some interesting strategic decisions.”

Comments