VANCOUVER – Dublin-based Minco PLC (LSE-AIM: MIO) is planning to produce high-grade manganese from its Woodstock project in New Brunswick for 25% below the industry’s average cost to supply a global steel market that relies on increasingly fragmented Chinese output.

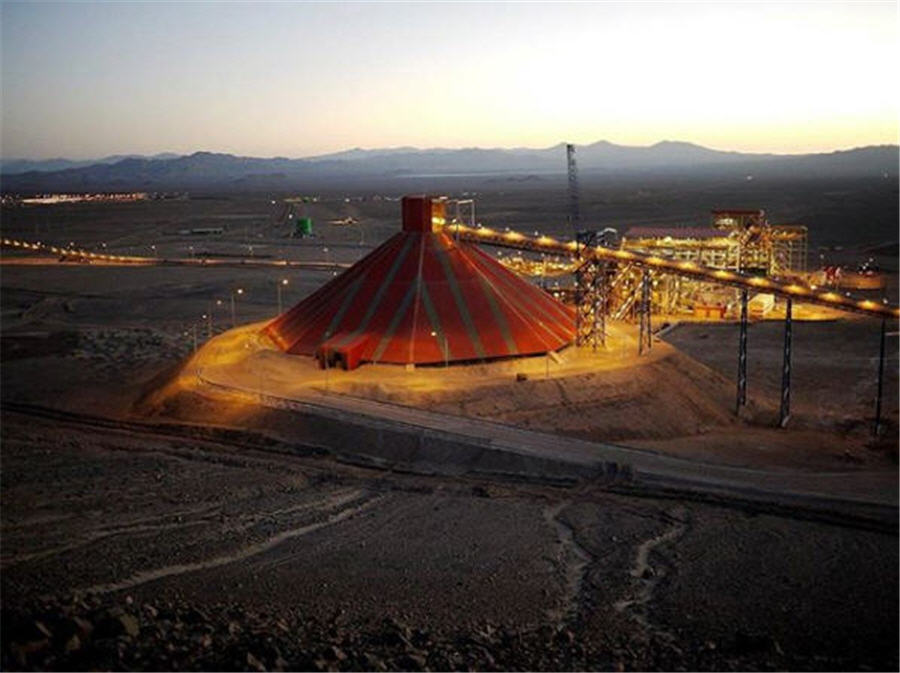

According to a new preliminary economic assessment (PEA), Minco could turn Woodstock into an open pit mine for $864 million. The project would churn through 3,000 tonnes of ore per day (tpd) to produce 80,000 tonnes of electrolytic manganese metal (EMM) annually.

The investment would give Minco an operation with an after-tax net present value of $461 million and a 14.4% after-tax internal rate of return, enabling the project to repay its capital costs in seven years. Those estimates use a manganese price of US$1.38 per lb. and an 8% discount rate.

The Woodstock mine should be able to produce a pound of EMM for US68¢ over its 40-year mine life. By contrast, the reported average cost of production in China, which accounts for 98% of the world’s EMM output, is US91¢ per lb.

Woodstock offers several advantages. First, the deposit is amenable to open pit mining and offers a strip ratio of 1.34. Those factors translate into a mining cost of just US4¢ per lb. EMM. In China, where grades are declining and some operations are moving underground, mining costs average US27¢ per lb. EMM.

Second, electricity rates in New Brunswick are relatively low, which means power adds US17¢ to the cost of producing each pound of EMM. In China, power adds an average of US30¢ to the per-pound cost.

There are two types of mineralization at Woodstock: red and grey. Both types of rock comprise rhodochrosite, a manganese carbonate mineral, within an iron-rich matrix.

The presence of manganese as rhodochrosite is an advantage. The carbonate mineral is readily soluble in acid. Many other manganese deposits host oxide forms of the metal, which are not acid soluble and thus can only be recovered through roasting and reduction technologies.

The red-versus-grey difference is because the iron at Woodstock comes in two forms. The red mineralization contains iron that is predominantly oxide; the iron in the grey rock is primarily in carbonate form. This matters because the carbonate iron is more readily leachable and therefore consumes more sulphuric acid, boosting operating costs.

The open pit resource considered in the PEA stands at 41.4 million tonnes grading 9.92% manganese. Of that roughly 60% is red mineralization, with grey rock making up the rest.

The Woodstock PEA describes a 40-year mine life, though the open pit mine only operates for 13 years. In that phase the highest-grade ore is sent for processing, bearing an average grade of 11.7% manganese. The rest of the ore is stockpiled to feed the processing facility for the subsequent 27 years, during which time the head grade would average 9.86% manganese.

There are several steps involved in producing EMM. First the ore is pre-concentrated: magnetic separation pulls out iron, which has the double benefit of upgrading the mill feed to an average grade of 15.65% manganese and generating iron concentrate as a co-product. In fact, the mine would also produce 23,200 tonnes of 62% iron ore fines annually.

The manganese ore is then leached with sulphuric acid at a controlled tempertature, which optimizes acid consumption. Trace heavy metals are removed and then the manganese sulphate solution is subjected to electrolysis to produce EMM grading better than 99.7% manganese.

The process requires a steady supply of sulphuric acid as well as lime. To meet that demand the PEA envisions a sulphuric acid plant and a lime kiln on site.

The Woodstock project is located 5 km west of the town of Woodstock, in west-central New Brunswick.

For more information visit www.mincoplc.com.

Comments

Ken Drew

is Iron Ore Hill in Jacksonville , NB part of the area to be mined and if so what can the people living on Iron Ore Hill road expect in the very near future