Opemiska copper project: PEA confirms Quebec potential

XXIX Metal (XXIX.V; US-QCCUF: OTCQB) announced the filing of an independent preliminary economic assessment (PEA) technical report for its Opemiska project. The report outlined robust economics for the copper project, located in Chapais, Quebec. XXIX is advancing its Opemiska and Thierry copper projects, two significant Canadian copper assets.

The Opemiska project, highlighted as one of Canada's highest-grade open-pitable copper deposits, underpins the company’s position as a key player and one of Eastern Canada's largest copper developers.

The technical report, titled “NI 43-101 Preliminary Economic Assessment (PEA) Technical Report for the Opemiska Copper Project, Chapais, Quebec,” became effective on October 17, 2025, with an issue date of December 2, 2025. Ausenco prepared and compiled the report, with contributions from independent qualified persons.

The PEA provides a 17-year mine life, projecting total payable copper of 715 million pounds, alongside 409 thousand ounces of gold and 2.08 million ounces of silver. The study indicates strong after-tax base case economics, with a C$505 million Net Present Value at an 8% discount rate (NPV8%) and a 27.2% Internal Rate of Return (IRR). Using current spot pricing, these figures increase to an NPV8% of C$897 million and a 39.3% IRR.

The project showed a rapid payback period of 2.3 years for its initial capital of C$617 million, attributed to upfront high-grading. The PEA also forecasts potential high-grade annual recovered payable production during the first six years, including 59 million pounds of copper, 34 thousand ounces of gold, and 174 thousand ounces of silver per year. Opemiska positions itself as a low-cost producer, with a US$1.03/lb C1 cash cost net of by-product credits over the first six years, rising to US$1.40/lb over the mine's life.

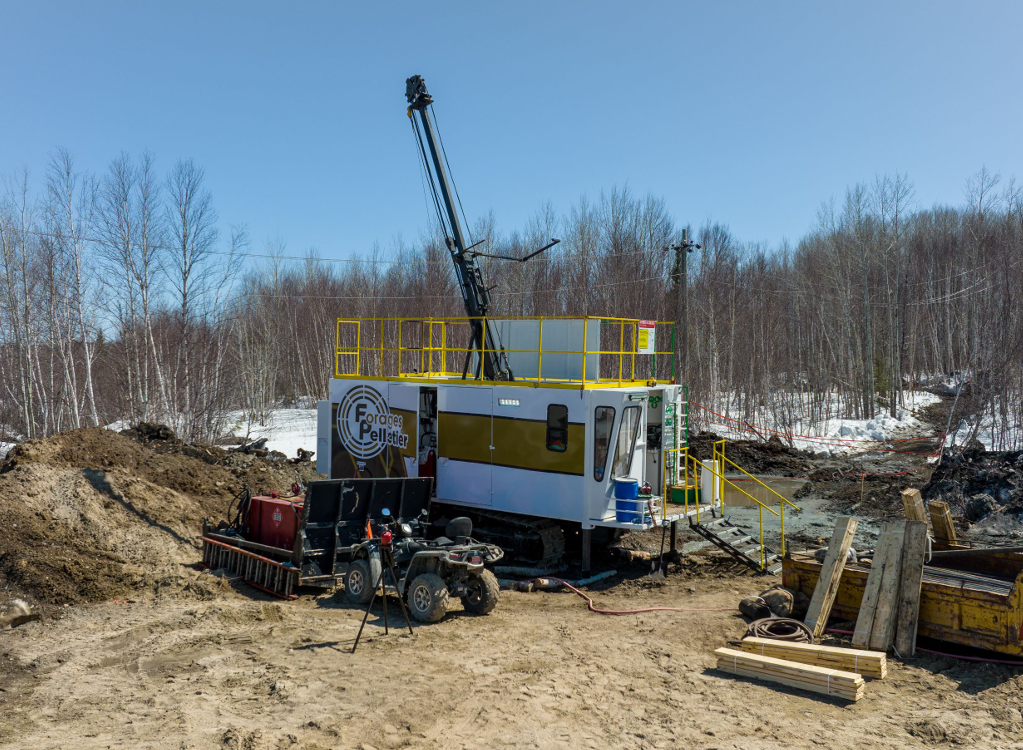

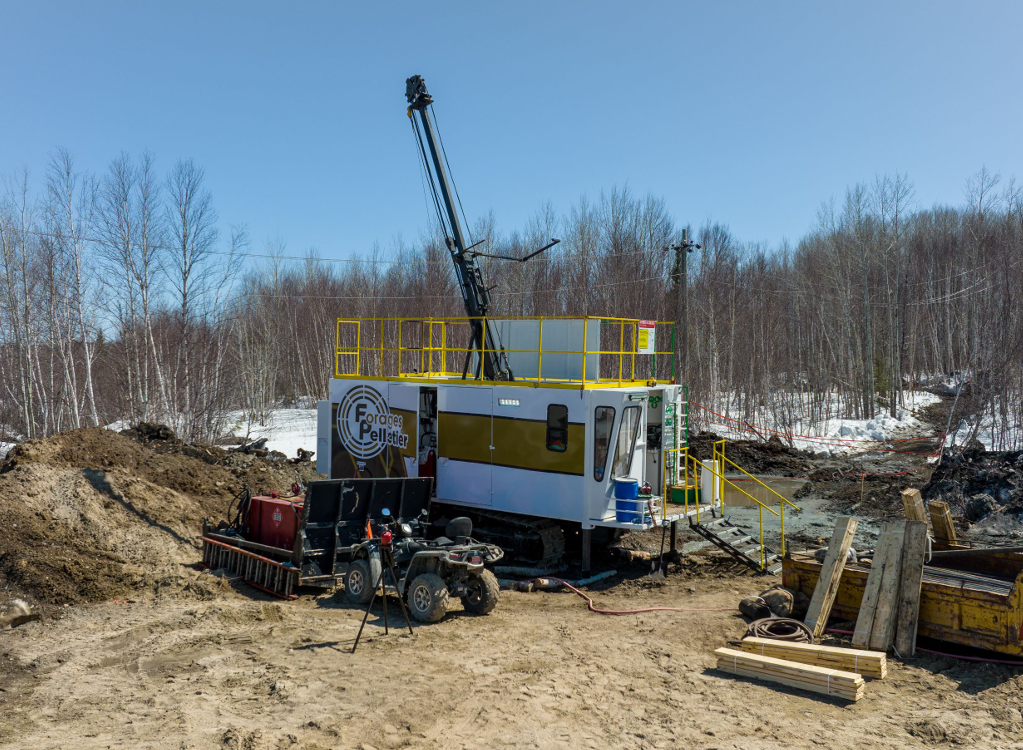

The project demonstrates significant leverage to rising copper and gold prices, with a projected $4.40 billion in life-of-mine revenue, comprising 70.7% copper, 27.9% gold, and 1.4% silver. The PEA incorporates 44.3 million tonnes of inferred mineral resources (0.32% copper, 0.18 g/t gold, 0.77 g/t silver). Inferred mineral resources can only be used for economic analysis within a PEA. The company notes additional resource upside, including the Cooke gold zone, where active drilling is currently underway.

The Opemiska project spans 213 sq. km (21,333 hectares) in Quebec's Chapais-Chibougamau region and benefits from significant existing infrastructure and nearby access to the Horne smelter. It comprises four past-producing mines, with Springer and Perry underpinning the current PEA. Cooke, a third past-producing mine located approximately 3km east of the proposed pit, is undergoing evaluation for its gold resource potential.

The technical report is available in its website at www.Xxix.ca.

Comments