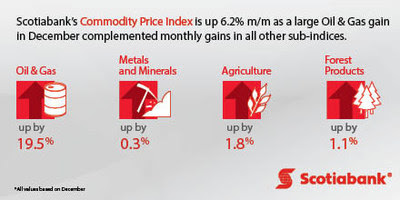

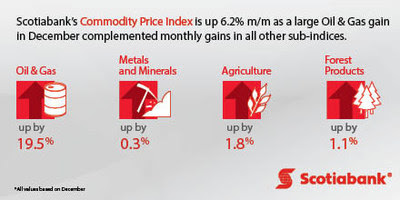

TORONTO - The Scotiabank Commodity Price Index gained 6.2% m/m in December as a large oil and gas gain complemented monthly gains in all other sub-indices. Commodities are expected to broadly benefit from rising prices in 2017 after many averaged cycle-lows last year.

Oil prices for North American benchmark World Trade Index have been moderately upgraded and are now forecast to average US$58/bbl in 2017 and US$61/bbl in 2018. Three key trends that will shape the oil market in 2017 are OPEC member compliance; the strength and pace of the United States shale patch's rebound; and the persistence of global demand on growth.

Base metals are expected to gain from a more buoyant global economy and rising manufacturing activity. Copper saw the most significant outlook adjustment as stronger-than-anticipated Chinese demand runs up against weaker supply growth. Zinc remains the metal with the strongest supporting fundamentals, and the higher 2016 hand-off prompted a mild upgrade to price expectations.

The outlook for gold has deteriorated slightly on the back of a stronger macroeconomic outlook, rising inflation and interest rate expectations and a so-far muted market response to political uncertainty. Prices are now forecast to average US$1,200/oz in 2017 and 2018, down from US$1,300/oz prior. However, the market's sanguine view of the risk environment is slanted bullish, and gold is likely to find some support as these views revert to balance.

Read the full Scotiabank Commodity Price Index online at

www.Scotiabank.com/ca/en/0,,3112,00.html.

Comments