The Alaska giant: NOVAGOLD readies Donlin for its defining decade

NOVAGOLD is entering a pivotal new phase as it advances the Donlin Gold Project toward a construction decision, buoyed by strong 2025 drill results, a strengthened treasury, and a series of regulatory wins that have reduced uncertainty around one of North America’s largest undeveloped gold deposits. The company was recently accepted into the federal FAST-41 permitting program, giving Donlin a clearer and more predictable federal timeline, while a November decision by the Alaska Supreme Court upheld key water rights and the right-of-way for the state-controlled segment of the planned natural gas pipeline — two major validations of the project’s path forward. With roughly 40 million ounces in measured and indicated resources, continued high-grade drill intercepts, and a bankable feasibility study (BFS) set to kick off before year-end, NOVAGOLD is positioning Donlin as a generational, long-life asset in a stable jurisdiction at a time when gold prices and investor interest in large-scale U.S. projects remain strong. Against this backdrop, Canadian Mining Journal sat down with CEO Greg Lang (GL) to discuss the company’s progress, the latest drill results, and what lies ahead as Donlin moves closer to development.

CMJ: As a conversation starter, please talk to us briefly about the history of NOVAGOLD, and tell us how you became CEO.

GL: I will start with the recent history of NOVAGOLD. The company was founded about 25 years ago and was a successful junior exploration company. Its two main assets were the Donlin Gold Project in Alaska and the Galore Creek Project in British Columbia. I joined NOVAGOLD in 2012, around the same time as our chairman and largest shareholder, Dr. Thomas S. Kaplan. Together, we set about restructuring the company. We believed that assets in great jurisdictions would ultimately command a premium, so we transformed NOVAGOLD into a pure-play company focused on the Donlin Gold Project. After completing the restructuring in 2012, we moved forward with permitting, which we successfully completed. That brings us to today. The modern history of the company is focused on great assets in great places — like what we have in Alaska. We believe that jurisdictional safety, exemplified by stable and mining-friendly regions such as Alaska, is becoming one of the key investment criteria in the mining industry as the world becomes increasingly complex.

My background is in operations. I was a long-time Barrick employee, running their Australian business for five years, and immediately before joining NOVAGOLD, I was President of Barrick Mining Corporation’s North American business for eight years. In that role, I was involved with the Donlin Gold Project. I was ready for a change and was introduced to Dr. Kaplan by a mutual acquaintance in the industry. We shared a similar vision for Donlin Gold and the future direction we wanted to take the company, whereby we reached an arrangement: he would take on the role of chairman, and I would leave Barrick to become CEO of NOVAGOLD.

CMJ: The latest drill program has confirmed consistent, high-grade mineralization. What do these results mean for Donlin Gold’s overall resource potential and its standing among global development projects?

GL: We recently reported results from the 2025 drill program at Donlin Gold, which consisted of approximately 18,000 metres of drilling, designed to advance three principal objectives critical to the project’s development.

First, we conducted tight-spaced drilling — almost like a blast hole pattern — within the ore zones. This approach was specifically intended to provide the mining engineers with high-resolution data to refine future mine planning. The results were highly encouraging, confirming the continuity of high-grade mineralization over short intervals and reinforcing confidence in the consistency of the ore body.

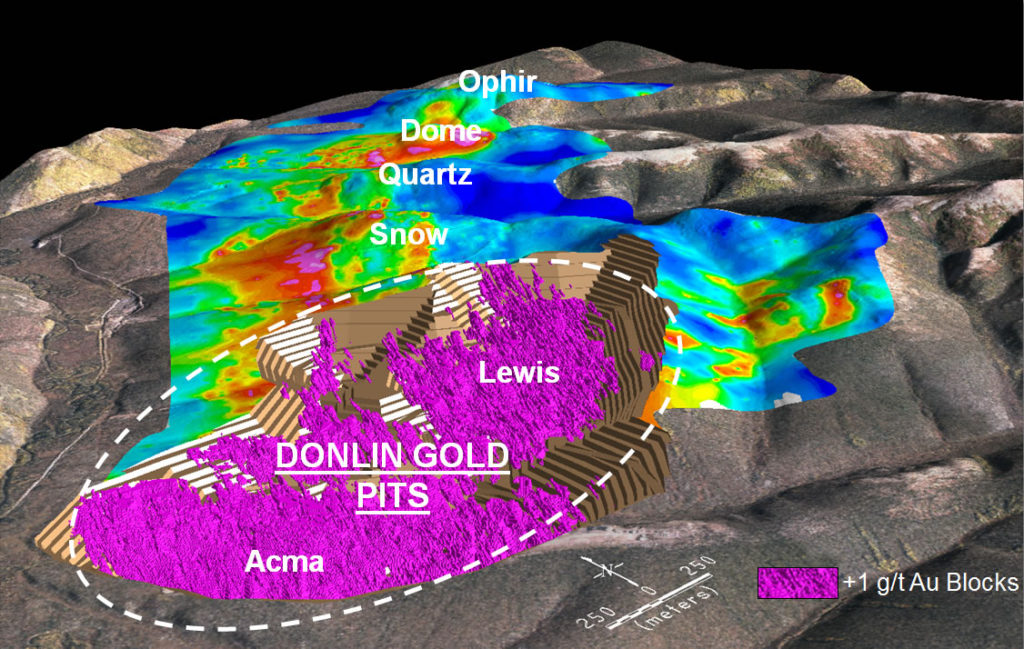

Second, around the two known ore bodies, ACMA and Lewis, there are about 6 million ounces of inferred material. We focused on converting a portion of the inferred resources to measured and indicated categories. This step is essential for enhancing the robustness of the resource model and increasing confidence in the mineral inventory. Additionally, we targeted sparsely drilled areas of the pit to better define the mineralization and potentially expand the resource base.

Third, we conducted geotechnical work, drilling holes in the pit to support the ultimate pit slope designs, and along what will be the access road connecting the mine site with the port on the Kuskokwim River. These holes are instrumental in informing the design of the pit slopes and supporting broader infrastructure planning. This work directly contributes to the engineering activities underway as part of the BFS, a critical milestone in advancing Donlin Gold toward a construction decision.

The program was very successful. Although Donlin Gold is modeled as a 2.25 g/t deposit, the intercepts averaged almost 4.0 g/t of gold.

As in previous years, drilling revealed more intrusive dikes than were originally modeled, which is consistent with our evolving understanding of the deposit’s geology. These intrusives, particularly when intersecting key fault structures, tend to yield exceptionally high grades — sometimes approaching one oz./t. Such intercepts are not only geologically significant but also economically impactful, as they enhance the overall grade and value of the resource.

Each drill campaign continues to add to the mineral inventory, and the data from this year’s program will be incorporated into the updated geologic model. This refined model will ultimately form the basis for the BFS, helping to shape the development of potentially one of America’s largest and most significant gold mines.

CMJ: How do the new results contribute to resource conversion and geotechnical work, and what role will they play in shaping the upcoming BFS?

GL: We are currently incorporating the latest drill results into our geologic model, which will inform the updated BFS. While it is a bit premature to state the exact impact on resources, the results are certainly positive. With approximately 40 million ounces of gold in measured and indicated resources. At an average grade that remains among the highest for open-pit gold projects globally, we are confident that Donlin Gold has the scale and quality needed to support the next phase of development.

CMJ: NOVAGOLD expects to select an engineering firm for the BFS in the coming months. What criteria are you using to make that choice, and how will it influence the project’s timeline?

GL: Shortly after we announced the completion of our transaction with Paulson Advisers LLC, we agreed it was time to advance Donlin Gold by updating the BFS and move toward a potential construction decision. After the transaction closed, we moved quickly to develop and issue a formal request for proposal (RFP) to select a lead engineering firm.

Given the scale and complexity of Donlin Gold, we were highly selective in who we invited to bid. Our goal is to identify a lead engineering firm not only capable of delivering a high-quality BFS, but also equipped to carry through with detailed engineering, procurement, and ultimately, construction management of the mine. While many companies are qualified to complete a BFS, we prioritized those that would be accountable for the outcome and had the depth and experience to support Donlin Gold’s long-term development.

The RFPs were issued in the third quarter and received in the fourth quarter. We anticipate awarding the work before the end of the year. While cost is certainly a factor, we are equally focused on the strength of each company’s proposed team, their track record, project schedule, and overall alignment with our development strategy. We have narrowed the field to firms that we know can meet the high standards required for a project of this magnitude.

CMJ: What are the key milestones investors and stakeholders should watch for before the end of 2025 as Donlin Gold moves closer to development?

GL: Several important catalysts are on the horizon for NOVAGOLD and the Donlin Gold Project. First and foremost is the anticipated award of the BFS. Once the contract is awarded, we will be able to provide guidance on project schedule and cost. This will be a pivotal milestone in advancing Donlin Gold toward a construction decision.

In addition, we are designing a district-wide exploration program to evaluate the broader potential of the Donlin Gold land package. This initiative reflects our belief that Donlin Gold is not only a world-class deposit but also part of a highly prospective gold district.

Combined with our strong financial position — $125 million in cash and term deposits as of August 31, 2025 — NOVAGOLD is well-equipped to fund its share of upcoming development activities.

These milestones represent meaningful progress toward unlocking the value of Donlin Gold and positioning it as one of the largest and highest-grade open-pit gold mines in the U.S.

CMJ: How do you balance the excitement around these drill results with the need to manage costs, timelines, and community expectations responsibly?

GL: Donlin Gold is truly a generational asset — few gold mines go into production with a projected 30-year mine life and the scale to produce over a million ounces annually. That long-term potential brings both excitement and responsibility. Our approach is grounded in disciplined project management, strong partnerships, and a deep commitment to the communities we serve.

Donlin Gold is located on private land owned by two Alaska Native corporations: Calista Corporation, which owns the mineral rights, and The Kuskokwim Corporation (TKC), which owns the surface rights. We have life-of-mine agreements in place with both, and their support has been instrumental throughout the permitting process at both the federal and state levels. These corporations are not just stakeholders; they both have a vested interest in the success of Donlin Gold.

Donlin Gold is in one of the most economically challenged regions of Alaska, where few other large-scale opportunities exist. That is why we have prioritized local hiring and community engagement from the outset. This year alone, we welcomed employees from 22 local villages across the Yukon-Kuskokwim (Y-K) region. These individuals are not only skilled workers; they are also the best ambassadors for the project. The jobs Donlin Gold provides are well-paying and meaningful, and they represent a vital source of economic stability for families and communities.

We take social license seriously. We engage actively with over 60 villages in the Y-K region, and we are planning training programs to prepare local residents for future employment at the project. We recognize that industrial-scale mining is new to many in the Y-K region, and workforce development is a cornerstone of our long-term strategy. As we advance the project, we remain focused on managing costs and timelines.

CMJ: How do you see the company in the next five years?

GL: I am incredibly proud of where NOVAGOLD is today. We have a new partner in Paulson who is fully aligned with our long-term vision for Donlin Gold, we are entering a pivotal phase of development with strong alignment and momentum. We have completed federal permitting and are nearing the finish line on state-level permitting. We have a strong treasury with $125 million in cash and term deposits — enough to see us through the responsible completion of the BFS.

Donlin Gold is a generational asset, and we have always believed that no mine should be built before its time. We have taken a disciplined approach to development, ensuring that the project is technically sound, economically viable, and socially responsible. With gold prices at record highs and a supportive environment for financing, I believe we have positioned the company well for this moment.

We are grateful to have been recently accepted into the FAST-41 program, a federal initiative that enhances transparency, accountability, and predictability in the federal permitting process. Established in 2015, FAST-41 ensures that permitting timelines are clearly defined, publicly available, and coordinated among federal agencies, while maintaining every existing environmental safeguard and regulatory requirement. This designation is expected to result in a more efficient permitting timeline and reflects the strategic importance of Donlin Gold as a responsible and key economic development project in Alaska.

And in November, we welcomed the Alaska Supreme Court’s decision affirming both the project’s water rights permits for the mine and the Department of Natural Resources’ approval of the State’s ROW for the state-owned lands portion of the proposed 316-mile natural gas pipeline. The ruling validates the State of Alaska’s thorough review process and reinforces that the project can move forward in a manner that safeguards the lands, waters, and communities of the Y-K and southcentral regions.

Over the next five years, I see NOVAGOLD transitioning from a developer to a builder. We will be focused on executing the BFS, finalizing engineering and procurement strategies, and preparing for a construction decision. Just as importantly, we will continue deepening our engagement with Alaska Native Corporations and the communities in the Y-K region, ensuring that Donlin Gold delivers lasting benefits for generations to come.

Comments