August: Top 40 revenues reach a record $177B in 2022: up $28B from the previous year

Top 40 revenues climbed up to more than $177 billion in 2022, mainly enhanced by Nutrien’s total revenue boost by almost $15 billion. Therefore, it is no surprise to our readers to see Nutrien, again, on top of our annual Top 40 list for 2022. In 2018, the Agrium and PotashCorp merger created Nutrien, a leader in global agriculture. Since then, Nutrien has dominated our Top 40 list. In July 2022, Nutrien announced agreements to acquire Brazilian agricultural retail companies Casa do Adubo S.A. and Marca Agro Mercantil. These acquisitions are meant to support Nutrien’s retail growth strategy in Brazil and may have added to Nutrien’s revenue boost in 2022.

It is interesting to realize that Nutrien’s domination on top of the list may not be affected in 2023 ranking by the recent acquisition of Newcrest by Newmont, as evident by combining Newmont’s and Newcrest’s revenues in 2022. Last May, Newmont agreed to acquire Newcrest by way of an Australian scheme of arrangement under which Newmont will acquire 100% of the issued shares in Newcrest Mining. The acquisition, though, “creates an industry-leading portfolio with a multi-decade gold and copper production profile in the world’s most favorable mining jurisdictions,” said Tom Palmer, president and CEO of Newmont.

Again, most of the companies on this year’s list are primary gold miners. That includes the new additions to the Top 40: Sumitomo and Aries. There are some copper-gold miners and many gold-silver miners. Several companies moved up the list assisted by their acquisitions and mergers in 2022. Both gold and copper continued their gains overall last year.

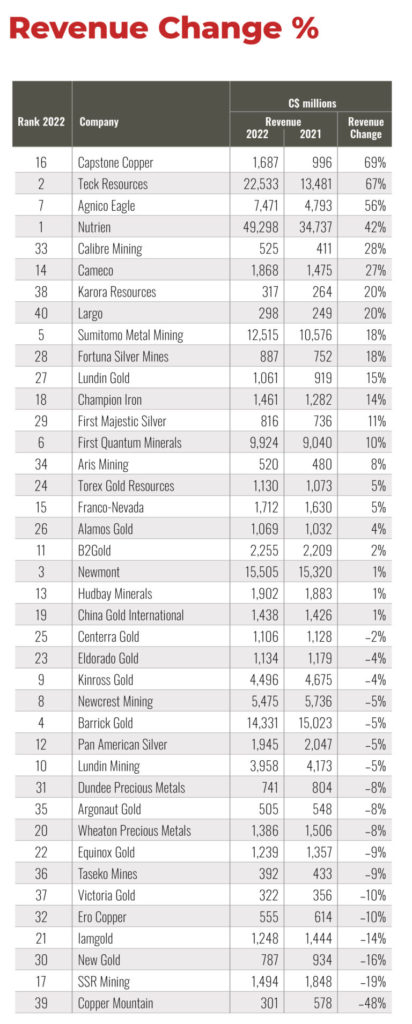

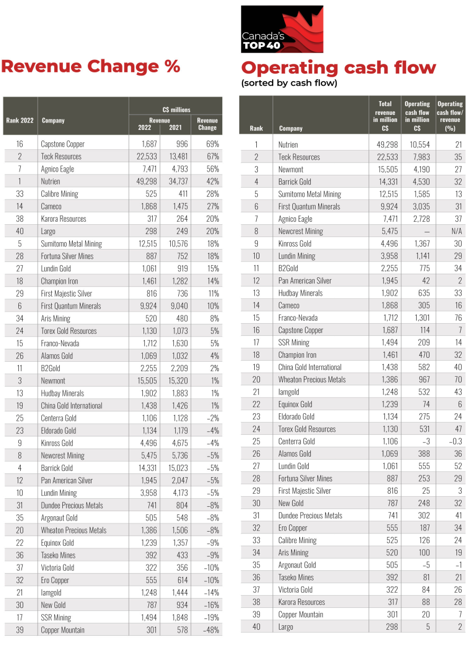

Good news is that 26 out of the 40 on the list achieved more total revenue in 2022 than in 2021. The bad news is that only four companies: Nutrien, Tech Resources, Agnico Eagle, and Capstone Copper bagged the biggest revenue gains in 2022 compared with 2021; good for them! In the next section, we will explain how they were able to make those profits. Additionally, 14 companies were unable to improve their revenues in 2022 over 2021 numbers.

Net revenue (synonymous with profit) refers to the company’s total revenue less its operating expenses, interest paid, depreciation, and taxes. Surprisingly, only 12 of the 40 were able to report positive net revenue change in 2022, and that is the ugly truth.

Other than Nutrien’s stronghold to the first place, this year’s ranking has been dynamic. Among the many changes, Teck resources moved up to the second place from the fourth place in 2021 and 2020.

Yamana Gold (11th place last year) disappeared from the list, and Pan American moved up the list to 12th place, following the completion of its previously announced acquisition of all the issued and outstanding common shares of Yamana, also following the sale by Yamana of its Canadian assets to Agnico Eagle. It is worth noting that Agnico Eagle’s merger with Kirkland Lake Gold (completed in February 2022) may have contributed to its total revenue boost by more than $2.6 billion in 2022 compared to 2021.

Capstone Copper climbed from 27th place in 2021 to 16th in 2022, likely a result of its combination with Mantos Copper.

Turquoise Hill Resources (10th place in 2021) disappeared from the list this year, as Rio Tinto has completed its acquisition of Turquoise Hill in Dec. 2022.

Only two royalty and streaming companies (Franco-Nevada and Wheaton Precious Metals) made the list this year, down from three last year. Despite the acquisition of Great Bear Resources, Kinross Gold moved down slightly only to the ninth place (from eighth in 2021). Fortuna Silver Mines combined with Roxgold late in 2021, and Fortuna moved up the list from 31st to 28th place in 2022 (see our report on Fortuna’s Séguéla mine visit on page 29 of this issue).

Aris Gold joined the list this year. GCM Mining (formerly Gran Colombia Gold) was 31st on the list in 2021, but it is no longer on the list this year due to the fact that it acquired all outstanding Aris Gold shares that were not already held by GCM Mining in July 2022, and the resulting entity was named Aris Gold Corp., which explains why Aris Gold suddenly made it to the 34th place on the list this year out of nowhere.

Also, new to the list is the Japanese Sumitomo Metal Mining. Listed on a Canadian stock exchange (TSE: 5713), and based

on several agreements between Sumitomo and Iamgold, Sumitomo now owns 30% of the Côté-Gosselin gold mine in Canada. The Côté-Gosselin gold project remains on track for gold production in early 2024. Additionally, beginning in January 2023, Sumitomo will contribute funding amounts to the Côté-Gosselin gold project for approximately $340 million over the course of 2023. In exchange, Iamgold will transfer an approximate 10% interest in the Côté-Gosselin JV to Sumitomo. Sumitomo also owns 80% of the advanced exploration Frotet gold mine in Quebec, with 20% owned by Kenorland Minerals.

Whether this is the beginning of a Japanese wave of companies added to our list or not is something that we can only tell in the next few years.

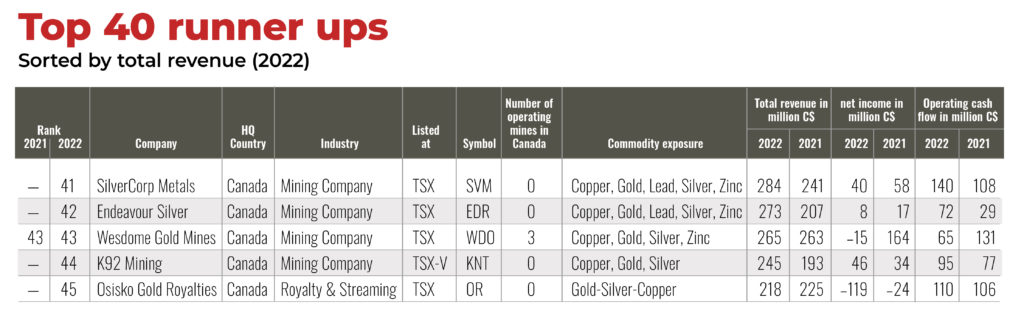

The runner-ups

Again, this year, a list of five runner-ups is provided. As usual, the list was predominated by new companies that made it for the first time, including SilverCorp Metals, Endeavour Silver, K92 Mining, and Osisko Gold Royalties (all mainly gold and copper miners). And like last year’s runner-ups list, only Wesdome Gold from the previous year’s runner-ups made the list this year, advancing up to 43rd from 44th in 2021.

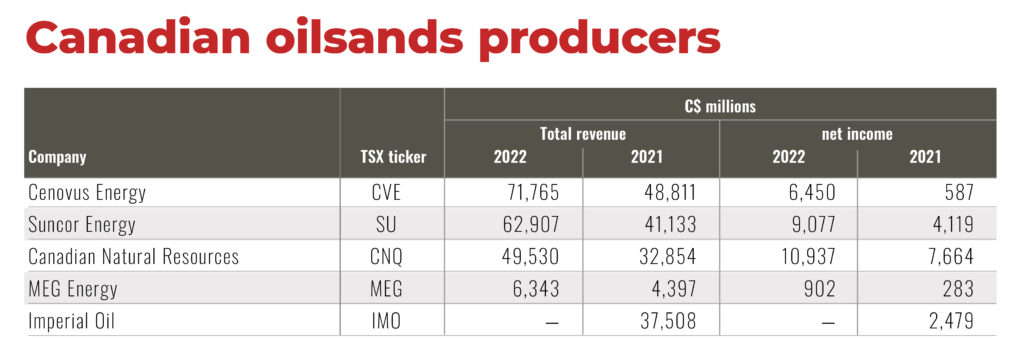

The oilsands

Canada has committed to net-zero by 2050. However, an interim goal would require the oil and gas industry to cut 42% of its greenhouse gas (GHG) emissions below 2019 levels by 2030. Both levels of government are providing support to the industry in the form of funding and tax credits but disagree on the methods to reach a carbon-neutral economy.

Ottawa is crafting policies that would put legislative pressure on the sector to decarbonize more quickly, including an impending emissions cap and killing “inefficient” fossil fuel subsidies. Despite that, as shown in the oilsands table, Canada’s oilsands sector saw tremendous increases in revenues in 2022, compared to 2021. Oil prices continued to soar due to the geopolitical instability caused by the war in Ukraine.

Cenovus Energy replaced Suncor Energy on top of the list. In June 2022, Cenovus Energy acquired BP’s 50% stake in Sunrise oilsands project. British energy giant, BP, is planning to focus on offshore oil development instead of Alberta’s oilsands. Cenovus also completed the acquisition of Husky Energy for $3.9 billion in stock in Jan. 2021.

At the time of drafting this article, Imperial Oil’s 2022 total revenue had not been reported yet.

THE CRITERIA FOR CHOOSING THE TOP 40

TO BE ELIGIBLE FOR CMJ’S TOP 40 CANADIAN MINERS LIST, COMPANIES MUST MEET TWO OF THE FOLLOWING THREE CRITERIA:

1 BE DOMICILED IN CANADA.

2 TRADE ON A CANADIAN STOCK EXCHANGE.

3 HAVE A SIGNIFICANT SHARE OF AN OPERATING MINE OR ADVANCED DEVELOPMENT IN CANADA.

WE HAVE PUT EXTRA EFFORT INTO CHECKING THE ELIGIBILITY OF ALL THE MINERS ON THE CURRENT LIST. HOWEVER, WE REMAIN OPEN TO THE SUGGESTIONS OF OUR READERS.

2023 Forecast

In May 2023, Teck Resources confirmed that it has received a revised, unsolicited, non-binding proposal from Glencore, which would see that company acquire Teck. However, later in June 2023, Glencore confirmed that it submitted alternative proposal to acquire Teck’s steelmaking coal business. As a result, Teck Resources may disappear from the list next year and may or may not be replaced by Glencore.

Copper Mountain will disappear from the list, since it was announced in June 2023 that Hudbay Minerals has acquired all the outstanding common shares of Copper Mountain, which made the latter a wholly owned subsidiary of Hudbay. However, the transaction created a premier American focused copper miner. In general, big acquisitions and mergers are expected in 2023.

Comments