[caption id="attachment_1003728848" align="aligncenter" width="460"]

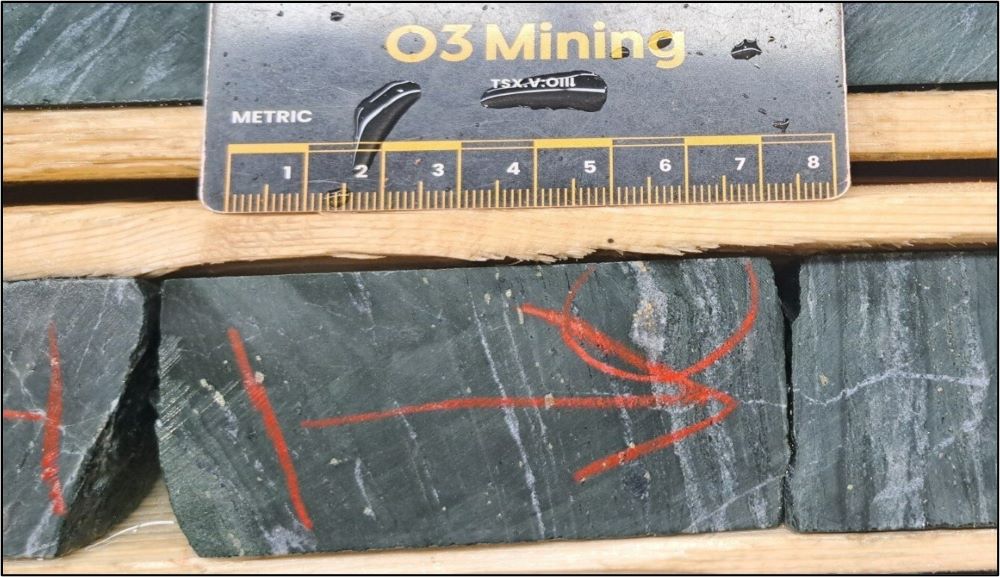

Underground at the Bulyanhulu mine. (Image: Acacia Mining)

Underground at the Bulyanhulu mine. (Image: Acacia Mining)[/caption]

TORONTO –

Barrick Gold has indicated it is willing to buy out the minority shareholders of

Acacia Mining if that is what it takes to resolve tax and environmental woes of Acacia in Tanzania.

Barrick already holds 63.9% of Acacia’s shares. It is offering 0.153 of a Barrick share for each ordinary share of Acacia. The offer may be reduced if Acacia pays any further dividends to shareholders.

The argument goes back to 2016 when Tanzania delivered a tax demand for tens of billions of dollars to Acacia. The government estimated the gold output from the Bulyanhulu, Buzwagi and North Mara gold-copper mines at 10 times what Acacia reported. Then the government refused to let Acacia export its concentrates. And as governments sometimes do, the country wielded its licensing and environmental powers to make things tougher for Acacia.

The buyout news comes as Barrick says it has reached a tentative agreement with the government of Tanzania regarding their differences. Barrick did the negotiating, and that put Acacia’s corporate nose out of joint as it was not consulted along the way.

This story certainly has had legs – meaning it is still going strong after so many months. Final resolution is not yet agreed, but if the government of Tanzania’s goal was to push Acacia out of the country, it may succeed, if only because Barrick rebrands the company.

See either

www.Barrick.com or

www.AcaciaMining.com for more information.

Underground at the Bulyanhulu mine. (Image: Acacia Mining)[/caption]

TORONTO – Barrick Gold has indicated it is willing to buy out the minority shareholders of Acacia Mining if that is what it takes to resolve tax and environmental woes of Acacia in Tanzania.

Barrick already holds 63.9% of Acacia’s shares. It is offering 0.153 of a Barrick share for each ordinary share of Acacia. The offer may be reduced if Acacia pays any further dividends to shareholders.

The argument goes back to 2016 when Tanzania delivered a tax demand for tens of billions of dollars to Acacia. The government estimated the gold output from the Bulyanhulu, Buzwagi and North Mara gold-copper mines at 10 times what Acacia reported. Then the government refused to let Acacia export its concentrates. And as governments sometimes do, the country wielded its licensing and environmental powers to make things tougher for Acacia.

The buyout news comes as Barrick says it has reached a tentative agreement with the government of Tanzania regarding their differences. Barrick did the negotiating, and that put Acacia’s corporate nose out of joint as it was not consulted along the way.

This story certainly has had legs – meaning it is still going strong after so many months. Final resolution is not yet agreed, but if the government of Tanzania’s goal was to push Acacia out of the country, it may succeed, if only because Barrick rebrands the company.

See either

Underground at the Bulyanhulu mine. (Image: Acacia Mining)[/caption]

TORONTO – Barrick Gold has indicated it is willing to buy out the minority shareholders of Acacia Mining if that is what it takes to resolve tax and environmental woes of Acacia in Tanzania.

Barrick already holds 63.9% of Acacia’s shares. It is offering 0.153 of a Barrick share for each ordinary share of Acacia. The offer may be reduced if Acacia pays any further dividends to shareholders.

The argument goes back to 2016 when Tanzania delivered a tax demand for tens of billions of dollars to Acacia. The government estimated the gold output from the Bulyanhulu, Buzwagi and North Mara gold-copper mines at 10 times what Acacia reported. Then the government refused to let Acacia export its concentrates. And as governments sometimes do, the country wielded its licensing and environmental powers to make things tougher for Acacia.

The buyout news comes as Barrick says it has reached a tentative agreement with the government of Tanzania regarding their differences. Barrick did the negotiating, and that put Acacia’s corporate nose out of joint as it was not consulted along the way.

This story certainly has had legs – meaning it is still going strong after so many months. Final resolution is not yet agreed, but if the government of Tanzania’s goal was to push Acacia out of the country, it may succeed, if only because Barrick rebrands the company.

See either

Comments