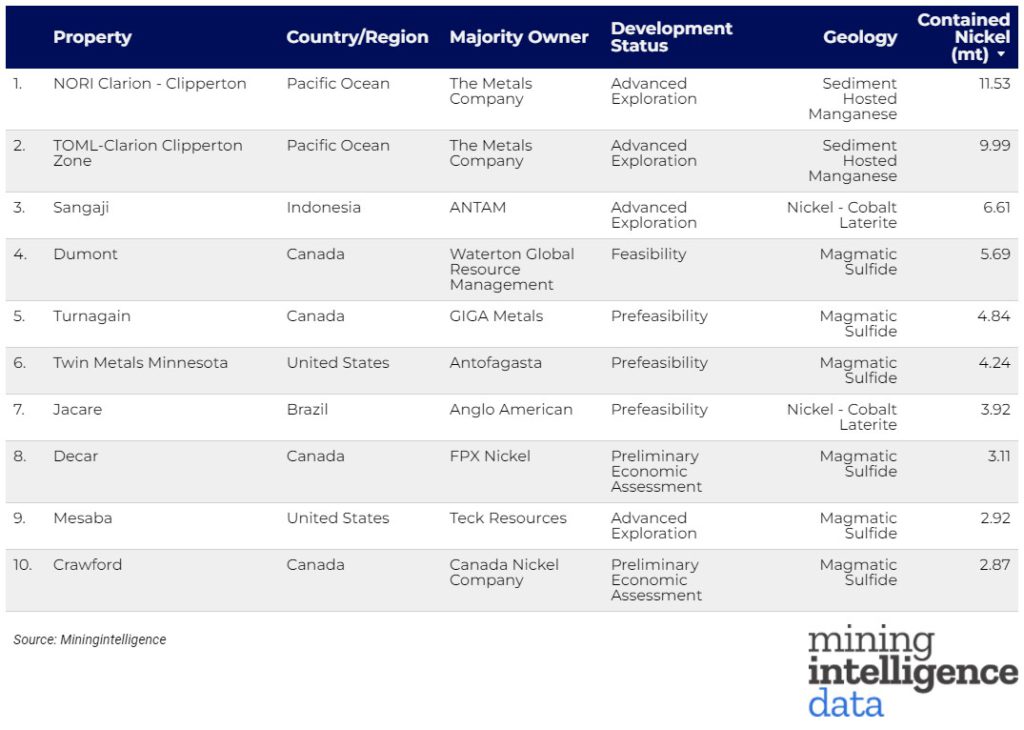

RANKED: World’s biggest nickel projects – 2022

Nickel is used mainly in the steelmaking process, but also in production of batteries for electric vehicles, and it is the metal that has grabbed the most headlines so far this year.

This week alone, the price jumped by the 15% daily limit on the London Metal Exchange, adding to a string of sharp price moves as the market seeks to reset following an unprecedented short squeeze and week-long trading halt.

A chaotic trading whirlwind at the beginning of March saw the nickel price spiking 250% to a high of $101,365 a tonne. The spike was driven in large part by a short squeeze centered on Chinese tycoon Xiang Guangda, who had amassed a big wager that nickel prices would fall through his company Tsingshan Holding Group Co.

When the dust settles after the nickel price drama, what remains is the certainty of the demand for the metal, as electric car makers race to build more batteries and manufacturers increasingly use high-nickel cathode battery chemistries.

To identify major nickel deposits that could form part of the global supply landscape in the future, MINING.COM and sister company MiningIntelligence compiled the 10 largest projects under development worldwide and ranked them based on contained nickel resources in the measured, indicated and inferred categories.

Other commodities: cobalt, copper, manganese

In top spot is the Nori Clarion-Clipperton polymetallic project, located 4,000 metres deep into the northeastern part of the Pacific Ocean with 11.53 million tonnes (mt) contained metal. The project is named after the seafloor zone between Hawaii and Mexico, in international waters. The exploration contract is held by Nauru Ocean Resources Inc., but the Metals Company, formerly Deep Green Metals, has exclusive access to this area.

Other commodities: cobalt, copper, manganese

The TOML exploration zone in neighboring Tonga is also part of The Metals Company's portfolio, with estimated resources 9.9 mt tonnes contained nickel and with similar grades to NORI. In 2020, the Metals Company acquired Tonga Offshore Mining Limited (TOML), giving the company exploration rights to a 74,713 km2 block of CCZ seabed that contains an inferred resource of 756 million wet tonnes of polymetallic nodules.

Other commodities: cobalt, iron

The Sangaji project in Halmahera, Indonesia, held by Indonesian miner ANTAM is in third place with 6.61 mt contained nickel.

Other commodities: cobalt, palladium, platinum, magnetite

In 4th place is Waterton Global Resource Management's Dumont nickel-sulphide deposit in Quebec. With 6.61 mt of contained nickel, once in production, Dumont is expected to rank among the biggest nickel operations in the world, with an average annual nickel production of 39,000 tonnes for over 30 years. In 2021, Waterton hired Goldman Sachs as advisers to sell the project, seeking to capitalize on demand for the resource.

Other commodities: cobalt

The Turnagain project operated by Giga Metals in British Columbia is in fifth place with 4.84 mt contained nickel. Giga Metals aims to develop Turnagin into the world’s first carbon-neutral mine.

Other commodities: cobalt, copper, gold, palladium, platinum, silver

In sixth place is Antofagasta’s Twin Metals project located in Minnesota’s Duluth Complex mining camp with 4.24 mt contained nickel. The proposed mine has been under close scrutiny for years over potential environmental risks. Last year, the US Bureau of Land Management agreed to reconsider its decision to renew 13 prospecting permits in Minnesota, which could have allowed Antofagasta to expand its proposed copper-nickel mine, leaving the project in limbo.

Other commodities: cobalt

Anglo American's Jacare project in Brazil is in seventh place with 3.92 mt contained nickel. Jacare lies about 90 miles away from the Vale's Onça Puma nickel mine.

Other commodities: N/A

In eighth place is FPX Nickel’s greenfield discovery at Decar with 3.11 mt contained nickel. The project – named after the district in central British Columbia, hosting the awaruite mineralization – is estimated to produce 37,369 tonnes of concentrate per annum over a mine life of 24 years.

Other commodities: cobalt, copper, gold, palladium, platinum

Teck Resources' Mesaba nickel project in the US is in ninth place with 2.92mt contained nickel. Mesaba is the largest sulphide deposit in Minnesota’s Duluth Complex.

Other commodities: cobalt, palladium, platinum

Canada Nickel Company's Crawford project in Ontario rounds out the list with 2.87 mt contained nickel. The operation is set to generate 2.05 tonnes of carbon dioxide per tonne of nickel-equivalent production over a mine life of 25 years – 93% lower than the industry average of 29 tonnes of CO2.

*Honourable mentions go to Zebediela in South Africa and Windy Craggy in Northern British Columbia as significant deposits and to Ivanhoe's Platreef project in South Africa, which has moved into construction.

Download the data from Miningintelligence here.

This article was originally published on www.Mining.com.

2 Comments

Mark Appleby

Kenbridge Nickel Project not even mentioned ?

Marilyn Scales

Kenbridge ranks #100 with 5.5 kt, according to our researchers.