Costs of Rook I project rise 70% says NexGen

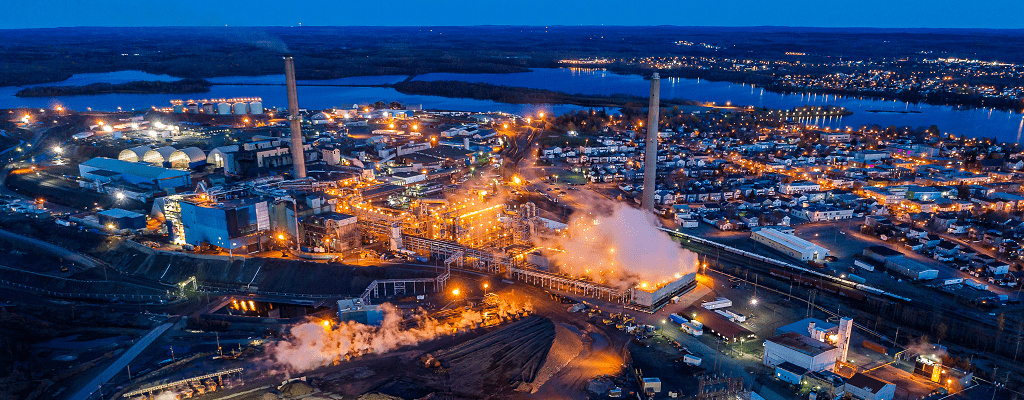

Representation of NexGen Energy’s Rook I project in Saskatchewan. CREDIT: NEXGEN ENERGY

NexGen Energy has revised the cost estimates for its Rook I uranium project in Saskatchewan, with expenses now 70% higher than projected in 2021. The updated capital cost is $2.2 billion, up from $1.3 billion. Operating costs are projected to nearly double to $13.86 per pound of uranium oxide (U3O8), compared to $7.58 in the previous estimate.

The project’s after-tax net cash flow is expected to average $1.93 billion annually over the first five years, down from $2 billion. The after-tax net present value has decreased to $6.3 billion from $7.7 billion, with the internal rate of return now at 45%, down from 79%.

“NexGen’s updated capex, opex and sustaining capital reflect the company’s focus on ensuring that every aspect of the project aligns for the development of a truly world-class resources project,” said NexGen’s CEO Leigh Curyer. “The updated capital cost presents an all-encompassing spend to bring the Rook I project into production based on robust, proven mining and construction methodologies, with a payback period of 12 months.”

Annual production is expected to reach 21.7 million pounds of U3O8, with a capacity of up to 30 million pounds. The project has 3.7 million tonnes of measured and indicated resources grading 3.1% U3O8. Sustaining capital costs are now estimated at $785 million, averaging $70 million per year, more than double the $33 million estimated previously.

Engineering progress has moved from 18% to about 45% complete. Construction will commence following final federal environmental assessment approval, with detailed engineering and procurement proceeding in the meantime.

Comments