Jorge Ganoza on why Fortuna is chasing value, not ounces

Fortuna Mining CEO discusses Séguéla Mine growth, West Africa strategy, and industry challenges

Fortuna Mining recently reported an extension of the expected mine life at its flagship Séguéla gold operation, reinforcing its position as a cornerstone asset in the company’s portfolio. During an onsite interview at the Séguéla mine in November 2025, Canadian Mining Journal’s Editor-in-Chief, Dr. Tamer Elbokl, spoke with Jorge A. Ganoza, president, CEO, and director of Fortuna Mining, about capital allocation, portfolio strategy, operational resilience, expansion prospects, and value-focused growth across West Africa and beyond.

Q: Séguéla has been Fortuna Mining’s strongest cash generator this year, helping deliver robust free cash flow. How are you prioritizing that capital between West Africa growth projects, balance-sheet strength, and potential shareholder returns over the next 12 months?

A: Undoubtedly in this price environment and with the low costs of the Séguéla mine, we have been enjoying strong free cash flow generation. But we have been deploying capital towards organic growth. We have expanded our exploration programs from 2024 into 2025, and we are looking to expand them further into 2026. Also, we have the Diamba Sud Gold Project in Senegal, which is advancing rapidly. We recently published a preliminary economic assessment (PEA) for the Diamba Sud Project that shows an internal rate of return on invested capital of 72% with an NPV of over half a billion dollars using $2,750 gold price. So, we have plenty of opportunities to continue deploying capital. We have a very strong pipeline of opportunities for further growth and optimization. Naturally, we first envision investing capital towards those opportunities and more exploration. Then, we have a share buyback program in place. Returning capital to shareholders through the buyback is something we have been doing, particularly at the end of 2024 and the start of 2025. And we will consider a dividend policy in due time, but I think we do not have shortage of investment opportunities for the capital we are generating.

Q: Following the divestiture of Yaramoko, Fortuna Mining reset its 2025–26 guidance around a streamlined portfolio. What strategic filters now determine which assets remain core — and what would prompt you to add or exit a jurisdiction?

A: We have a very clear criteria with respect to what we need strategically in our portfolio. We need assets that can perform at or below the average cost curve for all-in sustaining costs. We need assets where we can project a life of mine of a decade at least. They also must be located within the jurisdictions of choice for us, which are West Africa and Latin America. The two mines we sold at the beginning of the year did not meet the life of mine criteria. So, we decided to divest. Additionally, exiting Yaramoko in Burkina Faso also had some security considerations.

Now, we have streamlined the portfolio, and the assets we have today meet the basic strategic criteria that we set up for the company. All of them are assets that offer growth opportunities. With respect to bringing new assets to the portfolio, I think the main consideration for us is that “we are chasing value, not ounces,” and that is something important to keep in mind in this high price environment for gold. Our jurisdictions of choice are West Africa and Latin America. Within West Africa, we are in the coastal countries, like Cote d’Ivoire and Senegal, and we are also investing in Guinea through a joint venture.

Q: Power reliability and plant debottlenecking have been central themes at Séguéla mine. What long-term structural steps are you implementing to improve site resilience and harden uptime through 2026?

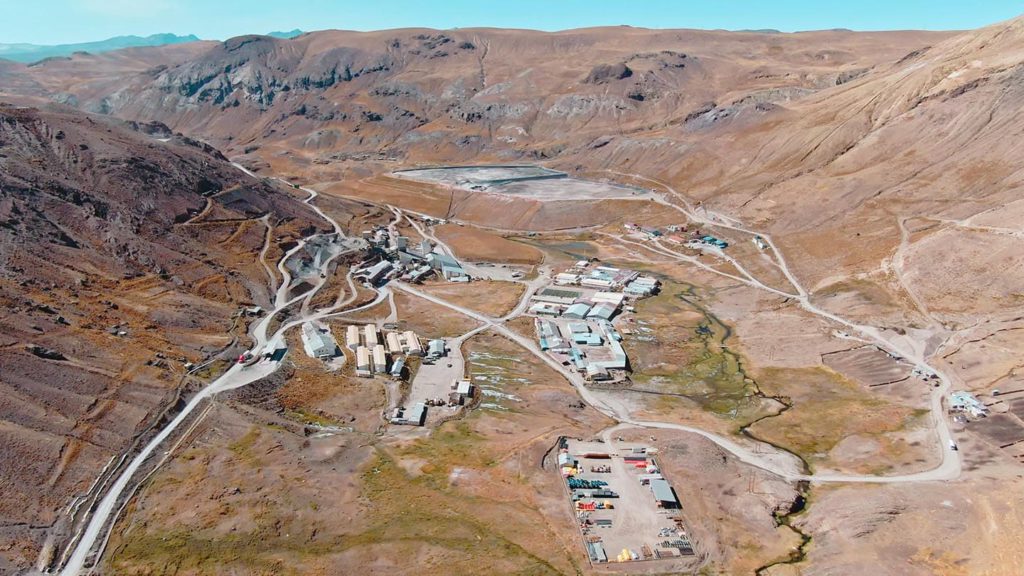

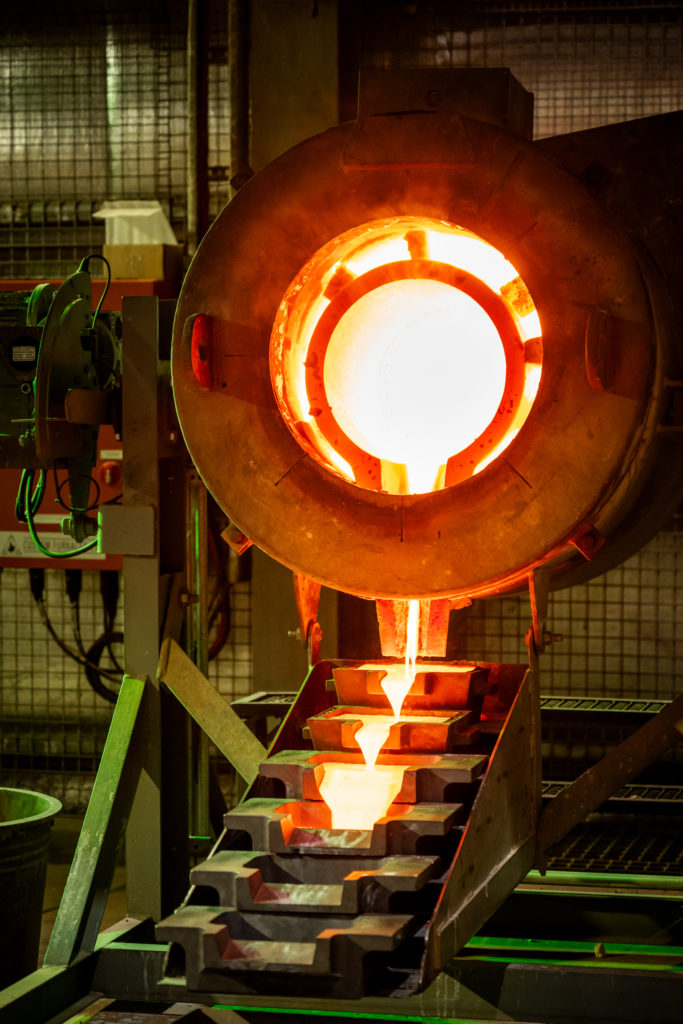

A: At this mine (Séguéla), we have been enjoying tremendous exploration success, and that geologic foundation is underpinning our growth plans at this mine. As we just announced, we have not only balanced depletion for the year but also increased the size of reserves by 11%. Now, we can talk about a life of mine of 7.5 years, solely on reserves. We have expanded our indicated resources, exclusive of reserves, by 100% to over 700,000 oz. of gold. We also expanded or inferred resources to about 700,000 oz. of gold, which is year-over-year growth of 15%. So, all of this is underpinning the expansion studies at this mine. We are also looking at underground mining scenarios. That study is expected to be completed in December 2025, and we are launching an expansion study as well for the processing plant. The plant currently has an annual throughput capacity of 1.75 million t/y, and we are looking to expand that to 2.5 million t/y.

Q: Diamba Sud’s PEA outlined exceptionally strong economics with a 70%+ IRR case. What are the gating milestones you need to see before moving toward a construction decision, and how will the experience from Séguéla mine guide your execution strategy in Senegal?

A: With the robust economics that we have shown in the PEA and the exploration potential that we can continue to see, the construction decision is a matter of when, not if, and we want to advance our engineering studies. We want to move from the PEA to a definitive feasibility study (DFS) in the first half of 2026. With the DFS, we want to be going public with a construction decision.

We are not advancing the project sequentially. Instead, we are doing several activities in parallel. We continue exploring, advancing the engineering studies, and we have initiated the permitting process. Last October, we filed our environmental and social impact assessment with the government. We are working closely with the authorities, and we expect a swift approval in the first quarter of 2026. Since the government is truly engaged with us, we have asked permission to initiate some early work to expand the camp facilities and start some excavations.

Q: Fortuna Mining has emphasized disciplined capital allocation. With Séguéla mine outperforming and Diamba Sud emerging as a high-value project, how do you balance organic growth with increasing M&A activity across West Africa and the Americas? What defines a value-accretive deal today?

A: Our first focus is organic growth, and we have a robust pipeline of opportunities, expansion, advancing the Diamba Sud project to production, and initiatives that we have at our other mines. We are currently drilling and exploring for gold in Mexico, Argentina, Cote d’Ivoire, and Guinea, outside of our mine sites. So, we have a lot of optionality there. I go back to my original statement: In this high gold price environment, it is easy to chase ounces, but we are more focused on value.

Now, what defines value? First, we need to see opportunities for growth. For example, we continue harvesting growth at Séguéla mine. When we acquired Séguéla mine, the mineral endowment was about a million to 1.4 million oz. of gold. Today, based on our latest reserve numbers, plus what we have depleted, Séguéla stands at over 3 million oz. of gold and continues growing. We envision the same for the Diamba Sud project. For example, Caylloma Mine in Peru is a mine that has been running for generations, and we continue to see the mine producing. For us, a value proposition needs to come with a strong view and exploration potential. Sounds like fundamental economics, right? Again, Fortuna is chasing value, not ounces.

Q: You have spoken about building a resilient, multi-jurisdictional mining company. After navigating Côte d’Ivoire’s grid reliability issues and exiting Yaramoko, what new risk screens or scenario-planning tools are you applying before committing major capital to new regions or expansions?

A: We feel very comfortable investing in the jurisdictions where we are currently located. We believe Côte d’Ivoire is a premier mining jurisdiction. In our interactions in Senegal, we find a government that is very committed to developing successfully modern mining. So, I think challenges might arise from this high gold price environment that has got everybody excited, but there is a flip side to that: governments will be asking for a bit more of the pie. Ultimately, we believe that all the jurisdictions where we are currently operating are welcoming and are working hand in hand with us to develop the mining industry.

Q: As gold markets remain volatile, what are your key sensitivity bands for 2025–26 in terms of cash flow, AISC, and sustaining capital? How do the current price scenarios influence drilling intensity, development pacing, and debt strategy?

A: I believe that the issue that we all need to address is what this $4,000 per oz. gold price means for the industry. There is a flip side to that, so let me make a reflection here: The last time we saw historic high gold price was in 1980 when gold reached $800 per oz. If we fast forward to 2025 and adjust that for inflation, that means $3,100 per oz. However, gold is trading over $4,000 today. A person in a position of responsibility or leadership in 1980, such as a professional with 10 years of experience, would be 75 or 80 years old today. So, no one in our generation has dealt before with this price environment.

So, what does this mean? There are risks associated with the structural bottlenecks of our industry. For example, when an underdog wants to build a mine, do they have enough qualified engineers? Are there enough manufacturing lines to provide the equipment we use in the industry or enough supply chains?

I believe that if prices stay where they are or continue moving higher, we are going to start seeing mounting pressure on all supply chains, and we are already thinking about that and preparing for the challenges that will come attached to it.

This article is based on a CMJ video interview recorded during a site visit to Séguéla Gold Mine in Côte d’Ivoire. The videos can be found here:

Comments