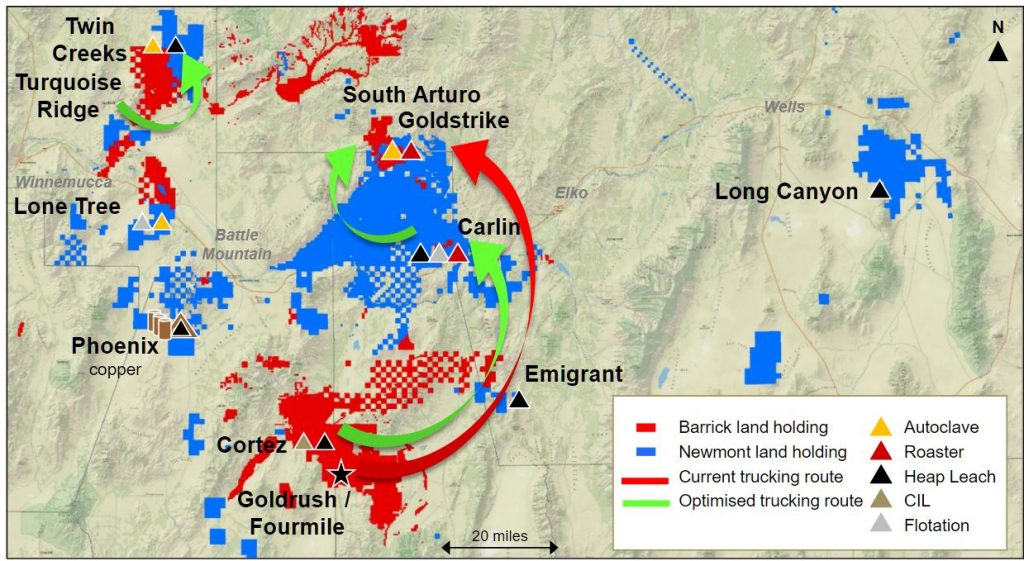

[caption id="attachment_1003727429" align="aligncenter" width="472"]

Barrick (red) and Newmont (blue) holdings in Nevada. (Image: Newmont Min

Barrick (red) and Newmont (blue) holdings in Nevada. (Image: Newmont Mining)[/caption]

Much has been speculated about mergers among gold producers since

Barrick Gold announced the takeover of

Randgold Resources last September.

The $6-billion Barrick-Randgold deal came together without a hitch and was finalized on Jan. 2, 2019, making Barrick once again the world’s largest gold miner. Former Randgold exec Mark Bristow stepped into the leadership of Barrick and put his own stamp on the company. Layoffs at the head office ensued.

Not to be outdone,

Newmont Mining and

Goldcorp announced their business combination on Jan. 14, 2019. The deal was said to be worth about $10 billion, and it would make Newmont Goldcorp the largest gold producer in the world.

Then Barrick’s Bristow announced a hostile, all-share deal to take over Newmont, provided that Goldcorp was cut loose, late in February. The deal was valued at $18 billion. Newmont resisted saying it was a “low ball offer”, and its board unanimously rejected Barrick’s proposal on March 4.

The story thus far has as many plot twists as any soap opera on daytime television.

Everyone – investors, analysts, global miners – has speculated on the ultimate outcome.

The situation looks to have settled down for now. Barrick and Newmont announced the terms of a joint venture for their assets in Nevada. This is an arrangement that was first proposed 20 years ago but never gained traction.

The joint venture will belong 38.5% to Newmont and 61.5% by Barrick, with the latter being the operator. Representation on the JV board will be based on ownership, and advisory committees will have equal representation. After all, there are an estimated $5 billion to be reaped in synergies in the state.

And Barrick will withdraw its hostile bid for Newmont.

Goldcorp is supportive of the joint venture because the merger of it and Newmont can still go ahead. The Goldcorp board continues to recommend that its shareholders vote for the Newmont offer.

One big question remains: What makes Barrick so keen to swallow up other gold miners? Is it simply hubris? Or is it that new gold deposits are getting harder to find and more expensive to develop, as the

Financial Post suggested. We can speculate, but may never know why.

Barrick (red) and Newmont (blue) holdings in Nevada. (Image: Newmont Mining)[/caption]

Much has been speculated about mergers among gold producers since Barrick Gold announced the takeover of Randgold Resources last September.

The $6-billion Barrick-Randgold deal came together without a hitch and was finalized on Jan. 2, 2019, making Barrick once again the world’s largest gold miner. Former Randgold exec Mark Bristow stepped into the leadership of Barrick and put his own stamp on the company. Layoffs at the head office ensued.

Not to be outdone, Newmont Mining and Goldcorp announced their business combination on Jan. 14, 2019. The deal was said to be worth about $10 billion, and it would make Newmont Goldcorp the largest gold producer in the world.

Then Barrick’s Bristow announced a hostile, all-share deal to take over Newmont, provided that Goldcorp was cut loose, late in February. The deal was valued at $18 billion. Newmont resisted saying it was a “low ball offer”, and its board unanimously rejected Barrick’s proposal on March 4.

The story thus far has as many plot twists as any soap opera on daytime television.

Everyone – investors, analysts, global miners – has speculated on the ultimate outcome.

The situation looks to have settled down for now. Barrick and Newmont announced the terms of a joint venture for their assets in Nevada. This is an arrangement that was first proposed 20 years ago but never gained traction.

The joint venture will belong 38.5% to Newmont and 61.5% by Barrick, with the latter being the operator. Representation on the JV board will be based on ownership, and advisory committees will have equal representation. After all, there are an estimated $5 billion to be reaped in synergies in the state.

And Barrick will withdraw its hostile bid for Newmont.

Goldcorp is supportive of the joint venture because the merger of it and Newmont can still go ahead. The Goldcorp board continues to recommend that its shareholders vote for the Newmont offer.

One big question remains: What makes Barrick so keen to swallow up other gold miners? Is it simply hubris? Or is it that new gold deposits are getting harder to find and more expensive to develop, as the Financial Post suggested. We can speculate, but may never know why.

Barrick (red) and Newmont (blue) holdings in Nevada. (Image: Newmont Mining)[/caption]

Much has been speculated about mergers among gold producers since Barrick Gold announced the takeover of Randgold Resources last September.

The $6-billion Barrick-Randgold deal came together without a hitch and was finalized on Jan. 2, 2019, making Barrick once again the world’s largest gold miner. Former Randgold exec Mark Bristow stepped into the leadership of Barrick and put his own stamp on the company. Layoffs at the head office ensued.

Not to be outdone, Newmont Mining and Goldcorp announced their business combination on Jan. 14, 2019. The deal was said to be worth about $10 billion, and it would make Newmont Goldcorp the largest gold producer in the world.

Then Barrick’s Bristow announced a hostile, all-share deal to take over Newmont, provided that Goldcorp was cut loose, late in February. The deal was valued at $18 billion. Newmont resisted saying it was a “low ball offer”, and its board unanimously rejected Barrick’s proposal on March 4.

The story thus far has as many plot twists as any soap opera on daytime television.

Everyone – investors, analysts, global miners – has speculated on the ultimate outcome.

The situation looks to have settled down for now. Barrick and Newmont announced the terms of a joint venture for their assets in Nevada. This is an arrangement that was first proposed 20 years ago but never gained traction.

The joint venture will belong 38.5% to Newmont and 61.5% by Barrick, with the latter being the operator. Representation on the JV board will be based on ownership, and advisory committees will have equal representation. After all, there are an estimated $5 billion to be reaped in synergies in the state.

And Barrick will withdraw its hostile bid for Newmont.

Goldcorp is supportive of the joint venture because the merger of it and Newmont can still go ahead. The Goldcorp board continues to recommend that its shareholders vote for the Newmont offer.

One big question remains: What makes Barrick so keen to swallow up other gold miners? Is it simply hubris? Or is it that new gold deposits are getting harder to find and more expensive to develop, as the Financial Post suggested. We can speculate, but may never know why.

Comments