[caption id="attachment_1003725886" align="aligncenter" width="469"]

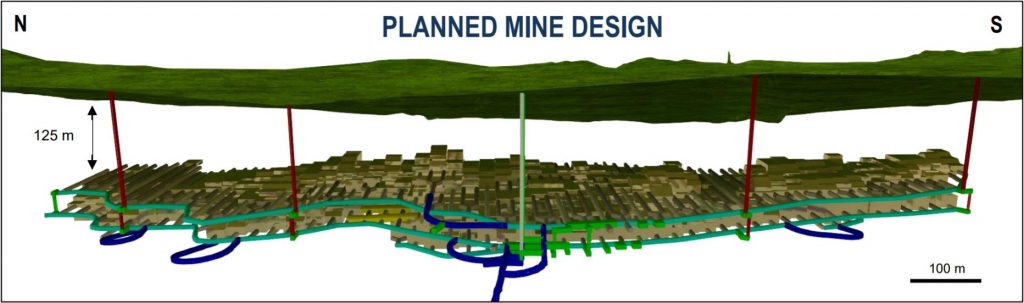

The planned Loma Larga gold-copper mine design. (Image: INV Metals)

The planned Loma Larga gold-copper mine design. (Image: INV Metals)[/caption]

ECUADOR – Toronto-based

INV Metals is in receipt of a positive feasibility study for its 100% owned Loma Larga gold-copper-silver project 30 km southwest of Cuenca. The study examines an underground mine and 3,000-t/d mill that will produce gold-pyrite and gold-copper concentrates.

Loma Larga has an after tax net present value of $356 million (all U.S. dollars) and an internal rate of return of 24.7%. Payback after taxes will take 2.6 years. INV expects to spend $279 million on pre-production capex, $62 million on sustaining costs, and another $22 million on closure costs. Life of mine all-in sustaining costs will be $609 per oz. of gold.

INV hopes to complete the permitting and financing in 2019, followed by construction in 2020 and first production in the second half of 2021.

The project will produce an average of 150,000 oz of gold annually. Over its 12-year life, 1.68 million oz. of gold, 9.83 million oz. of silver, and 71.3 million lb. of copper will be produced.

Proven and probable reserves are 13.9 million tonnes grading 4.91 g/t gold, 29.6 g/t silver and 0.29% copper. Including reserves, the measured and indicated resources are 19.8 million tonnes at 4.25 g/t gold, 27.8 g/t silver and 0.25% copper. The inferred resource is 4.7 million tonnes grading 2.2 g/t gold, 29.7 g/t silver and 0.14% copper.

The newest corporate presentation is available at

www.INVmetals.com.

The planned Loma Larga gold-copper mine design. (Image: INV Metals)[/caption]

ECUADOR – Toronto-based INV Metals is in receipt of a positive feasibility study for its 100% owned Loma Larga gold-copper-silver project 30 km southwest of Cuenca. The study examines an underground mine and 3,000-t/d mill that will produce gold-pyrite and gold-copper concentrates.

Loma Larga has an after tax net present value of $356 million (all U.S. dollars) and an internal rate of return of 24.7%. Payback after taxes will take 2.6 years. INV expects to spend $279 million on pre-production capex, $62 million on sustaining costs, and another $22 million on closure costs. Life of mine all-in sustaining costs will be $609 per oz. of gold.

INV hopes to complete the permitting and financing in 2019, followed by construction in 2020 and first production in the second half of 2021.

The project will produce an average of 150,000 oz of gold annually. Over its 12-year life, 1.68 million oz. of gold, 9.83 million oz. of silver, and 71.3 million lb. of copper will be produced.

Proven and probable reserves are 13.9 million tonnes grading 4.91 g/t gold, 29.6 g/t silver and 0.29% copper. Including reserves, the measured and indicated resources are 19.8 million tonnes at 4.25 g/t gold, 27.8 g/t silver and 0.25% copper. The inferred resource is 4.7 million tonnes grading 2.2 g/t gold, 29.7 g/t silver and 0.14% copper.

The newest corporate presentation is available at

The planned Loma Larga gold-copper mine design. (Image: INV Metals)[/caption]

ECUADOR – Toronto-based INV Metals is in receipt of a positive feasibility study for its 100% owned Loma Larga gold-copper-silver project 30 km southwest of Cuenca. The study examines an underground mine and 3,000-t/d mill that will produce gold-pyrite and gold-copper concentrates.

Loma Larga has an after tax net present value of $356 million (all U.S. dollars) and an internal rate of return of 24.7%. Payback after taxes will take 2.6 years. INV expects to spend $279 million on pre-production capex, $62 million on sustaining costs, and another $22 million on closure costs. Life of mine all-in sustaining costs will be $609 per oz. of gold.

INV hopes to complete the permitting and financing in 2019, followed by construction in 2020 and first production in the second half of 2021.

The project will produce an average of 150,000 oz of gold annually. Over its 12-year life, 1.68 million oz. of gold, 9.83 million oz. of silver, and 71.3 million lb. of copper will be produced.

Proven and probable reserves are 13.9 million tonnes grading 4.91 g/t gold, 29.6 g/t silver and 0.29% copper. Including reserves, the measured and indicated resources are 19.8 million tonnes at 4.25 g/t gold, 27.8 g/t silver and 0.25% copper. The inferred resource is 4.7 million tonnes grading 2.2 g/t gold, 29.7 g/t silver and 0.14% copper.

The newest corporate presentation is available at

Comments