[caption id="attachment_1003746014" align="aligncenter" width="550"]

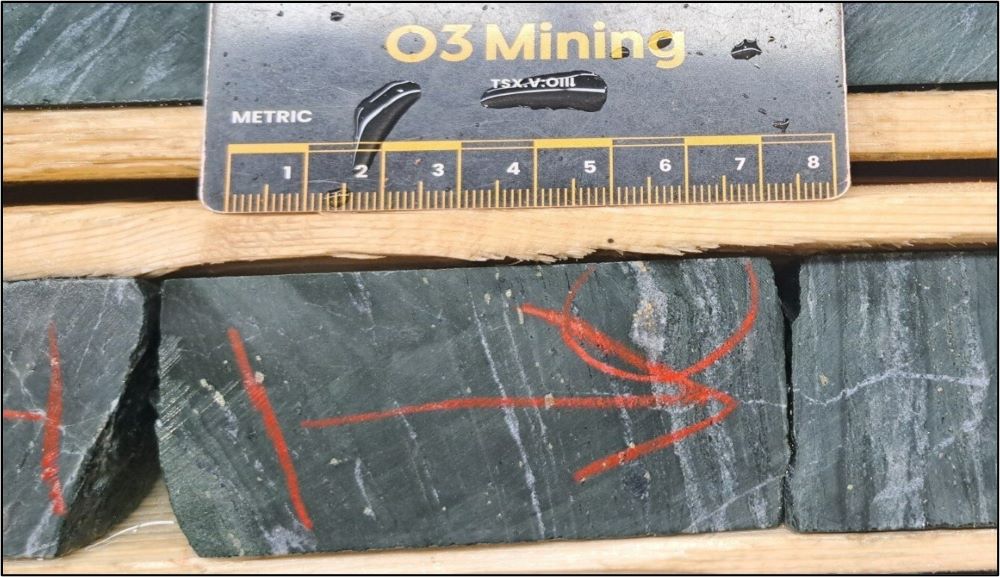

Southern Silver's Cerro Las Minitas project in Mexico. Credit: Southern Silver Exploration

Southern Silver's Cerro Las Minitas project in Mexico. Credit: Southern Silver Exploration[/caption]

Southern Silver Exploration (TSXV: SSV) is sitting on one of the world’s largest undeveloped silver projects, Cerro Las Minitas in Durango, Mexico. The flagship property is now under 100% control of the company since it bought out its partner, Electrum Global Holdings, in September 2020 and the company is intent on not only making the project bigger, but better.

Southern Silver acquired Electrum’s 60% interest in CLM for US$15 million in cash and shares, a price equivalent to only $0.09 per silver equivalent ounce in the ground. To fund the deal, the company floated a C$14.5 million private placement. Electrum remains committed to Cerro Las Minitas as it holds 24% of SSV. To complete the transaction for 100% ownership, Electrum will receive a $2 million cash payment plus $2 million in Southern Silver shares (20-day VWOP) in March, as well as the same again in September.

The transaction simplified ownership and consequently management of the CLM project. Southern Silver considers ownership of Cerro Las Minitas, a transformative, value creating opportunity. Not only is it one of the largest – in terms of contained ounces – undeveloped silver-based projects in the world, but it is the highest grade project among the top 10 and full control will allow Southern to advance the project at an accelerated pace.

Cerro Las Minitas has a resource of 272 million ounces silver-equivalent by virtue of being a polymetallic sulphide deposit. There are indicated resources of 134 million oz. at a grade of 375 g/t silver-equivalent and inferred resources containing 138 million oz. at a grade of 334 g/t.

All of the resources contained in the current estimate were drilled in the western part of the project, in the Blind, El Sol, Las Victorias, and Skarn Front zones. The largest zone is Skarn Front containing over 200 million silver equivalent ounces. But there is more yet to come.

The current 10,000-metre drilling program covers the South Skarn and Mina La Bocona Extension targets on the east side of the property, VP exploration Rob Macdonald told

TNM. None of the results from these targets to the east are included in the current resource estimate, but a 400-by-300-metre mineralized zone has already been outlined at the South Skarn target and two new high-grade zones have been identified in recent drilling.

At Mina La Bocona, three targets are being tested: a new near-surface sulphide/oxide zone; the high-grade Muralla chimney and the La Bocona chimney which has been traced downward from the 210 level in the historical artisanal mine workings. Highlights from Muralla chimney include 704 g/t silver-equivalent over 4.0 metres and 728 g/t over 5.2 metres and a thick gold-silver oxide zone was identified adjacent to the top of the chimney, starting just 20 metres below surface, and returned 0.87 g/t gold and 24 g/t silver – or 704 g/t silver-equivalent – over 30.9 metres making it a compelling target for future exploration.

The current drilling program is being expanded by at least 5,000 metres, Macdonald said. There is evidence that drilling a further 400 metres to the northwest would encounter even more potentially economic mineralization.

There are good reasons to consider expanding the drill program. On Feb. 9, 2021, Southern Silver released bonanza-grade drill results from the down-dip projection of the La Bocona chimney. Core averaged 1,072 g/t silver, 18.8% lead and 7.5% zinc (2,040 g/t silver-equivalent) over 8.0 metres, including 3,180 g/t silver, 58.8% lead and 2.3% zinc over 0.6 metres (5,148 g/t silver-equivalent).

[caption id="attachment_1003746015" align="alignright" width="225"]

Drill rig at the Cerro Las Minitas project in Durango, Mexico. Credit: Southern Silver Exploration

Drill rig at the Cerro Las Minitas project in Durango, Mexico. Credit: Southern Silver Exploration[/caption]

The drill results will form part of a new resource estimate and a preliminary economic assessment due out late in 2021. Many of the building blocks for such a study are already in place for the currently known mineral resource including metallurgy and a preliminary mine design where the proposed mining would involve mechanical mining methods including long-hole stoping. Resources to the east may prove to have higher grades, but there is good continuity among the zones to the west. That means a fairly high volume of material could initially be milled to jump start cash flow.

Initial metallurgical testing has confirmed that separate lead, zinc and copper concentrates can be made from Cerro Las Minitas ore with excellent recoveries and grades meaning a high value for the potentially recovered ores.

Composites of the Blind and El Sol zones produced lead conc (2,800 ppm silver, 68% lead and 2% zinc at recoveries of 82% silver, 90% lead and 4% zinc) and zinc conc (52% zinc at with a 78% recovery rate).

Recent test results from the Skarn Front zone was tested and produced three separate concentrates, all of which received three stages of cleaning. The lead conc contained 65.1% lead and 5,505 g/t silver at recovery rates of 83.6% lead and 77.3% silver. The zinc conc assayed 54.0% zinc and 92 g/t silver, recovering 94.7% of the zinc and 8.0% of the silver. Finally, a copper conc contained 27.0% copper and 1,255 g/t silver with recovery of 60.2% of the copper and 6.5% of the silver.

Additional mineral processing work done in 2019 and 2020 confirmed that a copper-lead-zinc flotation circuit can accommodate large swings in both overall grade and sulphide content. Testing also demonstrated that the circuit can handle a head grade six times higher than average by controlling reagent dosage only.

Southern Silver is also working its Oro copper-gold-molybdenum project in the U.S. state of New Mexico. Here the team is hoping to outline a large porphyry discovery, but the project is less advanced than Cerro Las Minitas.

SSV has market cap of C$106.2 million and basic enterprise value of C$120.2 million, with 225.5M shares outstanding at C$0.47 at the end of January, 2021.

— The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by SOUTHERN SILVER EXPLORATION and produced in co-operation with the Canadian Mining Journal. Visit www.southernsilverexploration.com for more information.

Southern Silver's Cerro Las Minitas project in Mexico. Credit: Southern Silver Exploration[/caption]

Southern Silver Exploration (TSXV: SSV) is sitting on one of the world’s largest undeveloped silver projects, Cerro Las Minitas in Durango, Mexico. The flagship property is now under 100% control of the company since it bought out its partner, Electrum Global Holdings, in September 2020 and the company is intent on not only making the project bigger, but better.

Southern Silver acquired Electrum’s 60% interest in CLM for US$15 million in cash and shares, a price equivalent to only $0.09 per silver equivalent ounce in the ground. To fund the deal, the company floated a C$14.5 million private placement. Electrum remains committed to Cerro Las Minitas as it holds 24% of SSV. To complete the transaction for 100% ownership, Electrum will receive a $2 million cash payment plus $2 million in Southern Silver shares (20-day VWOP) in March, as well as the same again in September.

The transaction simplified ownership and consequently management of the CLM project. Southern Silver considers ownership of Cerro Las Minitas, a transformative, value creating opportunity. Not only is it one of the largest – in terms of contained ounces – undeveloped silver-based projects in the world, but it is the highest grade project among the top 10 and full control will allow Southern to advance the project at an accelerated pace.

Cerro Las Minitas has a resource of 272 million ounces silver-equivalent by virtue of being a polymetallic sulphide deposit. There are indicated resources of 134 million oz. at a grade of 375 g/t silver-equivalent and inferred resources containing 138 million oz. at a grade of 334 g/t.

All of the resources contained in the current estimate were drilled in the western part of the project, in the Blind, El Sol, Las Victorias, and Skarn Front zones. The largest zone is Skarn Front containing over 200 million silver equivalent ounces. But there is more yet to come.

The current 10,000-metre drilling program covers the South Skarn and Mina La Bocona Extension targets on the east side of the property, VP exploration Rob Macdonald told TNM. None of the results from these targets to the east are included in the current resource estimate, but a 400-by-300-metre mineralized zone has already been outlined at the South Skarn target and two new high-grade zones have been identified in recent drilling.

At Mina La Bocona, three targets are being tested: a new near-surface sulphide/oxide zone; the high-grade Muralla chimney and the La Bocona chimney which has been traced downward from the 210 level in the historical artisanal mine workings. Highlights from Muralla chimney include 704 g/t silver-equivalent over 4.0 metres and 728 g/t over 5.2 metres and a thick gold-silver oxide zone was identified adjacent to the top of the chimney, starting just 20 metres below surface, and returned 0.87 g/t gold and 24 g/t silver – or 704 g/t silver-equivalent – over 30.9 metres making it a compelling target for future exploration.

The current drilling program is being expanded by at least 5,000 metres, Macdonald said. There is evidence that drilling a further 400 metres to the northwest would encounter even more potentially economic mineralization.

There are good reasons to consider expanding the drill program. On Feb. 9, 2021, Southern Silver released bonanza-grade drill results from the down-dip projection of the La Bocona chimney. Core averaged 1,072 g/t silver, 18.8% lead and 7.5% zinc (2,040 g/t silver-equivalent) over 8.0 metres, including 3,180 g/t silver, 58.8% lead and 2.3% zinc over 0.6 metres (5,148 g/t silver-equivalent).

[caption id="attachment_1003746015" align="alignright" width="225"]

Southern Silver's Cerro Las Minitas project in Mexico. Credit: Southern Silver Exploration[/caption]

Southern Silver Exploration (TSXV: SSV) is sitting on one of the world’s largest undeveloped silver projects, Cerro Las Minitas in Durango, Mexico. The flagship property is now under 100% control of the company since it bought out its partner, Electrum Global Holdings, in September 2020 and the company is intent on not only making the project bigger, but better.

Southern Silver acquired Electrum’s 60% interest in CLM for US$15 million in cash and shares, a price equivalent to only $0.09 per silver equivalent ounce in the ground. To fund the deal, the company floated a C$14.5 million private placement. Electrum remains committed to Cerro Las Minitas as it holds 24% of SSV. To complete the transaction for 100% ownership, Electrum will receive a $2 million cash payment plus $2 million in Southern Silver shares (20-day VWOP) in March, as well as the same again in September.

The transaction simplified ownership and consequently management of the CLM project. Southern Silver considers ownership of Cerro Las Minitas, a transformative, value creating opportunity. Not only is it one of the largest – in terms of contained ounces – undeveloped silver-based projects in the world, but it is the highest grade project among the top 10 and full control will allow Southern to advance the project at an accelerated pace.

Cerro Las Minitas has a resource of 272 million ounces silver-equivalent by virtue of being a polymetallic sulphide deposit. There are indicated resources of 134 million oz. at a grade of 375 g/t silver-equivalent and inferred resources containing 138 million oz. at a grade of 334 g/t.

All of the resources contained in the current estimate were drilled in the western part of the project, in the Blind, El Sol, Las Victorias, and Skarn Front zones. The largest zone is Skarn Front containing over 200 million silver equivalent ounces. But there is more yet to come.

The current 10,000-metre drilling program covers the South Skarn and Mina La Bocona Extension targets on the east side of the property, VP exploration Rob Macdonald told TNM. None of the results from these targets to the east are included in the current resource estimate, but a 400-by-300-metre mineralized zone has already been outlined at the South Skarn target and two new high-grade zones have been identified in recent drilling.

At Mina La Bocona, three targets are being tested: a new near-surface sulphide/oxide zone; the high-grade Muralla chimney and the La Bocona chimney which has been traced downward from the 210 level in the historical artisanal mine workings. Highlights from Muralla chimney include 704 g/t silver-equivalent over 4.0 metres and 728 g/t over 5.2 metres and a thick gold-silver oxide zone was identified adjacent to the top of the chimney, starting just 20 metres below surface, and returned 0.87 g/t gold and 24 g/t silver – or 704 g/t silver-equivalent – over 30.9 metres making it a compelling target for future exploration.

The current drilling program is being expanded by at least 5,000 metres, Macdonald said. There is evidence that drilling a further 400 metres to the northwest would encounter even more potentially economic mineralization.

There are good reasons to consider expanding the drill program. On Feb. 9, 2021, Southern Silver released bonanza-grade drill results from the down-dip projection of the La Bocona chimney. Core averaged 1,072 g/t silver, 18.8% lead and 7.5% zinc (2,040 g/t silver-equivalent) over 8.0 metres, including 3,180 g/t silver, 58.8% lead and 2.3% zinc over 0.6 metres (5,148 g/t silver-equivalent).

[caption id="attachment_1003746015" align="alignright" width="225"] Drill rig at the Cerro Las Minitas project in Durango, Mexico. Credit: Southern Silver Exploration[/caption]

The drill results will form part of a new resource estimate and a preliminary economic assessment due out late in 2021. Many of the building blocks for such a study are already in place for the currently known mineral resource including metallurgy and a preliminary mine design where the proposed mining would involve mechanical mining methods including long-hole stoping. Resources to the east may prove to have higher grades, but there is good continuity among the zones to the west. That means a fairly high volume of material could initially be milled to jump start cash flow.

Initial metallurgical testing has confirmed that separate lead, zinc and copper concentrates can be made from Cerro Las Minitas ore with excellent recoveries and grades meaning a high value for the potentially recovered ores.

Composites of the Blind and El Sol zones produced lead conc (2,800 ppm silver, 68% lead and 2% zinc at recoveries of 82% silver, 90% lead and 4% zinc) and zinc conc (52% zinc at with a 78% recovery rate).

Recent test results from the Skarn Front zone was tested and produced three separate concentrates, all of which received three stages of cleaning. The lead conc contained 65.1% lead and 5,505 g/t silver at recovery rates of 83.6% lead and 77.3% silver. The zinc conc assayed 54.0% zinc and 92 g/t silver, recovering 94.7% of the zinc and 8.0% of the silver. Finally, a copper conc contained 27.0% copper and 1,255 g/t silver with recovery of 60.2% of the copper and 6.5% of the silver.

Additional mineral processing work done in 2019 and 2020 confirmed that a copper-lead-zinc flotation circuit can accommodate large swings in both overall grade and sulphide content. Testing also demonstrated that the circuit can handle a head grade six times higher than average by controlling reagent dosage only.

Southern Silver is also working its Oro copper-gold-molybdenum project in the U.S. state of New Mexico. Here the team is hoping to outline a large porphyry discovery, but the project is less advanced than Cerro Las Minitas.

SSV has market cap of C$106.2 million and basic enterprise value of C$120.2 million, with 225.5M shares outstanding at C$0.47 at the end of January, 2021.

— The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by SOUTHERN SILVER EXPLORATION and produced in co-operation with the Canadian Mining Journal. Visit

Drill rig at the Cerro Las Minitas project in Durango, Mexico. Credit: Southern Silver Exploration[/caption]

The drill results will form part of a new resource estimate and a preliminary economic assessment due out late in 2021. Many of the building blocks for such a study are already in place for the currently known mineral resource including metallurgy and a preliminary mine design where the proposed mining would involve mechanical mining methods including long-hole stoping. Resources to the east may prove to have higher grades, but there is good continuity among the zones to the west. That means a fairly high volume of material could initially be milled to jump start cash flow.

Initial metallurgical testing has confirmed that separate lead, zinc and copper concentrates can be made from Cerro Las Minitas ore with excellent recoveries and grades meaning a high value for the potentially recovered ores.

Composites of the Blind and El Sol zones produced lead conc (2,800 ppm silver, 68% lead and 2% zinc at recoveries of 82% silver, 90% lead and 4% zinc) and zinc conc (52% zinc at with a 78% recovery rate).

Recent test results from the Skarn Front zone was tested and produced three separate concentrates, all of which received three stages of cleaning. The lead conc contained 65.1% lead and 5,505 g/t silver at recovery rates of 83.6% lead and 77.3% silver. The zinc conc assayed 54.0% zinc and 92 g/t silver, recovering 94.7% of the zinc and 8.0% of the silver. Finally, a copper conc contained 27.0% copper and 1,255 g/t silver with recovery of 60.2% of the copper and 6.5% of the silver.

Additional mineral processing work done in 2019 and 2020 confirmed that a copper-lead-zinc flotation circuit can accommodate large swings in both overall grade and sulphide content. Testing also demonstrated that the circuit can handle a head grade six times higher than average by controlling reagent dosage only.

Southern Silver is also working its Oro copper-gold-molybdenum project in the U.S. state of New Mexico. Here the team is hoping to outline a large porphyry discovery, but the project is less advanced than Cerro Las Minitas.

SSV has market cap of C$106.2 million and basic enterprise value of C$120.2 million, with 225.5M shares outstanding at C$0.47 at the end of January, 2021.

— The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by SOUTHERN SILVER EXPLORATION and produced in co-operation with the Canadian Mining Journal. Visit

Comments