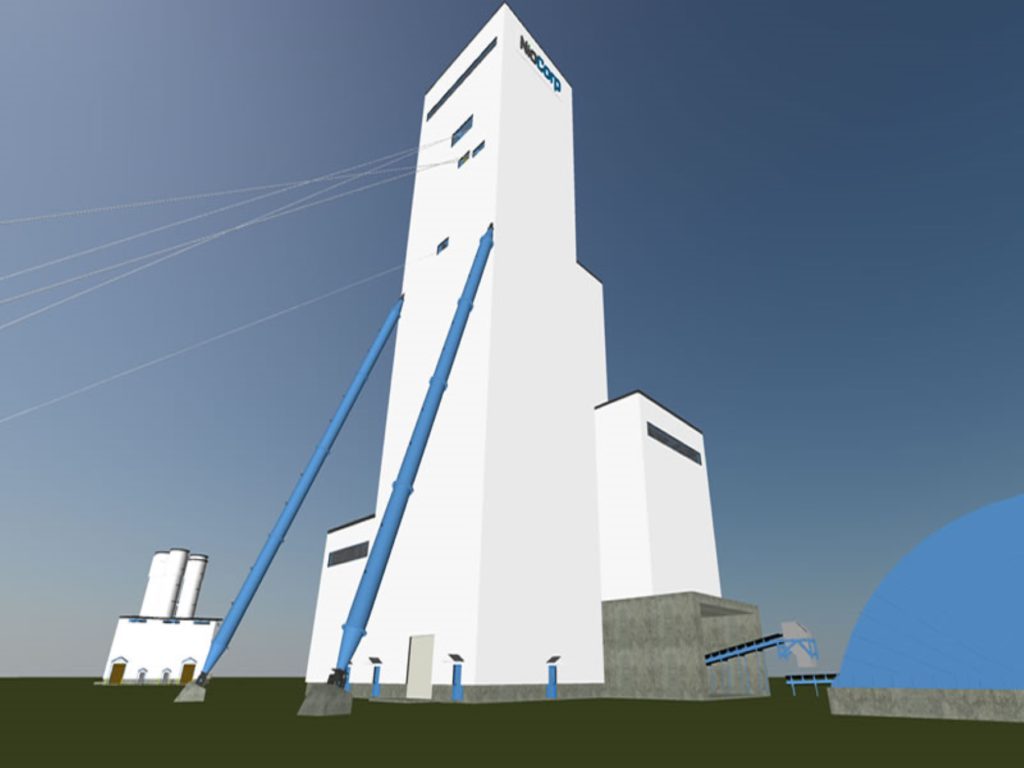

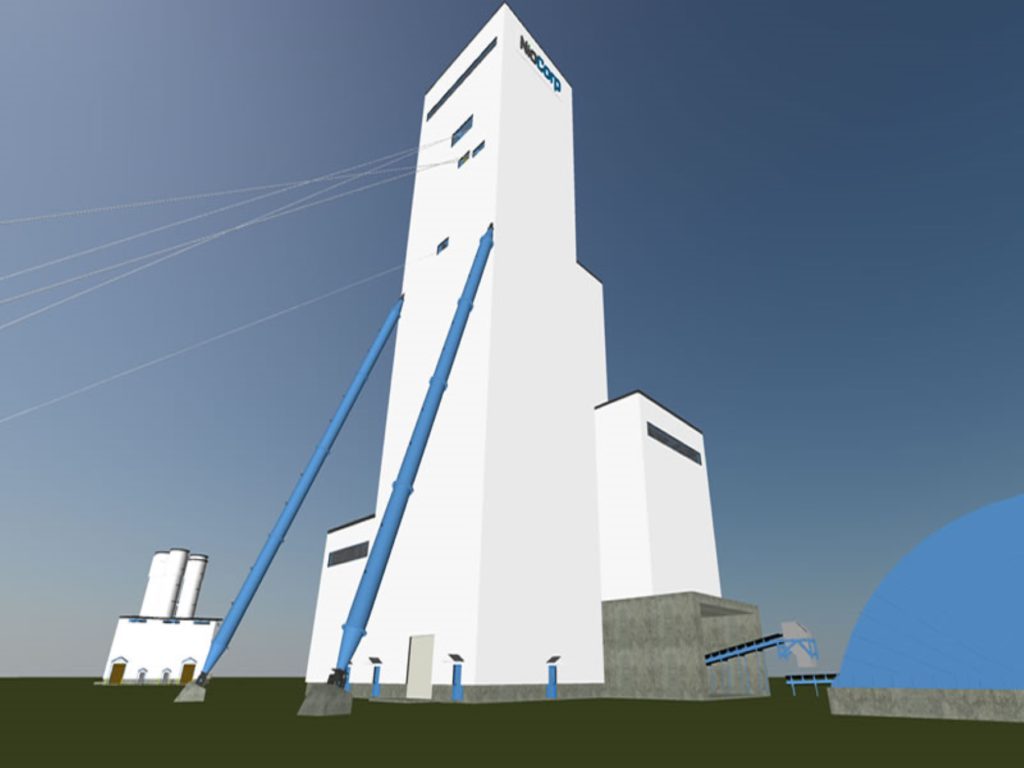

NioCorp deploys Equator Principles at Elk Creek superalloy project in U.S.

NioCorp (TSX: NB; US-OTC: NIOBF) has adopted the latest version (EP4) of the Equator Principles at the Elk Creek superalloy materials project in Nebraska. This is a key step in the company’s efforts to formalize its environmental, social and governance (ESG) principles.

The Equator Principles, developed by the Equator Principles Association, serve as a common baseline and risk management framework for financial institutions to identify, assess, and manage environmental and social risks when financing projects such as the Elk Creek. A total of 138 financial institutions in 38 countries have officially adopted the Equator Principles and have pledged not to finance projects that do not adhere to the Equator Principles' 10 key objectives.

NioCorp has instituted several practices as it adopts the Equator Principles. It has completed a comprehensive risk assessment along with management plans for high-risk areas. Preliminary environmental and social impact assessments have been done. A system has been developed, including key ESG subject areas that will be used in day-to-day activities. A more formal community engagement process has been developed and a grievance mechanism established for local communities and other stakeholders. A climate change risk assessment has been done for the project. Finally, the company has completed an environmental justice assessment for the project that demonstrates its positive impacts for the nearby residents.

NioCorp says Elk Creek is the highest grade niobium project in North American and the world’s largest prospective scandium producer. The project has been the subject of a definitive feasibility study and has received the key U.S. federal permits and is now seeking financing.

The company is redesigning the underground mine to further reduce risks and environmental impacts. Preproduction capital investments were US$879 million for a mine with a 36-year life and an after0-tax payback of 2.86 years.

The pre-tax net present value with an 8% discount was $2.56 billion, and after-tax internal rate of return was 25.8%. The project is expected to produce US$20.81 billion over its life.

When the feasibility study was completed in 2019, the Elk Creek project had proven and probable reserves of 36.3 billion tonnes grading 0.81% niobium oxide (Nb2O5), 2.86% titanium oxide (TiO2) and 65.7 ppm scandium. The average annual output is about 7,200 tonnes of ferroniobium.

Learn more at www.NioCorp.com.

Comments