Northern Nevada ‘far from being mature district’ – Bristow

Northern Nevada remains highly prospective for new gold discoveries and is “far from being a mature gold district”, said Barrick Gold CEO Mark Bristow.

Barrick operated Nevada Gold Mines (NGM) in the region, is a joint venture between Barrick (61.5%) and Newmont (38.5%).

According to the executive, Barrick-owned Fourmile is expected to more than triple its current mineral resource of 480,000 oz. at 10.04 g/t indicated in addition to 2.7 million oz. at 10.1g/t inferred.

Bristow said operational highlights of the past year included a record production by the post-merger Cortez and the continuing turnaround at Turquoise Ridge.

“The most significant development, however, was the completion of the Goldrush permitting process at the end of 2023. This enabled Cortez to accelerate the development of a key project which will already make a significant production contribution this year,” Bristow said.

The underground mine is expected to start ramping up production in 2024 after the commissioning of the initial project infrastructure and is forecast to produce 130,000 oz. in 2024 and grow to approximately 400,000 oz. per annum by 2028.

Barrick and NGM have invested more than $370 million in the project.

“The complex now boasts a production growth profile that goes well beyond 10 years as the geologists step up the replacement of the ounces depleted by mining.”

NGM completed the commissioning of the first 100 MW phase of its solar power project in the last quarter of 2023, with the second 100 MW scheduled to come on stream in the second half of this year.

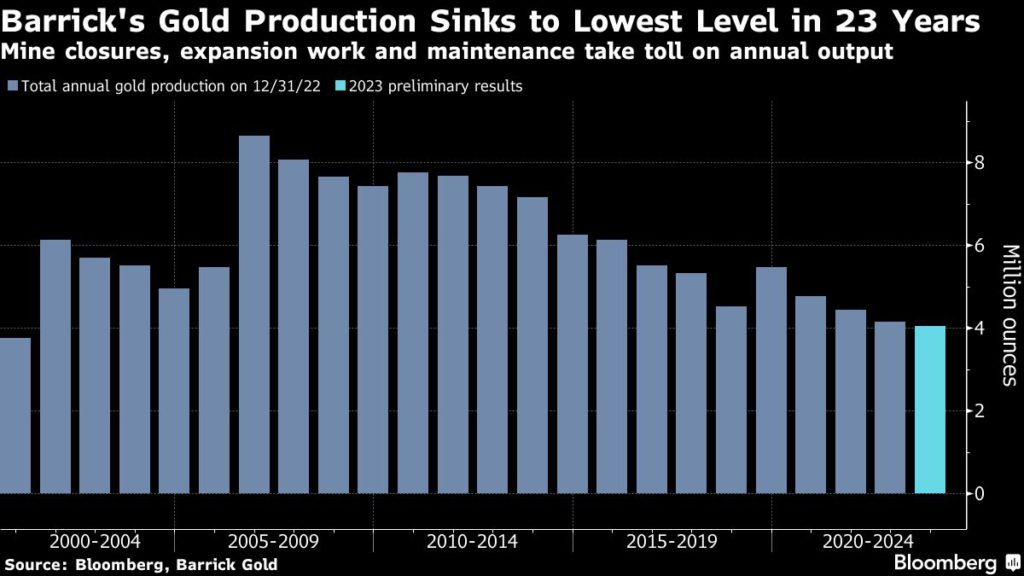

Barrick’s gold output hit its lowest level since 2000 last year following a series of setbacks across its operations.

Maintenance and repair work at its Nevada mines, an expansion at Pueblo Viejo in the Dominican Republic and a prolonged shutdown at a major asset in Papua New Guinea all contributed to a 23-year low in total bullion ounces for the world’s second-largest gold miner.

Investors will be seeking insight into this year’s production outlook when the Canadian metals producer reports fourth-quarter earnings on Wednesday.

Read More: Barrick to spend $136 million on failed Pascua-Lama project

THIS ARTICLES WAS ORIGINALLY POSTED ON MINING.COM.

Comments