Remedies for mining investors in Mexico under the CPTPP amid judicial reform

On September 1, 2025, Mexico completed the appointment of its first group of popularly elected judges, including all nine Supreme Judges of Mexico. This unprecedented step gave full effect to the judicial reform enacted in September 2024, which replaced the traditional career judiciary based on competence with a system where candidates are preselected by Congress and chosen by citizens through the ballot box.

The consequence of this reform has been the abandonment of the judicial career path that once ensured competence, independence, and a clear separation of powers. Today, many appointees may lack the rigorous preparation and experience previously required of judges. But more troubling still is the structural bias created by an appointment process controlled by the political branches. Judges now owe their position not to a lifetime of professional advancement but to legislative selection and electoral politics, both dominated by the governing majority.

This raises the danger that judges will be predisposed to favour the government in disputes, particularly when state policy, finances, or political agendas are at stake. In practice, this alignment with the administrative branch risks transforming courts from guardians of legality into facilitators of government action. These developments have undermined the rule of law and can increase investment risk. Moody’s issued a downgrade citing the weakening of institutional checks and balances and its effect on long-term investment stability. The U.S. Chamber of Commerce, the Washington Office on Latin America, Human Rights Watch, and the Inter-American Commission on Human Rights have all heavily criticized the reform, warning that it erodes judicial independence and increases systemic risk.

The consequences for the mining sector are immediate and severe. Canadian companies operating in Mexico rely on courts to uphold licenses and permits against arbitrary revocation, to provide recourse in environmental and community disputes, and to ensure that regulatory obligations are applied consistently. If judges are inclined to side with government agencies, litigation before Mexican courts and administrative bodies becomes less a matter of law and more a question of political alignment. A mining company challenging the denial of a concession, for example, may find courts unwilling to contradict the administrative branch. Likewise, disputes with local communities may be decided in line with political interests rather than objective legal principles.

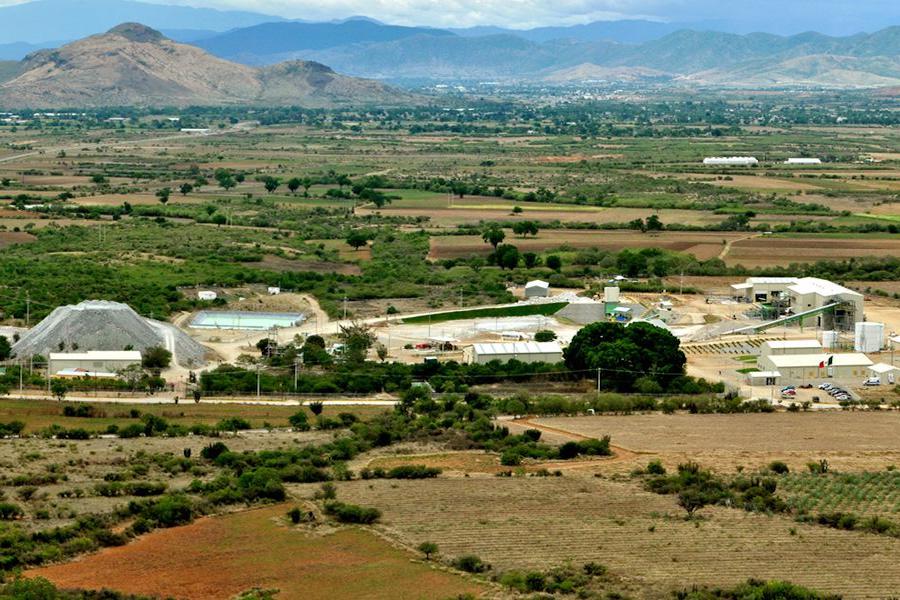

Credit: Fortuna Mining

To meet this risk, investors in Mexico should familiarise themselves with the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The CPTPP is a free trade agreement between eleven countries, including Canada and Mexico, that (amongst other things) requires Mexico to accord investments “fair and equitable treatment.” This specifically includes not denying justice in criminal, civil, and administrative adjudicative proceedings.

A denial of justice can come in many forms, including judicial bias, prolonged delays, denying the right to proper notice, or denying the right to be heard. The politicization of Mexico’s judiciary is especially concerning in environmental matters. Mining projects are often subject to extensive federal and state oversight, and conflicts routinely arise over compliance with environmental standards. Under a system where judges are structurally dependent on government nomination and electoral processes, impartial review of administrative decisions cannot be assumed. This exposes companies to unpredictable outcomes, regardless of their level of compliance or the strength of their legal position.

These issues often develop incrementally at the local level of administrative and judicial involvement where the project is based. But they can culminate in catastrophic impacts on projects. For example, according to a March 21, 2025, news release, Almaden Minerals Ltd. had its mineral rights first suspended and then cancelled by an order of a Mexican court following a series of administrative and judicial actions that started with a local Ejido community suing the Mexican government over Indigenous consultation.

The CPTPP functions to both provide substantive protection from unfair and inequitable treatment by Mexico and provide a mechanism to enforce those through investor-state dispute settlement (ISDS) mechanism. Under CPTPP, a Canadian investor can bring a claim directly against the Mexican state in an international tribunal for actions of the Mexican judiciary that breach the protections set out in the CPTPP. This distinguishes the CPTPP from the CUSMA (the successor free trade agreement to the NAFTA) which contains its own provisions relating to investor protection but without recourse to ISDS for Canadian investors.

If a company is facing judicial interference, it must be aware of a specific provision in the CPTPP investment chapter that only applies to claims against Mexico, Viet Nam, Chile, and Peru. Under Appendix 9-J, an investor can pursue claims for breach of the obligations set out in the CPTPP either in local courts, or in international arbitration, but not both. This provision has not been interpreted, and it is unclear what would constitute an election if an investor took Mexico to court for breaching its own laws relating to, for example, issuing or revoking permits or licenses. In any situation where an action by an organ of the Mexican state can give rise to a claim under domestic law and the CPTPP, investors must weigh the risk that pursing remedies locally will eliminate the ability to pursue an ISDS claim. Investors would be well-advised to retain ISDS counsel early so not to put a foot wrong and waive a right to bring an ISDS claim.

Independence and competence in the Mexican judiciary is no longer guaranteed. Judges may lack the training to decide complex regulatory and environmental disputes, and even when they possess the knowledge, they may be unwilling to rule against the government that controls their appointment and re-election. The legal security that underpinned long-term mining investments in Mexico has entered a period of instability. Investors should take note and plan for maximum protection, including through a review of international treaties such as the CPTPP.

Andres Abogado is a managing partner at Abolaw, and J. Thomas Hatfield is a partner at McMillan LLP.

Comments