[caption id="attachment_1003719020" align="alignnone" width="550"]

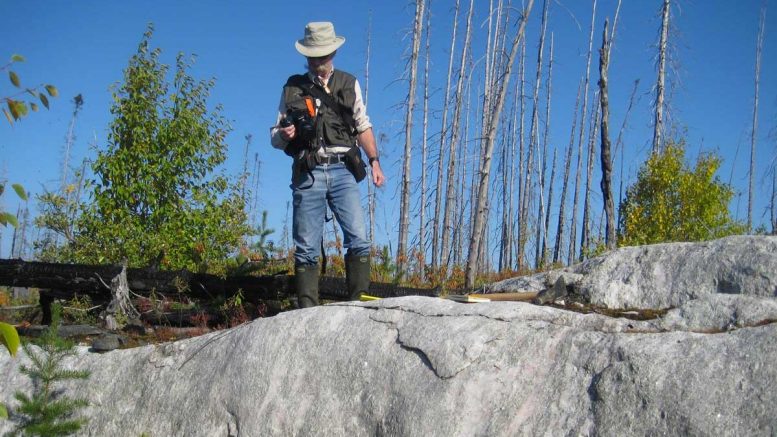

Exploration work at Nemaska Lithium's Whabouchi site in Quebec. Credit: Nemaska Lithium.

Exploration work at Nemaska Lithium's Whabouchi site in Quebec. Credit: Nemaska Lithium.[/caption]

Nemaska Lithium is pleased to announce that it has completed its previously announced bought deal public offering, for aggregate gross proceeds of $50,001,000.

In connection with the Offering, the Corporation issued a total of 47,620,000 common shares of the Corporation at a price of $1.05 per Common Share. The Offering was completed on a bought deal basis through a syndicate of underwriters comprised of National Bank Financial Inc., Echelon Wealth Partners Inc., Cormark Securities Inc. and Eight Capital, acting as co-lead underwriters, and of CIBC World Markets Inc., Canaccord Genuity Corp., Industrial Alliance Securities Inc. and Laurentian Bank Securities Inc.

The terms and the details of the Offering were previously announced by the Corporation on June 22, 2017 and June 12, 2017, and are provided in the Corporation's short form final prospectus filed with SEDAR.

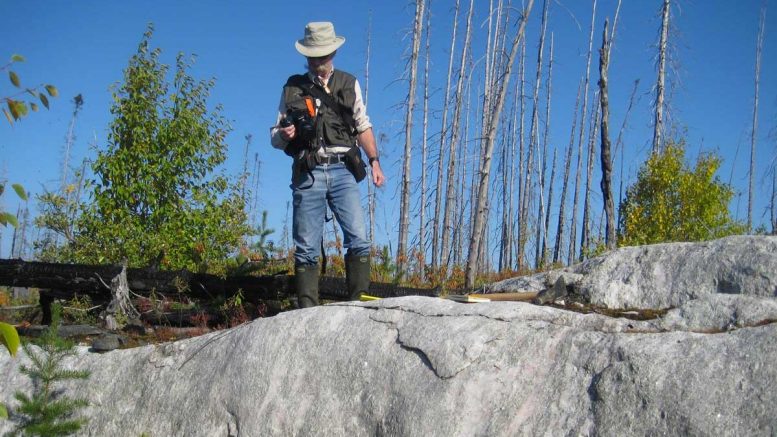

Exploration work at Nemaska Lithium's Whabouchi site in Quebec. Credit: Nemaska Lithium.[/caption]

Nemaska Lithium is pleased to announce that it has completed its previously announced bought deal public offering, for aggregate gross proceeds of $50,001,000.

In connection with the Offering, the Corporation issued a total of 47,620,000 common shares of the Corporation at a price of $1.05 per Common Share. The Offering was completed on a bought deal basis through a syndicate of underwriters comprised of National Bank Financial Inc., Echelon Wealth Partners Inc., Cormark Securities Inc. and Eight Capital, acting as co-lead underwriters, and of CIBC World Markets Inc., Canaccord Genuity Corp., Industrial Alliance Securities Inc. and Laurentian Bank Securities Inc.

The terms and the details of the Offering were previously announced by the Corporation on June 22, 2017 and June 12, 2017, and are provided in the Corporation's short form final prospectus filed with SEDAR.

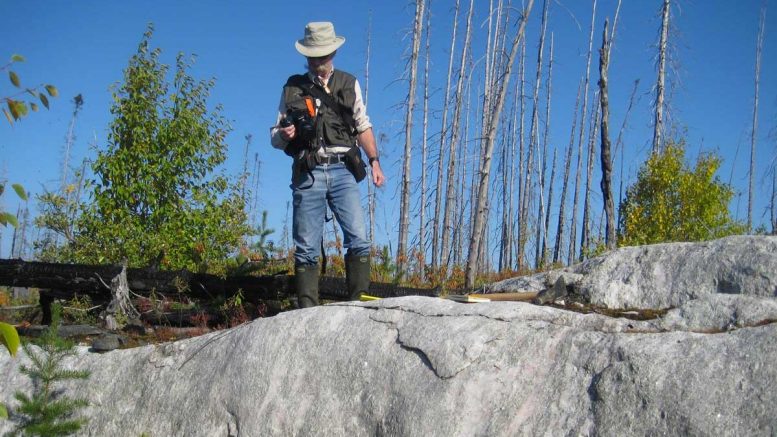

Exploration work at Nemaska Lithium's Whabouchi site in Quebec. Credit: Nemaska Lithium.[/caption]

Nemaska Lithium is pleased to announce that it has completed its previously announced bought deal public offering, for aggregate gross proceeds of $50,001,000.

In connection with the Offering, the Corporation issued a total of 47,620,000 common shares of the Corporation at a price of $1.05 per Common Share. The Offering was completed on a bought deal basis through a syndicate of underwriters comprised of National Bank Financial Inc., Echelon Wealth Partners Inc., Cormark Securities Inc. and Eight Capital, acting as co-lead underwriters, and of CIBC World Markets Inc., Canaccord Genuity Corp., Industrial Alliance Securities Inc. and Laurentian Bank Securities Inc.

The terms and the details of the Offering were previously announced by the Corporation on June 22, 2017 and June 12, 2017, and are provided in the Corporation's short form final prospectus filed with SEDAR.

Comments