ONTARIO – Toronto-based Queenston Mining is making plans to sink an exploration shaft at its Upper Beaver gold-copper property near Kirkland Lake, thanks to the conclusions of the preliminary economic assessment prepared by P&E Mining Consultants. The shaft will provide access for bulk sampling and to confirm the continuity of the deposit.

The PEA base case uses a gold price of US$1,275/oz and a copper price of $3/lb. It suggests a 2,000-t/d underground mine and mill with at least a 10-year life. Average annual production would be 120,000 oz of gold and 5.3 million lb of copper. The Upper Beaver project has an indicated resource of 3.1 million tonnes at 0.54% Cu and 8.84 g/t Au, plus an inferred resource of 3.1 million tonnes at 0.41% Cu and 7.15 g/t Au. Pre-production capital costs would be C$240 million.

Using the base case numbers, the Upper Beaver project has a pre-tax net present value (5% discount) of C$345 million, an internal rate of return of 26.5% and a payback period of 2.5 years. Using current metal prices of US$1,700/oz for gold and US$3.80/lb for copper, the NPV rises to C$688 million, the IRR to 41.6%, and the payback period would be shortened to 1.5 years.

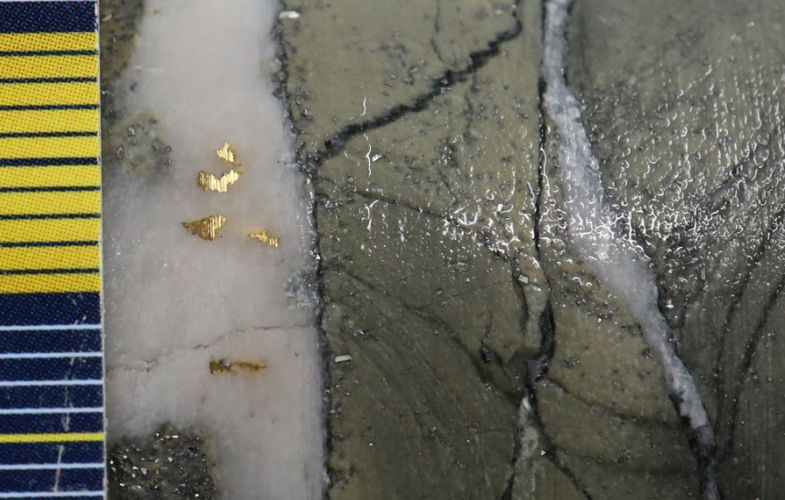

Queenston says the deposit is open both at depth and along strike. Recent discoveries have been made in the hanging wall, closer to the surface.

More details are available at Queenston.ca.

Comments

Mike

Im trying to find out who has received the contract for the collar work on this project, im pretty sure i have heard the name of guy chenard, i am looking to see if they might need some ventilation for this job……Can someone please let me know. Thank you.