JV Article: Newly public Zacapa Resources focuses on US copper-gold exploration with drill-ready targets in prolific belts

Zacapa Resources (TSX-V: ZACA), a mineral exploration company with six copper and gold projects in some of the world’s best jurisdictions – listed on the Toronto Stock Exchange last week, going public after over a year of whirlwind discovery and consolidation work as a private company.

Zacapa focuses on drill-ready targets in prolific belts that have Tier 1 discovery potential. The company’s portfolio includes Red Top and Pearl in the Laramide porphyry belt of Arizona; Miller Mountain in the Trans-Challis fault zone of Idaho; Dewdrop Moon in the Yerington district of Nevada, and South Bullfrog in the Walker Lane trend, also in Nevada.

The company has strategically accumulated a portfolio of southwest U.S. land packages and acquired drilling rights to projects that border mines and exploration properties operated by major miners such as BHP, Rio Tinto, Freeport McMoRan, and AngloGold Ashanti.

The company formed in 2020 and consolidated its assets in early 2021. By the second quarter it had raised over $9 million for exploration. With cash in hand, a new management team was brought in and in December, the group commenced their inaugural drill program at its Red Top project in Arizona – the state that accounts for nearly 75% of annual U.S. copper production.

Red Top – Foothold in the postcode of porphyry copper giants

Red Top is located within the Laramide porphyry copper province – second only to the Andean copper province in Chile and Peru in terms of global copper production at +500 million lb. per annum.

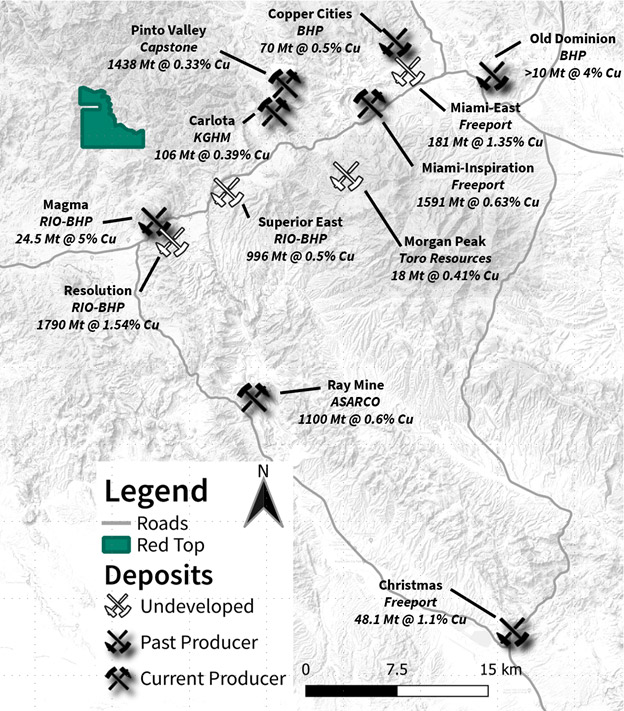

The project is in the Superior-Pioneer District, home to a multitude of deposits that stretch from Resolution in the west to the Globe-Miami area in the east (Figure 1).

Four of these porphyry copper deposits account for >7.4 billion tonnes at 0.73% copper (120 billion lb. of copper), non-43-101 compliant. Red Top is only 8 km northwest of Rio Tinto-BHP’s Resolution deposit, currently in development with 1.79 billion tonnes at 1.54% copper. The world's top two miners have already spent over $2 billion on exploration and development on the Resolution copper project.

“It’s a pretty strategic piece of ground”, says Zacapa Resources’ CEO Adam Melnik. “Red Top is in one of the most well-endowed porphyry copper districts on the planet, we just started drilling in December and have recently announced we have discovered porphyry copper mineralization in our maiden drill hole that was extended beyond one kilometer.

“We have wisely allocated capital to our projects as a private company, preparing catalysts for investors once we are public, including a major drill program before listing. Our geologists have been doing world class work testing areas where there could potentially be an ore body similar to Resolution,” Melnik says.

South Bullfrog – In the bullseye of the rapidly developing Beatty District

The company’s next drill campaign is kicking off in the second quarter of 2022 at the South Bullfrog gold project in Nevada.

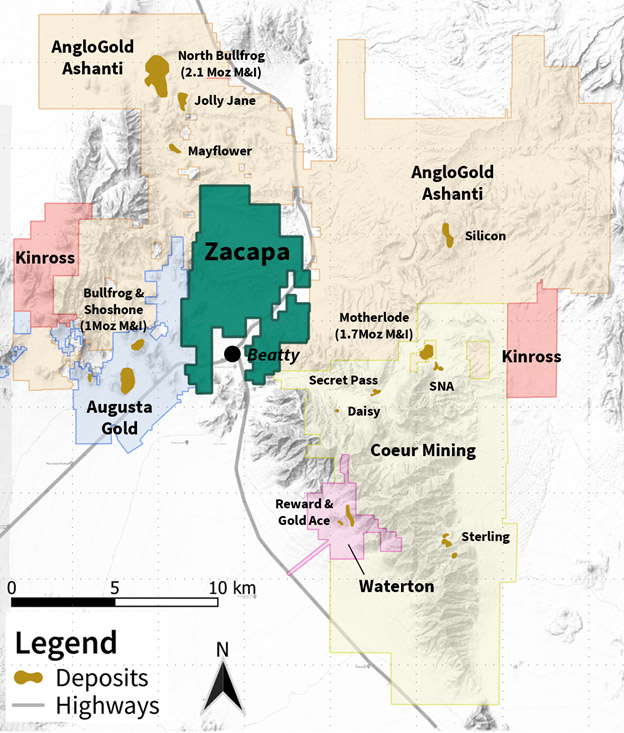

Earlier in 2021 an airborne magnetic survey was completed, and magnetic data suggests major structures could be present under alluvial cover in prospective host rock. The company has completed two phases of mapping and sampling and is currently finalizing a specialized geochemical and IP geophysical survey to refine targets under cover. Similar to many other operators in the Beatty District, where competition is fierce for new ground, the company strategically expanded its claim block by 40% last quarter.

Notably, in January, AngloGold Ashanti finalized its $370-million acquisition of Corvus Gold and announced its intention to create a hub and spoke production model from six deposits in the area, starting with North Bullfrog followed by Silicon, Merlin (including Lynnda Strip), and Mother Lode. AngloGold stated that the combined assets will help develop the Beatty district into a large, long life, low-cost operation with Tier 1 “company making” mines.

Sustainability focus

Melnik emphasizes that Zacapa’s corporate philosophy is to ‘think global and act local’ to ensure stakeholders are aligned with their projects. “We’re making sure that the local community sees that we’re present and we’re contributing to the local economy,” Melnik says.

Zacapa’s strong environmental and social governance (ESG) values have led to initiatives both large and small, from transplanting cacti that would normally be disturbed by drill pads to collaborating with drill contractors to minimize environmental impacts by drilling from wooden platforms and eliminating the use of sumps.

“Environmental stewardship is part of our culture and how we want to operate,” commented Melnik. The group is also taking the initiative to fence off all abandoned mine shafts on its South Bullfrog property.

“We’re well-prepared, we've got a good framework,” says Melnik, “we’ll be scaling best in class practices at our projects as we ramp up our drilling programs across the portfolio.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by CopperCorp Resources Inc. and produced in co-operation with Canadian Mining Journal. Visit Zacapa Resources for more information.

For a full report on Zacapa Resources, click here.

Comments