Agnico Eagle, Kirkland Lake create new gold giant in $13.5B merger

Canadian gold miners Agnico Eagle Mines (TSX: AEM) (NYSE: AEM) and Kirkland Lake Gold (TSX, NYSE: KL) (ASX: KLA) announced on Tuesday they are combining their businesses in a stock deal valued at $13.5 billion (about US$10.7B).

As part of the transaction, Kirkland Lake Gold shareholders will receive 0.7935 of an Agnico Eagle common share for each stock they hold. The deal values each Kirkland share at $50.63, or a discount of 9% to the stock’s Monday close.

Rumours of an imminent M&A deal involving Kirkland pushed its shares as much as 8.5% on Monday, closing 3.36% higher than Friday’s closing price.

The combined miner will have a market capitalization of approximately $24 billion. Once closed, the merger would also leave Agnico with $2.3 billion of available liquidity, a mineral reserve base of 48 million ounces of gold (969 million tonnes at 1.53 grams per tonne) and a pipeline of development and exploration projects.

The global gold miner is expected to generate of 3.4 million ounces of gold this year and could herald more consolidation in the gold industry where investors look for deals that unlock value, Agnico chief executive Sean Boyd said during a conference call on Tuesday.

Agnico Eagle shareholders will own about 54% of the combined company, while those of Kirkland Lake will have a 46% ownership.

“Both companies don’t have to do this,” Boyd said in the call. But the “strategic rationale makes sense and the industrial logic is there,” with a synergy of $2 billion over the next 10 years.

The new Agnico Eagle will be led by a combined board and management team. Its current boss, Sean Boyd, will become executive chair of the board, while Kirkland Lake chief executive Tony Makuch will be the combined company’s CEO.

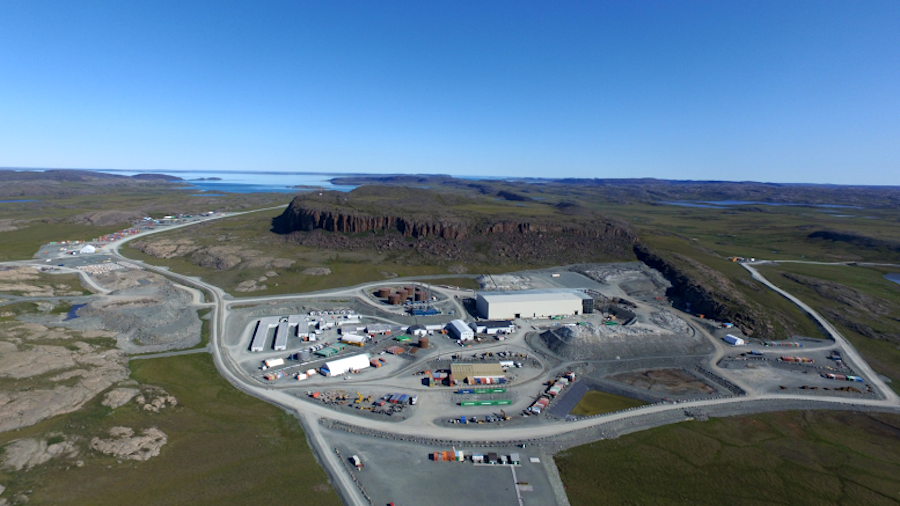

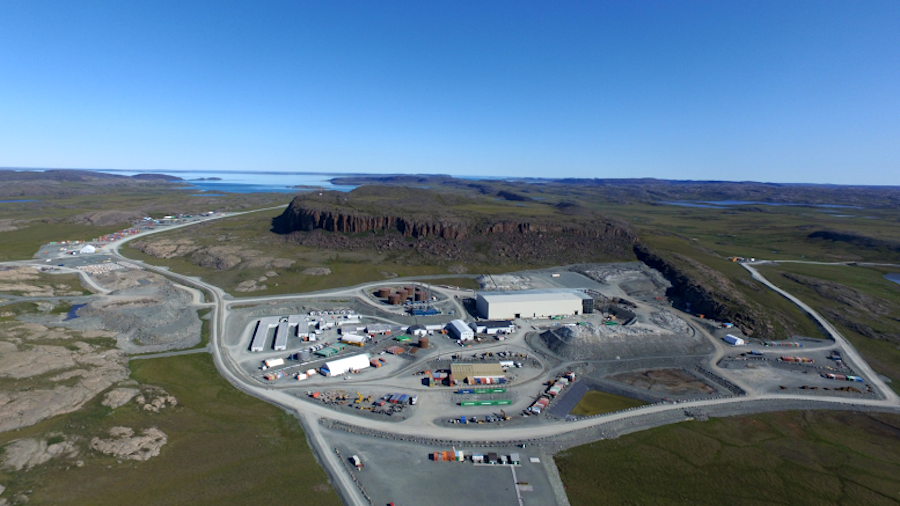

Toronto-based Agnico has mines in Canada, Finland and Mexico as well as exploration and development activities in those countries and the United States and Colombia.

Kirkland Lake Gold has the Macassa mine and Detour Lake mine, both in northern Ontario, and the Fosterville mine in Australia.

“This deal is more about a number of mines and location of mines in terms of manageability, rather than an overall ounce number,” Boyd said.

Agnico shares fell 0.7% to $63.34 at 11:49 a.m. trading in Toronto, while Kirkland Lake dropped 7.7% to $51.17 — its biggest intraday decline since November, as their merger offered investors a lower deal premium than other gold combinations.

Comments