During the most recent market downturn, when many of his peers were running for cover and trying to preserve cash, French Canadian geologist Philippe Cloutier went on a shopping spree.

The founder, president and CEO of

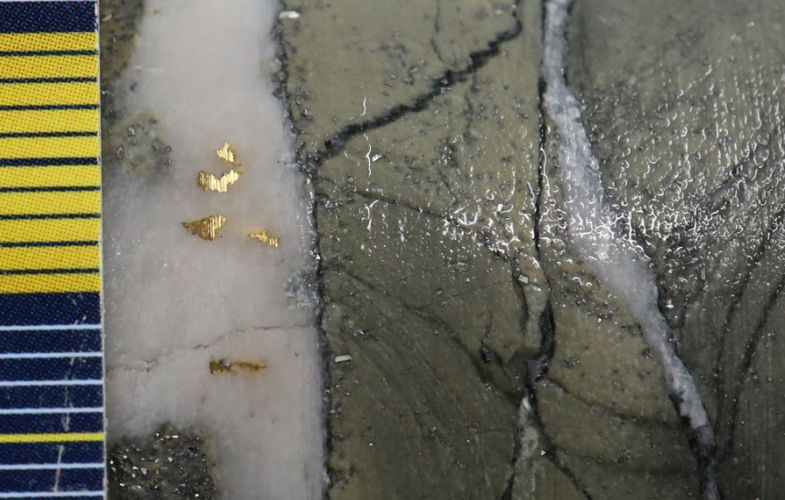

Cartier Resources (TSXV: ECR) bought three key assets at fire sale prices – all of them in the Abitibi Greenstone Belt, one of the world’s most prolific gold producing regions.

Since then Cartier has attracted investments from

Agnico Eagle Mines (TSX: AEM; NYSE: AEM), JP Morgan UK and Quebec funds.

“Our strategy was to focus on small, high grade historical resources that had been delineated in the pre-Bre-X days,” Cloutier says, describing the period leading up to the salting scandal in 1997 as a time when “companies were raising cash, coming up with showings and drilling them off down to 250 or 300 metres.”

Many of these projects were shelved after the Bre-X fiasco undermined confidence and decimated investment in the mining industry.

Continue reading at The Northern Miner.

Comments