[caption id="attachment_1003724675" align="aligncenter" width="474"]

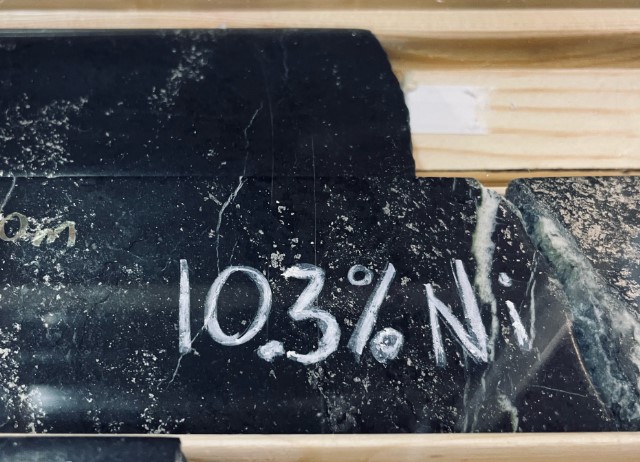

The Chidliak diamond project will soon have a new home in the De Beers Canada portfolio. (Image: Peregrine Diamonds)

The Chidliak diamond project will soon have a new home in the De Beers Canada portfolio. (Image: Peregrine Diamonds)[/caption]

TORONTO – Shareholders of

Peregrine Diamonds have voted overwhelmingly in favour of a takeover offer from

De Beers Canada. The arrangement was passed by 98.35% of votes cast by all stakeholders.

De Beers proposed to acquire all of the Peregrine common shares for a cash offer of $0.24 each, making the deal worth approximately $107 million.

Peregrine is the owner of the Chidliak diamond project on Baffin Island, Nunavut. The February 2018 updated 43-101 study estimated there are 22 million carats in two of the 74 known kimberlites at the site. The CH-6 pipe has an inferred resource of 17.96 million carats in 7.46 million tonnes at an average grade of 2.41 carats per tonne. The CH-7 pipe contains 4.23 million carats in 4.99 million inferred tonnes.

The preliminary economic assessment of May 2018 gave Chidliak a pre-tax net present value of $1.1 billion (7.5% discount) and an internal rate of return of 38.6%. Even after taxes, the numbers are excellent: NPV of $679 million (7.5%) and IRR of 31.1%. The project is expected to have a free cash flow of $2.04 billion over the life of the mine. The preproduction capex requirement is $455 million, including a contingency of $55 million.

Enjoy the Chidliak photo gallery at

www.PDiam.com.

The Chidliak diamond project will soon have a new home in the De Beers Canada portfolio. (Image: Peregrine Diamonds)[/caption]

TORONTO – Shareholders of Peregrine Diamonds have voted overwhelmingly in favour of a takeover offer from De Beers Canada. The arrangement was passed by 98.35% of votes cast by all stakeholders.

De Beers proposed to acquire all of the Peregrine common shares for a cash offer of $0.24 each, making the deal worth approximately $107 million.

Peregrine is the owner of the Chidliak diamond project on Baffin Island, Nunavut. The February 2018 updated 43-101 study estimated there are 22 million carats in two of the 74 known kimberlites at the site. The CH-6 pipe has an inferred resource of 17.96 million carats in 7.46 million tonnes at an average grade of 2.41 carats per tonne. The CH-7 pipe contains 4.23 million carats in 4.99 million inferred tonnes.

The preliminary economic assessment of May 2018 gave Chidliak a pre-tax net present value of $1.1 billion (7.5% discount) and an internal rate of return of 38.6%. Even after taxes, the numbers are excellent: NPV of $679 million (7.5%) and IRR of 31.1%. The project is expected to have a free cash flow of $2.04 billion over the life of the mine. The preproduction capex requirement is $455 million, including a contingency of $55 million.

Enjoy the Chidliak photo gallery at

The Chidliak diamond project will soon have a new home in the De Beers Canada portfolio. (Image: Peregrine Diamonds)[/caption]

TORONTO – Shareholders of Peregrine Diamonds have voted overwhelmingly in favour of a takeover offer from De Beers Canada. The arrangement was passed by 98.35% of votes cast by all stakeholders.

De Beers proposed to acquire all of the Peregrine common shares for a cash offer of $0.24 each, making the deal worth approximately $107 million.

Peregrine is the owner of the Chidliak diamond project on Baffin Island, Nunavut. The February 2018 updated 43-101 study estimated there are 22 million carats in two of the 74 known kimberlites at the site. The CH-6 pipe has an inferred resource of 17.96 million carats in 7.46 million tonnes at an average grade of 2.41 carats per tonne. The CH-7 pipe contains 4.23 million carats in 4.99 million inferred tonnes.

The preliminary economic assessment of May 2018 gave Chidliak a pre-tax net present value of $1.1 billion (7.5% discount) and an internal rate of return of 38.6%. Even after taxes, the numbers are excellent: NPV of $679 million (7.5%) and IRR of 31.1%. The project is expected to have a free cash flow of $2.04 billion over the life of the mine. The preproduction capex requirement is $455 million, including a contingency of $55 million.

Enjoy the Chidliak photo gallery at

Comments