FLIN FLON, Manitoba — Foran Mining is gaining steam at its flagship McIlvenna Bay volcanogenic massive sulphide (VMS) project in east-central Saskatchewan, west of Flin Flon, MB.

The company, which has a history spanning more than two decades, became dormant for many years until current chair Darren Morcombe revitalized the company.

Formed in 1989, Foran optioned the McIlvenna Bay polymetallic project from Cameco in 1998. It then bought it from Cameo in 2005, which was leaving the zinc business for uranium. But following disputes at board level, Foran lost its way and became idle for a few years.

When Morcombe got involved in 2010, Foran was trading at about a nickel, president and CEO Patrick Soares said during a presentation at the company’s camp in early April. The stock currently trades around 70¢, after hitting a yearly high of 99¢ last May.

“Darren was actually looking for a shell company, but he realized the assets in this company were fabulous,” Soares comments.

Morcombe explains in a phone interview from Lugano, Switzerland, that he discovered Foran “very much by chance,” noting he came across the company while surfing the Internet. This led him to contact a friend at Scotiabank, who happened to be advising Foran and told him about the company’s largest shareholder: the Summach family of Saskatoon, Sask.

“They weren’t really from the mining business. That’s why they found it difficult to move the asset along and the company to the next level,” Morcombe comments, who was attracted by the large, existing resource at McIlvenna Bay.

Subsequently, he found out that his next-door neighbour in Switzerland was on the bridal party for Summach’s eldest son’s wedding, creating a connection. Once Morcombe met the family, he quickly made a deal to get the company reorganized and refinanced.

In May 2010, the Summachs sold 56 million of the 63.4 million shares they held, representing a sale of 46% of the company’s outstanding shares.

During that month, Foran announced a 4-for-1 consolidation of shares and a private placement by Springtide Capital, Morcombe’s private investment company, of 4.17 million units consisting of one post-consolidation share and one warrant priced at 12¢ a unit.

From there, Morcombe built a shareholder base and board.

He connected with mining magnates and former colleagues, including Pierre Lassonde, chair of Franco-Nevada, and David Harquail, president and CEO of Franco-Nevada, who attended the site visit.

“It’s all about getting behind the people you know and supporting them,” Harquail says on-board a two-hour flight from Winnipeg to Flin Flon early this month.

Harquail, who held senior roles at Newmont Mining and the original Franco-Nevada group of companies, explains how he and Lassonde worked with Morcombe, who started off at Australia’s Normandy Mining.

In 2002, Denver-based Newmont bought Normandy and Toronto’s Franco-Nevada —founded in 1982 by Lassonde and Seymour Schulich — in a multi-billion dollar, three-way merger.

Morcombe joined forces with Harquail and Lassonde at Newmont before branching off on his own. He recently chaired Europe’s largest gold refinery, located in Switzerland, prior to its sale to Newmont.

When Morcombe took on Foran, marking his first foray into Canada, he asked his two former Newmont colleagues to take up shares in the company, which they happily did by participating in a $3.77 million, non-brokered private placement in June 2010.

Lassonde says he continues to buy Foran shares, and currently holds 11% of the company.

Morcombe became Foran’s chairman in July 2010, and in November that year consolidated the McIlvenna Bay project by acquiring the remaining 25% that the company did not own from Copper Reef Mining.

As part of the asset exchange agreement, Foran scooped up the Hanson Saskatchewan exploration project near its prized property, and 3 million Copper Reef shares.

In return, Copper Reef got $1 million in cash, a net tonnage royalty of 75¢ per tonne on ore extracted from McIlvenna Bay, and five of Foran’s Manitoba early stage properties. It also got a stake in Foran, which now represents 6% of the company.

Morcombe then recruited Soares to lead Foran, who was wrapping up at Brett Resources, which Osisko Mining acquired for its Hammond Reef gold project in 2010.

Subsequently, Soares put together Foran’s management, consisting of Tim Thiessen as chief financial officer, Fiona Childe as vice-president of corporate development, Roger March as vice-president of project exploration and Dave Fleming as vice-president of exploration.

Management holds 12% of the company’s outstanding shares, of which Morcombe holds 7%. On a fully diluted basis, Morcombe owns 12.5% of the company, which includes his 4.17 million warrants and 700,000 options.

Other large shareholders include Harquail and Charlie Bass, who is the co-founder of Australian-listed Aquila Resources.

At the end of March 2012, the company had 65 million shares, or 75 million shares fully diluted.

In late April, David Petroff joined Foran’s board. In 2009, he served as president and CEO of zinc producer Breakwater Resources until Nyrstar NV bought the company in mid-2011. Other director include: Soares, Franco-Nevada consultant Sharon Dowdall, metallurgist Maurice Tagami and Foran’s previous president Bradley Summach.

McIlvenna Bay

The McIlvenna Bay project consists of 30 claims spanning 203.8 sq. km. The junior also has several other claim blocks in the area, comprising another 213.4 sq. km.

The deposit is located one km south of Hanson Lake, SK, 375 km northeast of Saskatoon and 65 km west of Flin Flon, MB.

“The project itself is terrific,” Soares says. “It’s a rare find in a great location that has access to infrastructure that is close to a mining centre.”

McIlvenna Bay is near a highway, a rail head and power. Electrical power to the project is available through Saskatchewan Power, which is based in Creighton, SK.

The project site is accessible by an 18 km, all weather gravel road that connects to Saskatchewan’s provincial Highway 106. The gravel road, for which Foran holds the permit, runs through the property to support Foran’s exploration programs, as well as an adjacent sand operation.

Last year Foran built a 35-person camp on the property, which includes an office, core shack, core shop and storage facility.

Foran owns 100% of the project, with a 1% net smelter return (NSR) royalty payable to the Hanson joint venture between Cameco and BHP Billiton. Foran can buy the royalty for $1 million at any time.

The project is situated in the prolific Flin Flon greenstone belt of Manitoba-Saskatchewan, which hosts several world class VMS deposits.

The dominate miner in the region is HudBay Minerals, which has been recovering zinc and copper in the area for more than 100 years. The major is also a significant employer in Flin Flon, a mining town of roughly 6,000.

Since the McIlvenna Bay project lacks outcrop, the company used drill data and geophysics to interpret the local geology.

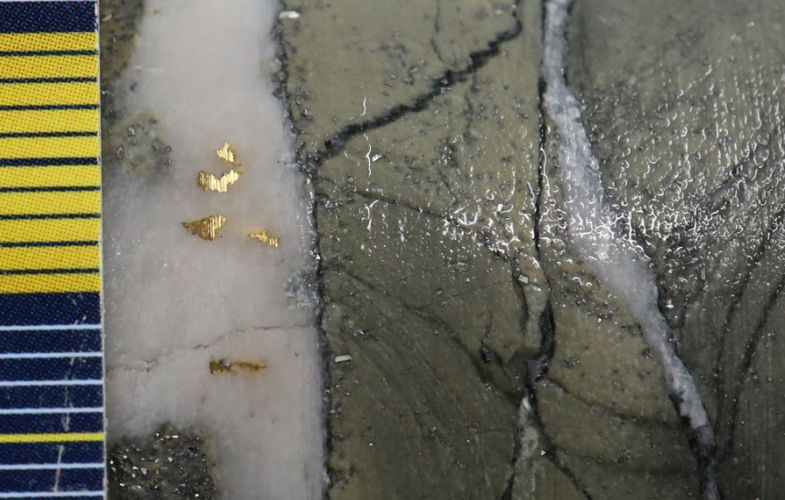

The project is a steeply dipping deposit overlain by a 30-metre dolomite cap. Mineralization extends vertically from the dolomite cap and can be traced over 1.9 km down-plunge.

The project hosts several lenses which can largely be grouped into two main zones: massive–semi massive sulphide zones (MSZ) and copper stockwork zones (CSZ).

Together the zones are 15 metres thick, and the deposit is still open at depth.

A National Instrument 43-101 compliant resource was last updated

for the MSZ resource in 2006, using a US$50 per tonne NSR cut-off. NSRs were derived using an average long-term price of US$1.50 per lb copper and US70¢ per lb zinc, and included certain provisions.

In late 2011, Foran’s new management reported the first National Instrument 43-101 compliant resource estimate for the CSZ, using a 1.10% CuEq cut-off. Copper equivalent grades include provisions for metallurgical recovery and smelter payable metal. Metal prices used for the 2011 resource include US$2.75 per lb copper, US$1 per lb zinc and US$1,300 per oz gold.

When the two estimates are combined, total indicated resources stand at 12.07 million tonnes of 1.16% Cu, 3.69% Zn and 19 g/t Ag, or 2.50% CuEq for 308 million lb copper, 981 million lb zinc, 95,400 oz gold and 7.46 million oz silver.

Total inferred resources amount to 9.57 million tonnes of 1.07% Cu, 3.86% Zn, and 19 g/t Ag, or 2.42% CuEq, for 227 million lb copper, 814 million lb zinc, 39,800 oz gold and 5.89 million oz silver.

Foran intends to update the global resource once it receives all the results from its second-phase drill program, which is designed to increase tonnage at both the MSZ and CSZ zones through 10,000 metres to 12,000 metres of infill and extensional drilling.

The updated resource estimate, which would combine the two estimates for the first time in one holistic resource statement, is expected out in the second half of the year.

That estimate will also be included in the upcoming preliminary economic assessment (PEA), which is currently targeted for 2013.

During 2012, the company aims to test up to five separate electromagnetic conductors located in two target areas within 7 km of the deposit. “These targets are located within the same or similar felsic stratigraphy that hosts VMS mineralization at the deposit,” the company says.

While the company’s focus is developing McIlvenna Bay, it believes the regional exploration could uncover more VMS deposits in the area, since these types of deposits typically form in clusters on the ocean floor, giving rise to VMS mining camps such as Flin Flon and Snow Lake in Manitoba.

“There has been no [regional] work done in the past decade,” Morcombe says. “With new technology and capital backing, we’re confident we could make more discoveries that would take the company to a new level.”

But for now, Foran will continue de-risking its prized McIlvenna Bay asset, which is one of the biggest undeveloped VMS deposits in Canada at 22 million tonnes. Typically VMS deposits in the area contain 3 million to 5 million tonnes of ore.

The project’s large high grade zinc and copper resource gives the company the luxury of developing it as a stand-alone project without tapping into the processing capabilities of senior miners, such as HudBay, notes Fraser Mackenzie’s analyst Vishal Gupta in a January report.

“Therefore, while other junior explorers in the region are dependent on a senior’s ‘approval’ to proceed with their exploration activities, the size and grades at McIlvenna Bay give Foran’s management the flexibility to de-risk the project to a much future extent without outside interference.”

The company has about $9 million on hand to finish off its drill program and work through its engineering, metallurgical and environmental studies, and complete a PEA on the project.

Technically the project is very straightforward, Morcombe says, adding the company is building on past work done on the property.

“The good thing is we have historical work that gives it a nice signpost of what the results should be,” Morcombe says.

From 1988 to 2007 about 70,000 metres of drilling were conducted on the project, along with historic resource estimates and feasibility level studies. In the 1990s, Cameco completed metallurgical test work on the project’s two mains zones. Metal recoveries achieved were 90% for zinc, 95% for copper, 60% for silver and 65% for gold.

Foran expects to release results from its metallurgical test program in the second half of the year. This is one of the inputs required for the scoping study.

Comparisons

The McIlvenna Bay project is similar to a few of HudBay’s underground operations in the area. It is shallow and steeply dipping — 70 to 80 degrees — like the major’s high grade copper development project, Reed Lake. It has the same throughput planned of 4,500 t/d as the upcoming Lalor deposit, and is not far off from 777 mine’s 4,100-t/d processing rate, notes analyst George Topping of Stifel Nicolaus. He initiated a “buy” rating and $1.50 price target on Foran in late March.

Topping predicts the capex for Foran’s project would be $464 million based on the costs of similar projects. Foran has yet to release an official figure, but envisions the project to process 1.2 million tonnes a year over a roughly 20-year life.

Given mineralization at McIlvenna Bay starts 30 metres below surface and that the combined average width of mineralized lenses is 15 metres, the company may be able to use a starter pit to improve the economics of “an otherwise potentially viable underground bulk-mining scenario,” Gupta says. He has a strong “buy” and a $1.20 price target.

The project is expected to come online in 2016.

Both analysts predict that the project will likely become an acquisition target before construction starts in 2015.

But for now, Morcombe says he is working on taking McIlvenna Bay down the development path. “The people we are putting into place all know how to build assets,” Morcombe says, referring to Foran’s management and directors.

“Hopefully we’ll become miners as soon as we can possibly or feasibly can,” he concludes.

Lassonde on Foran

“There are three things that matter to me,” Lassonde says after perusing Foran’s core shack. “Geology, geography and management.”

On the geology side, Lassonde says he finds McIlvenna Bay’s total resource and land package attractive.

“The two things I like best is when you total the whole thing up: there’s over a billion pounds of copper equivalent [in indicated and inferred] . . . and even if you put 1¢ per lb, it’s worth far, far more than what the stock is worth today.

“The second thing is [that] in our business, land is everything. You can’t find deposits if you don’t have land. I like the fact this company has assembled a big package of land. So when you got a big land package and you already have 1 billion lb copper equivalent. That looks good to me.

“Geography-wise, I love Canada. And not only that — Saskatchewan is one of the best provinces [for mining] in Canada.”

The province ranks as the sixth-best jurisdiction on the latest Fraser Institute’s survey of mining companies. The government also provides a 10-year royalty holiday on new base-metal mines.

Lassonde adds he also has faith in the management, led by Patrick Soares and chaired by Darren Morcombe.

“Darren used to work for me, so I know the guy very well,” Lassonde says. “And Patrick is a company builder. So I think [we have] all the elements to really build something special.”

To read more Northern Miner articles, click here

Comments