JV Article: Junior gains traction with BHP strategic investment

It took more than a decade quietly assembling a contiguous claim block about the size of half a million football fields in northwestern British Columbia, but the effort seems to be scoring some touchdowns for Brixton Metals Corp. (TSXV: BBB; US-OTC: BBBXF).

Last November, BHP (LSE: BHP; NYSE: BHP; ASX: BHP) took a 19.9% stake in the junior at a premium to market. Ninety percent of the proceeds from the private placement are being channeled into exploration at Brixton’s flagship copper-gold-silver-molybdenum Thorn project, 90 km east-northeast of Juneau, Alaska.

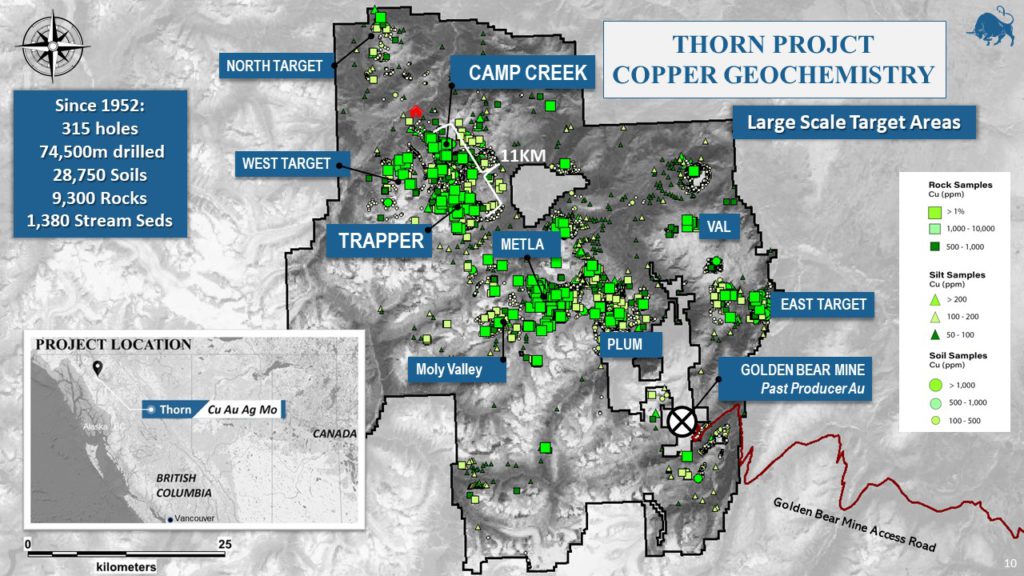

Since listing the company in 2010, Brixton co-founder Gary Thompson and his team have outlined 14 large-scale copper-gold targets at Thorn, most of which are several kilometres across. The project hosts district-scale copper-gold surface anomalies in what Brixton sees as an emerging Eocene-Triassic porphyry belt.

Geochemistry map of the Thorn project. Credit: Brixton Metals

Thorn’s southwestern claim boundary is about 40 km from tidewater on the Pacific Ocean and the nearest copper-gold mine, Red Chris, owned by Newcrest Mining (70%) and Imperial Metals (30%), is roughly 150 km to the southeast.

The Camp Creek copper-dominant porphyry target at Thorn is considered to be a blind discovery. Results from the 2022 drill program demonstrated the potential for broad intercepts of nearly 1,000 metres of copper mineralization and the target remains open in all directions.

g/t

Another assay released in October 2021 from drillhole THN21-184 cut 821 metres of 0.24% copper, 0.10 gram gold, 2.44 grams silver and 174.27 ppm molybdenum (0.48% copper-equivalent), including 318 metres of 0.42% copper, 0.17 g/t gold, 3.87 g/t silver and 294.12 ppm molybdenum (0.92% copper-equivalent) starting 880 metres downhole. The hole ended in strong mineralization due to the depth limitations of the drill.

Drilling in 2019 at the Oban diatreme breccia zone within the Camp Creek corridor returned a 554.7 metre interval of 0.57 g/t gold, 0.24% copper, 43.18 grams g/t silver, 0.55% zinc, and 0.28% lead (1.97 g/t gold-equivalent or 0.9% copper-equivalent) starting from 97 metres in drillhole THN19-150. The interval included 136 metres of 1.35 g/t gold, 133.62 g/t silver, 0.31% copper, 1.61% zinc and 0.89% lead (2.1% copper-equivalent or 5 g/t gold-equivalent) starting at 97 metres downhole.

Thompson believes one of the analogues for the Camp Creek target is Northern Dynasty Metals’(TSX: NDM; NYSE-AM: NAK) Pebble deposit in southwestern Alaska, the world’s largest undeveloped copper-gold-molybdenum-silver-rhenium deposit.

Geologists logging cores from the Camp Creek copper porphyry target at Thorn. Credit: Brixton Metals

“The Camp Creek and Trapper mineralizing intrusions have been dated at 90 to 95 million years old, which is the same age as the Pebble deposit and that’s unique,” he says. “Pebble and Camp Creek may have formed near each other 85-90 million years ago, but since then they have been separated along the dextral Denali fault system to their current locations about 1,100 km apart based on work by Goldfarb et al.”

What’s more, at the Metla target in the central part of the claim block, recent rock samples returning high copper-gold assay values demonstrated a differently aged system, coming in at around 220 million years old, which puts it in the Triassic age, Thompson says. “So, we think we may have two or more complete mineral systems that were formed differently in geological time. We have mineralization related to Eocene and Jurassic rocks, too, and when you have multiple pluses like this over time, combined with structurally well-prepared rocks, you have greater probability of forming large deposits.”

This year’s 18,000 to 20,000-metre drill program will focus on Camp Creek and the Trapper targets. The focus is the high-grade part of the mineralized systems and to expand mineralization laterally and at depth. Three drills are turning and Brixton plans to drill eight to 10 deep holes at Camp Creek and 40 plus shallow to moderately deep holes at Trapper. The company may also drill test some newly developed copper anomalies this season based on XRF real-time results.

Brixton released assays from its 2022 drill campaign at the Trapper target in January, including 253 metres grading 1.4 g/t gold from 42 metres in drillhole THN22-244, including a 93-metre interval of 3.22 g/t gold from 151 metres; and 64 metres of 5.74 g/t gold and 9.11 g/t silver from 114 metres downhole in THN22-205, including 52 metres of 6.97 g/t gold and 10.83 g/t silver starting from 120 metres.

“It’s an evolving story at Trapper,” Thompson says. “We like it because we’re drilling impressive gold intercepts from surface. It’s open in multiple directions with a 400-metre strike so far. It’s intriguing because we know that the gold here is associated with base metal veins and has a strong positive correlation to copper. We have yet to make the direct connection to a copper porphyry but this is something we are keen to discover at Trapper.”

Thompson notes that porphyry systems are tough for small companies because of the amount of drilling required. “We’ve been saying this is a big company project for years,” he says. “BHP at least recognized the potential that we do have this copper-dominant and large-scale mineralized system here.”

Thompson also notes that he wasn’t interested in a project-level deal, which he says is the deal structure major mining companies prefer, and was determined to wait it out for a strategic investor.

The earliest known exploration on the Thorn project was carried-out by Cominco in 1952, Kennco in 1959 and Chevron Minerals in the 1980s. Over 315 holes were collared on the property since exploration began in the 1950s, totaling 74,500 metres. Since acquiring the project in 2009, Brixton has drilled over 58,000 metres. Its drill program was guided by about 29,000 soil samples, 9,300 rock samples and 9,300 stream sediment samples from across the property.

For now, the company continues drilling its high-priority targets and hopes to hit the “‘momentum hole" – one of those holes that put you on a development path and you don’t look back – the hole that convinces everybody there is something real and big,” Thompson says. “I don’t think we’ve got that yet, based on the current market cap of the company. We’ll know when we hit it. In the meantime, we’re still in the ‘grind-it-out’ discovery phase, the toughest part, but also really the fun part.”

In addition to Thorn, Brixton wholly owns three other exploration projects: the Hog Heaven silver-gold-copper project in northwestern Montana, under option to Ivanhoe Electric Inc. (NYSE: IE); the Atlin goldfields project in northwestern B.C. under option to Pacific Bay Minerals (TSXV: PBM); and the Langis-HudBay silver-cobalt-nickel projects in Ontario.

Over the last year the junior has traded in a range of 11¢ and 31¢ per share and at press time was trading at 18¢. Brixton has about 381 million common shares outstanding for a market cap of roughly $69 million.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Brixton Metals and produced in co-operation with The Northern Miner. Visit www.brixtonmetals.com for more information.

Comments