JV Article: Lomiko Metals aims to be a regional hub to supply the graphite essential to lithium-ion battery manufacturers

Canadian explorer Lomiko Metals (TSXV: LMR; US-OTC: LMRMF) is looking for graphite and lithium – critical ingredients for the anode and cathode of lithium-ion batteries driving the global push towards decarbonization.

The junior miner is advancing its wholly owned flagship La Loutre graphite project in the Grenville graphite belt of southern Quebec, approximately 180 km northwest of Montreal.

The project sits close to several other graphite projects, including Northern Graphite‘s (TSXV: NGC;

US-OTC: NGPHF) Lac des Iles, about 50 km to the northwest, and Matawinie, owned by Nouveau Monde Graphite (TSXV: NOU; US-OTC: NMGRF), 100 km northeast.

Lomiko is also exploring the highly prospective belt in search of additional graphite deposits to develop “a sustainable supply of large flake natural graphite for the emerging regional electric vehicle battery manufacturing market and wider markets for graphite,” says Gordana Slepcev, the company’s chief operating officer.

According to Benchmark Mineral Intelligence, global demand for graphite from the battery manufacturing sector is expected to soar over the next decade, rising 30% annually. However, in the absence of new supplies, Benchmark forecasts a deficit of 8 million tonnes of graphite by 2040.

At La Loutre, the company’s extensive resource expansion and upgrade drill program planned for summer 2022 will drill about 120 infill holes (18,000 metres) in two zones on the property, known as the Electric Vehicle and Battery zones. (To date, the company has drilled 49 holes (6,942 metres) on Electric Vehicle and 62 holes (8,218 metres) on Battery.)

The drilling campaign is already underway to help confirm the orebody’s shape and size and support an upgrade of the current inferred mineral resources to the measured and indicated category, Slepcev says.

“We expect the drilling campaign will take four to five months to complete, and the results will be used to generate an updated resource estimate, which we plan to release by end of the year or early in January, depending on the assays turnaround time.”

She added that the updated resource will form the basis for a prefeasibility study on the project and “will include plans for a carbon-neutral mine.”

Mineral resources at La Loutre currently stand at 23.2 million indicated tonnes grading 4.51% graphitic carbon (Cg) for 1 million tonnes contained graphite and inferred resources of 46.8 million tonnes grading 4.01% Cg for 1.9 million tonnes of graphite. The estimate was based on a cut-off grade of 1.5% graphite.

In July 2021, a preliminary economic assessment (PEA) for La Loutre outlined an open pit mine with a 15-year mine life producing 97,400 tonnes of graphite concentrate annually for a total of 1.4 million tonnes over the life of the mine. All-in sustaining costs are expected to average US$406 per tonne of graphite concentrate over the mine’s life.

Initial capital costs stand at $236.1 million, with $37.7 million budgeted for sustaining capital over the mine life. The early-stage study estimated the after-tax net present value at $185.6 million, using an 8% discount rate and a graphite concentrate price of US$916 per tonne, and the after-tax internal rate of return at 21.5%. The initial capital would be paid back in just over four years.

Lomiko is also conducting further metallurgical testing on graphitic material from La Loutre and has shipped samples of graphite concentrate to three independent laboratories to confirm the purity of the graphite.

Earlier this spring, a testing program completed by Corem and ProGraphite laboratories yielded “encouraging results” from a 1.8-kg graphite flotation concentrate evaluated as part of the company’s 2021 metallurgical program, which Slepcev says showed that the graphite concentrate could be “successfully upgraded from a purity of 98.4% graphitic carbon to greater than 99.9%.”

“The additional testing conducted this year will provide greater certainty and confidence of the graphite’s suitability for anode battery applications, which require graphite concentrates with purities as high as 99.95%.”

The company has collected 1 tonne of core material that will be tested to confirm the results of the initial metallurgical test work during the PEA and the most recent test work on the graphite concentrate done by Corem and ProGraphite.

“The results from the additional testing to be completed by SGS Laboratories are expected in the second half of this year and will be used to further define the process flowsheet that will inform the plant design as part of the proposed PFS,” Slepcev says.

The concentrate generated during the flotation testing, she added, will be used for battery trials and other high-value testing as a continuation of the initial work completed by Corem and ProGraphite in early this year “but on a bigger concentrate sample.”

As part of Lomiko’s proposed regional exploration program, it has already staked 236 claims on six projects covering 142.6 sq. km in the Laurentian region of Quebec. The claims lie within a 100-km radius of La Loutre, with 28 of them contiguous to La Loutre.

Slepcev says the early-stage greenfield exploration program “will target numerous underexplored mineralized showings and comprise high-definition airborne magnetic and time-domain electromagnetic surveys.”

The surveys, she added, will cover all six projects and provide the company with “a good indication of where to look next. Once the results of the surveys have been assessed, we will then follow up any identified targets with geological, prospecting, and sampling programs.”

According to Slepcev, Lomiko currently has around $5.9 million in the treasury, which she says, “will fund the resource drilling campaign, metallurgical testing, and baseline data collection." However, to fund the proposed PFS, the company “will look to raise additional capital.”

The company, she continues, “is looking to raise $5-7 million that would be used to complete all required studies including the resource estimate, mine planning, plant design, and infrastructure and geotechnical studies and designs at La Loutre and regional exploration program.”

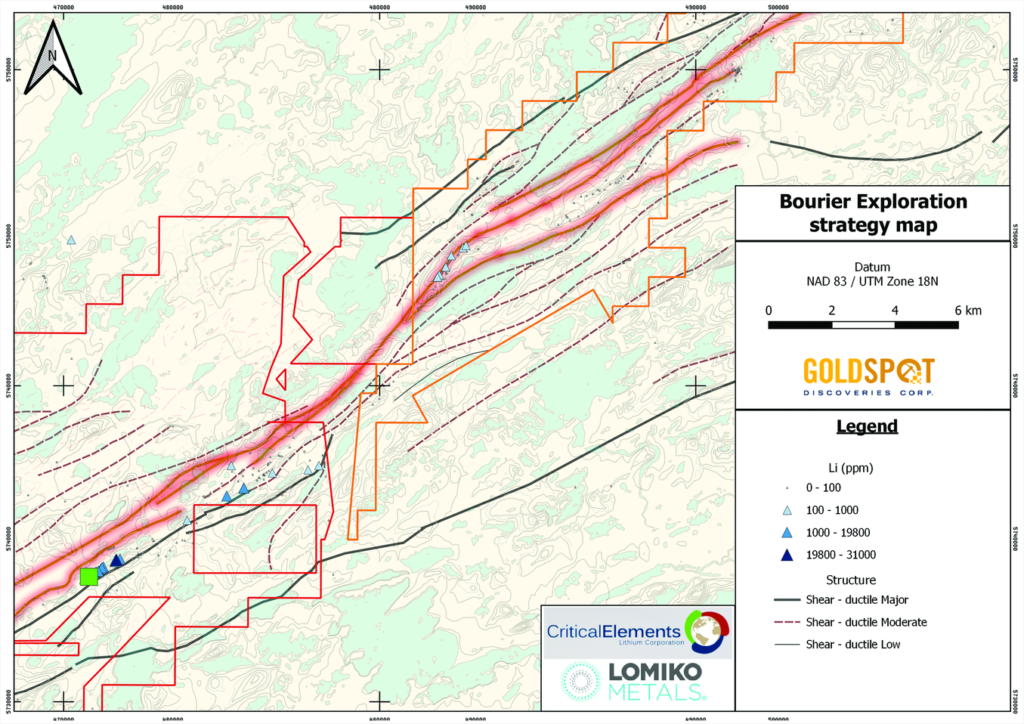

Lomiko’s lithium asset is the 102.5-sq.-km Bourier project in the James Bay region of Quebec, approximately 450 km northeast of Val-d’Or. Bourier is an early-stage exploration target that Lomiko optioned from Critical Elements Lithium (TSXV: CRE; US-OTC: CRECF).

Currently, Lomiko is working towards the first stage of 49% ownership and consequently to the second stage of 70% in the property, Slepcev says. “At this point, we are reviewing the plans with Critical Elements for the upcoming 2022 exploration program on the property. We are looking forward to following up on the lithium-tantalum-caesium anomalies and targets outlined in 2021.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by LOMIKO METALS and produced in co-operation with The Northern Miner. Visit www.lomiko.com for more information.

Comments