New Found Gold raising $50M for Queensway project

New Found Gold (TSXV: NFG; NYSEA: NFGC) announced it has chosen a syndicate of underwriters led by BMO Capital Markets to raise $50 million by way of a bought deal financing. The money will be used to continue exploration and drilling at the company’s Queensway gold project 15 km west of Gander, Nfld.

The underwriters have agreed to purchase approximately 6.3 million charity flow-through common shares of the company at a price of $8.00 per share. The underwriters also have an overallotment of 15%. The offering is expected to close on or about Dec. 14, and it is subject to regulatory approvals both in Canada and the U.S.

New Found’s Queensway project is well situated, having logging road and a high voltage power line on the property as well as access to a skilled workforce.

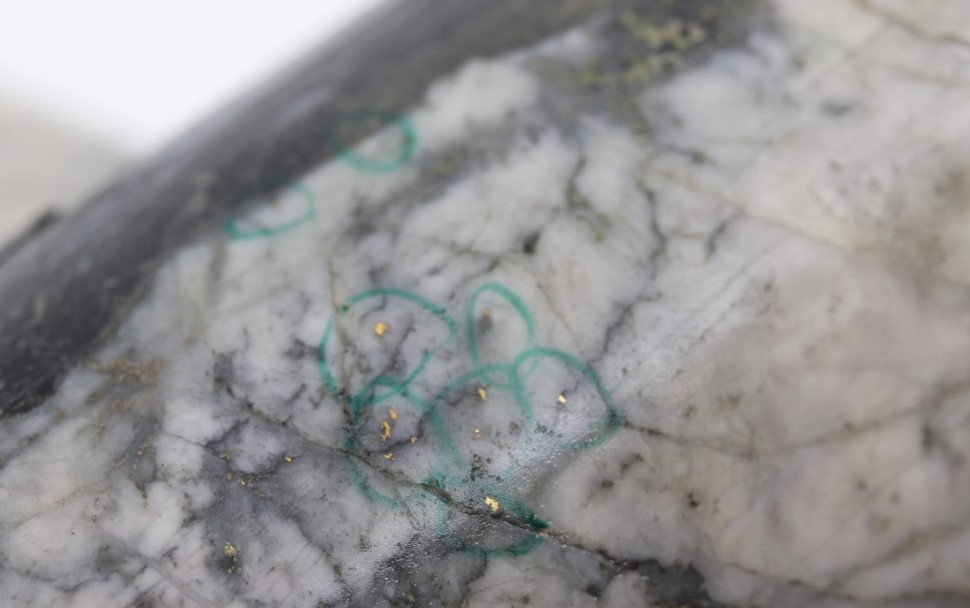

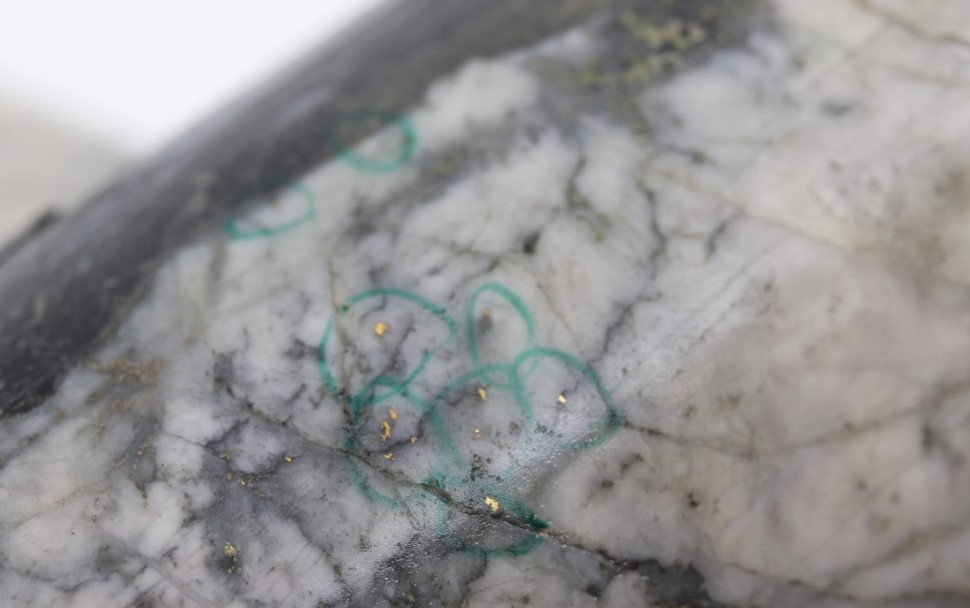

The company is drilling gold targets along 9.5 km of the Appleton fault and 12.4 km along the HBP fault. The current 400,000-metre drill program is about 74% complete. Gold mineralization is hosted in middle Ordovician sediments of sub-greenschist to greenschist metamorphic grade. It is fault-hosted in quartz carbonate veining where visible gold is common.

High-grade assays are common at Queensway – 117 g/t gold over 2.0 metres, 36.5 g/t over 2.2 metres, 28.8 g/t over 2.0 metres, and 42.6 g/t over 32 metres, including 171.6 g/t gold over 6.5 metres.

Earlier this year, New Found raised $130 million for its exploration program.

More information about the Queensway project is posted on www.NewFoundGold.ca.

Comments

Georges Jr Bernier

What type of operation it will be?

Open pit or underground?