Sprott explains the new copper supercycle

The following is an abridged version of the copper supercycle as explained by Sprott in its current monthly report.

A new copper supercycle is emerging, built on several rising geopolitical and market trends, including electrification, national security concerns, environmental policy, supply constraints and deglobalization. In combination, these are a powerful catalyst for copper demand.

The prior commodities supercycle that started two decades ago was driven by China rejoining the global economy, leading to mass industrialization and the urbanization of hundreds of millions of people. The current copper supercycle is far more global in reach, has many more demand sectors, and is entwined with the national security of many countries.

The U.S. is increasing tariffs and bans on materials imports to strengthen domestic industries and address security concerns. These measures include higher tariffs on Chinese energy transition-related goods to counter China's dominance in this vital industry. Despite this, China will continue to focus on energy transition, resulting in parallel or duplicate supply chains that draw on the same limited global materials supply. Meanwhile, producers are looking for ways to boost copper output in a market where the ability to grow production is exceptionally challenging.

These factors all point to an exceptionally bullish outlook for copper. Below, we examine the key drivers behind the new copper supercycle.

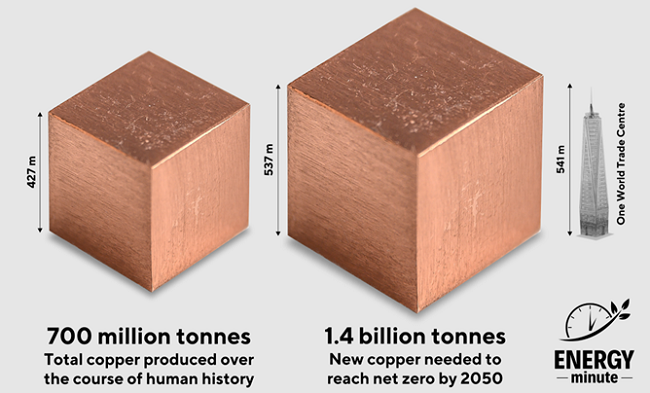

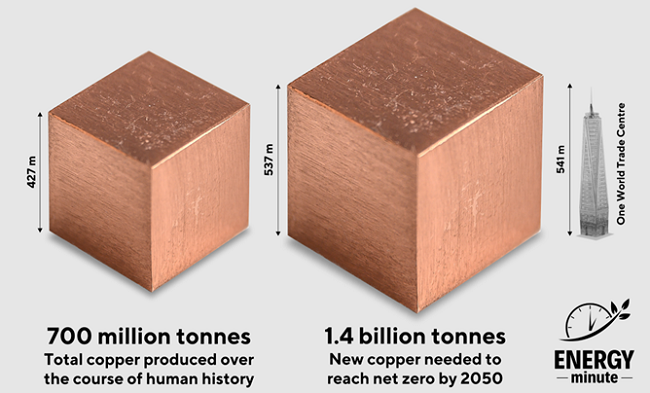

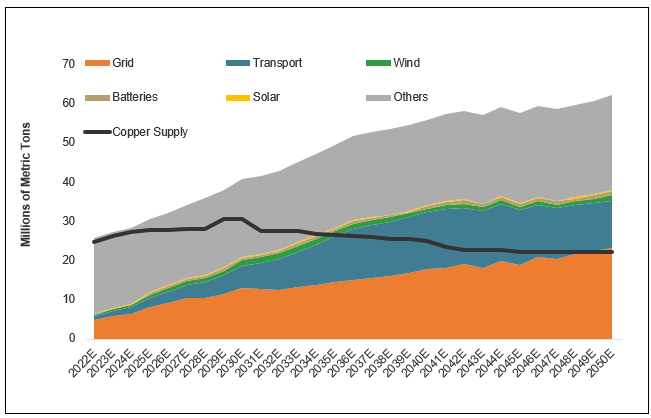

Structural Shortages

Copper demand is surging due to the global push towards electrification, which covers a wide array of technologies and initiatives. EVs are a major factor. Renewable energy sources like solar and wind power need large quantities of copper. The electrification of public transport systems also fuels the demand for copper.

Meanwhile, supply is not keeping up with demand. Developing a new copper mine is lengthy and expensive, often taking over a decade from exploration to production. These projects increasingly face stringent environmental regulations and community resistance, complicating development in major copper mining regions.

The mining sector has also seen long periods of underinvestment due to the cyclical nature of commodity markets. The long run of low copper prices has meant reduced exploration budgets and fewer discoveries.

Overdependence on M&A

The copper mining industry is focusing on redistributing existing assets through M&A rather than developing new assets. Greenfield projects are expensive and risky, requiring significant capital for exploration, development and regulatory compliance amid fluctuating metal prices. M&A is considered a more cost-effective, quicker, and lower-risk strategy to expand production. It can provide immediate access to proven reserves and existing operational infrastructures, bypassing the delays and uncertainties of new projects. This is especially pertinent in the copper markets, where rapid demand growth makes speed to market essential.

However, in the longer term, relying on M&A over new discoveries may slow the industry's supply response to price signals and lead to prolonged market tightness, supporting a bullish outlook for the copper market.

Resource Nationalism

Global macro and policy factors are also key drivers for copper demand. Policies like the U.S. Inflation Reduction Act and the EU’s REPowerEU plan support investment in green technologies and infrastructure. Rapid industrialization in emerging markets escalates copper demand for infrastructure and manufacturing. Trade policy changes (i.e., bans and tariffs), political instability and rising resource nationalism in copper-producing regions can disrupt supply chains and cost structures, leading to price spikes.

Copper pricing is also influenced by currency fluctuations—the dollar's value significantly impacts global copper prices. Central banks' monetary policies further affect commodity prices – for example, expansionary policies typically boost copper.

Higher Price Expectations

The recent rebound in copper prices to near new all-time highs suggests the market increasingly recognizes the reality of long-term supply constraints. Speculative trading also influences the copper market, adding short-term price volatility as traders react to economic indicators and policy announcements.

Given copper's pivotal role in modern technologies and green energy solutions, robust demand and supply fundamentals indicate the potential for a higher price trajectory for copper.

Click here to go to Sprott’s current monthly report, which contains the firm’s bullish outlook for copper.

Comments