Volt Lithium’s cost cuts help Alberta project weather metal price crash

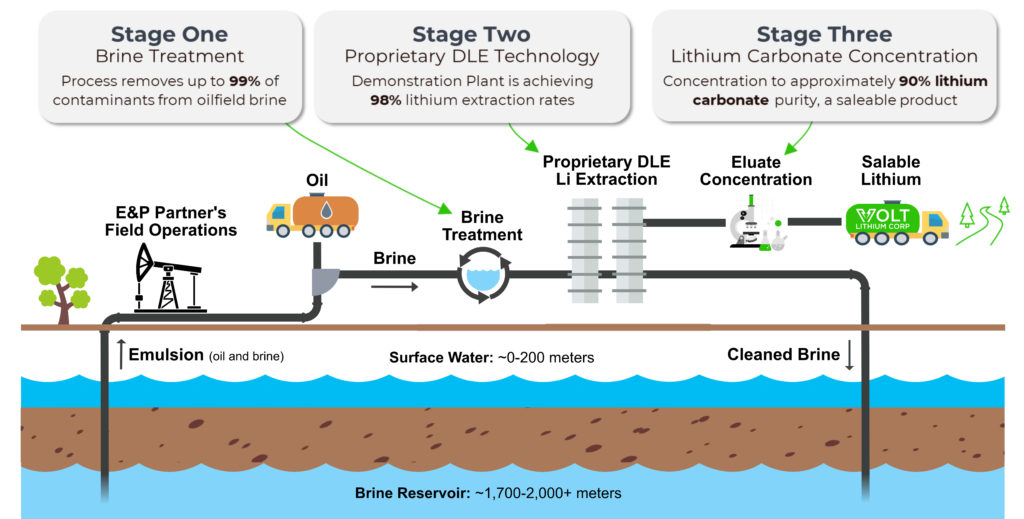

Volt Lithium (TSXV: VLT) has cut nearly two-thirds of its lithium production cost as it prepares to start the low-grade Rainbow Lake brine project in northwest Alberta next year.

Testing in February of brine associated with privately held Cabot Energy and Cenovus Energy (TSX: CVE) oil wells dating from the 1960s showed a cost of US$2,885 per tonne of lithium carbonate equivalent (LCE) versus US$8,057 in May.

The company produced 90% LCE from 34 parts per million (ppm) lithium brine through its proprietary direct lithium extraction process, president and CEO Alex Wylie said in an interview.

“We've developed a compound, or most people call them media, that is really agnostic to things like magnesium and other items, other minerals that might cause interference in the process,” Wylie said by phone from Calgary. “We can get to a purity with our process without doing final concentration steps and that I would say is pretty novel.”

Correction: A previous version of this story said Volt is working with Coterra Energy (NYSE: CTRA). It is actually Cabot Energy. Coterra was formerly known as Cabot Oil and Gas, a different company than Cabot Energy.

Comments