Liberty Gold raises cash through royalty transaction, private placement with Wheaton

Liberty Gold (TSX: LGD) said on Monday it has entered a series of transactions that will provide the company the opportunity reduce the royalty interest on its Black Pine oxide gold project on "attractive financial terms."

First, it reached an agreement to purchase the existing 0.5% net smelter return (NSR) from a private company on certain claims at Black Pine for a consideration of US$3.5 million cash and 200,000 shares of the company. The 0.5% NSR was part of the consideration paid when Liberty acquired Black Pine back in 2016.

Then, the company signed an agreement to grant an affiliate of Wheaton Precious Metals a new 0.5% NSR royalty for cash consideration of US$3.6 million covering all claims comprising Black Pine. As part of this transaction, Liberty has been granted an option to repurchase half of the royalty for US$3.6 million at any point in time up to the earlier of commercial production at Black Pine or January 1, 2030.

“It is a rare occasion to have an opportunity to reduce the royalty interest of a mining project, particularly one as high quality and favourably located as Black Pine. This option further de-risks the future development of Black Pine and would result in more of the project economics being attributable to Liberty Gold’s shareholders," Jason Attew, CEO of Liberty Gold, commented.

In addition to the NSR purchase and resale, Liberty has arranged a private placement of up to 22.9 million shares at US$0.34 per share for proceeds of US$5.7 million. Wheaton is expected to subscribe for US$5 million of the offering and become the company's newest shareholder. The remaining amount will be subscribed by existing shareholders, management and directors.

Proceeds of the financing will be used by Liberty for exploration within the Great Basin of United States, one of the most prolific gold-producing regions in the world, stretching across Nevada and into Idaho and Utah.

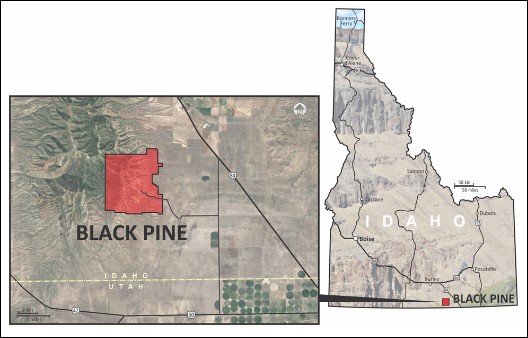

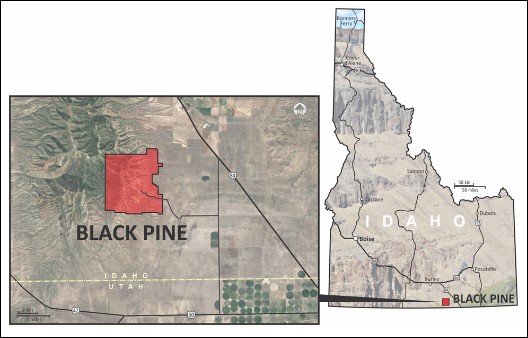

Black Pine is a Carlin-style, sedimentary rock-hosted (Carlin-style) gold property located in Cassia County, southern Idaho. It is host to a past-producing heap leach gold mine that operated between1991-1998. During this time, it produced approximately 435,000 oz. of gold at a historical grade of 0.7 gram per tonne from seven shallow pits.

Earlier this year, Liberty announced an update to the initial 2021 resource estimate for Black Pine that was larger than expected. The deposit now contains indicated resources of 157.3 million tonnes grading 0.52 g/t for 2.61 million oz. and inferred resources of 35.15 tonnes grading 0.43 g/t for 483,000 oz.

Shares of Liberty Gold fell 6.2% to $0.30 apiece by 12:30 p.m. EDT, holding just above its 52-week low. The Vancouver-based gold exploration company has a market capitalization of $95.8 million.

THIS ARTICLE WAS ORIGINALLY POSTED ON MINING.COM

Comments