[caption id="attachment_1003733839" align="aligncenter" width="625"]

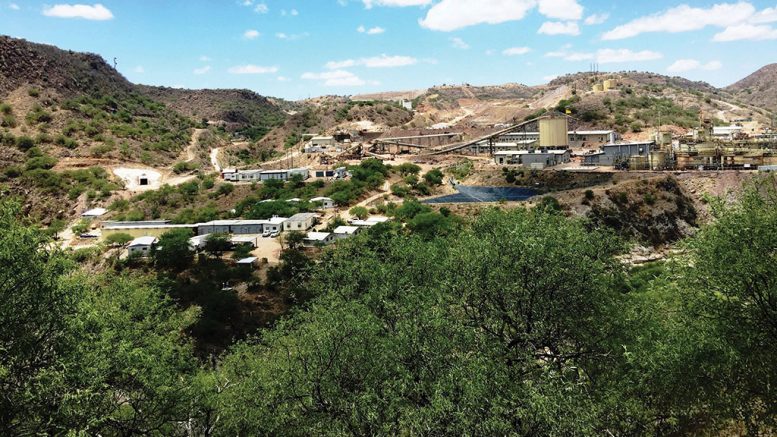

Premier Gold Mines' Mercedes mine in Mexico, its silver stream is currently held by Orion Credit: Premier Gold Mines

Premier Gold Mines' Mercedes mine in Mexico, its silver stream is currently held by Orion Credit: Premier Gold Mines[/caption]

MONTREAL – Newly launched royalty company

Nomad has entered into purchase agreements worth US$268 million with

Orion Resource Partners and US$65 million with

Yamana Gold to acquire portfolios of royalty, stream and gold loan assets.

“Together with our partners, Orion and Yamana, we are excited to combine our significant expertise to deliver a new generation royalty company and execute an aggressive growth plan,” Vincent Metcalfe, CEO of the royalty company, and Joseph de la Plante, its chief investment officer, said in a release.

The new company will hold a portfolio of 10 royalty, stream and gold loan assets which are anticipated to generate over US$30 million in operating cash margin by 2021.

As part of the US$268-million Orion acquisition, Nomad is acquiring streams in five assets in Africa, Australia and the U.S. as well as a gold loan. The company will issue 396.5 million common shares to Orion, at $0.9 each, as consideration.

The Yamana portion of the transaction will add three royalties in Brazil and Argentina to Nomad’s portfolio as well as a commercial production payment on

Mineros’ Gualcamayo mine deep carbonates project. Nomad will pay Yamana US$20 million in cash and issue US$45 million in shares, at $0.9 each. The cash component will be made up of a combination of cash on hand as well as of proceeds from a private placement of subscription receipts.

Currently operating as publicly traded

Guerrero Ventures, the company will change its name to Nomad Royalty Company upon completion of the transaction, which is expected in the second quarter. On a pro-forma basis, Orion will hold approximately 77% of Nomad’s shares outstanding whereas Yamana will own 13%.

For more information, visit

www.Yamana.com.

Premier Gold Mines' Mercedes mine in Mexico, its silver stream is currently held by Orion Credit: Premier Gold Mines[/caption]

MONTREAL – Newly launched royalty company Nomad has entered into purchase agreements worth US$268 million with Orion Resource Partners and US$65 million with Yamana Gold to acquire portfolios of royalty, stream and gold loan assets.

“Together with our partners, Orion and Yamana, we are excited to combine our significant expertise to deliver a new generation royalty company and execute an aggressive growth plan,” Vincent Metcalfe, CEO of the royalty company, and Joseph de la Plante, its chief investment officer, said in a release.

The new company will hold a portfolio of 10 royalty, stream and gold loan assets which are anticipated to generate over US$30 million in operating cash margin by 2021.

As part of the US$268-million Orion acquisition, Nomad is acquiring streams in five assets in Africa, Australia and the U.S. as well as a gold loan. The company will issue 396.5 million common shares to Orion, at $0.9 each, as consideration.

The Yamana portion of the transaction will add three royalties in Brazil and Argentina to Nomad’s portfolio as well as a commercial production payment on Mineros’ Gualcamayo mine deep carbonates project. Nomad will pay Yamana US$20 million in cash and issue US$45 million in shares, at $0.9 each. The cash component will be made up of a combination of cash on hand as well as of proceeds from a private placement of subscription receipts.

Currently operating as publicly traded Guerrero Ventures, the company will change its name to Nomad Royalty Company upon completion of the transaction, which is expected in the second quarter. On a pro-forma basis, Orion will hold approximately 77% of Nomad’s shares outstanding whereas Yamana will own 13%.

For more information, visit

Premier Gold Mines' Mercedes mine in Mexico, its silver stream is currently held by Orion Credit: Premier Gold Mines[/caption]

MONTREAL – Newly launched royalty company Nomad has entered into purchase agreements worth US$268 million with Orion Resource Partners and US$65 million with Yamana Gold to acquire portfolios of royalty, stream and gold loan assets.

“Together with our partners, Orion and Yamana, we are excited to combine our significant expertise to deliver a new generation royalty company and execute an aggressive growth plan,” Vincent Metcalfe, CEO of the royalty company, and Joseph de la Plante, its chief investment officer, said in a release.

The new company will hold a portfolio of 10 royalty, stream and gold loan assets which are anticipated to generate over US$30 million in operating cash margin by 2021.

As part of the US$268-million Orion acquisition, Nomad is acquiring streams in five assets in Africa, Australia and the U.S. as well as a gold loan. The company will issue 396.5 million common shares to Orion, at $0.9 each, as consideration.

The Yamana portion of the transaction will add three royalties in Brazil and Argentina to Nomad’s portfolio as well as a commercial production payment on Mineros’ Gualcamayo mine deep carbonates project. Nomad will pay Yamana US$20 million in cash and issue US$45 million in shares, at $0.9 each. The cash component will be made up of a combination of cash on hand as well as of proceeds from a private placement of subscription receipts.

Currently operating as publicly traded Guerrero Ventures, the company will change its name to Nomad Royalty Company upon completion of the transaction, which is expected in the second quarter. On a pro-forma basis, Orion will hold approximately 77% of Nomad’s shares outstanding whereas Yamana will own 13%.

For more information, visit

Comments